As we all know, the IT and software development industry has been driving strong innovation and automation for the last couple of decades, touching on multiple facets, industries and sectors. In the last few years, we have seen rapid evolution in the forms of Artificial Intelligence (AI), Data Analytics, Blockchain, Robotics and many breakthrough technologies. This trend has also helped with the evolution of software development and deployment. One of the recent innovations in this context is the increasing adoption of Low Code and No Code technology.

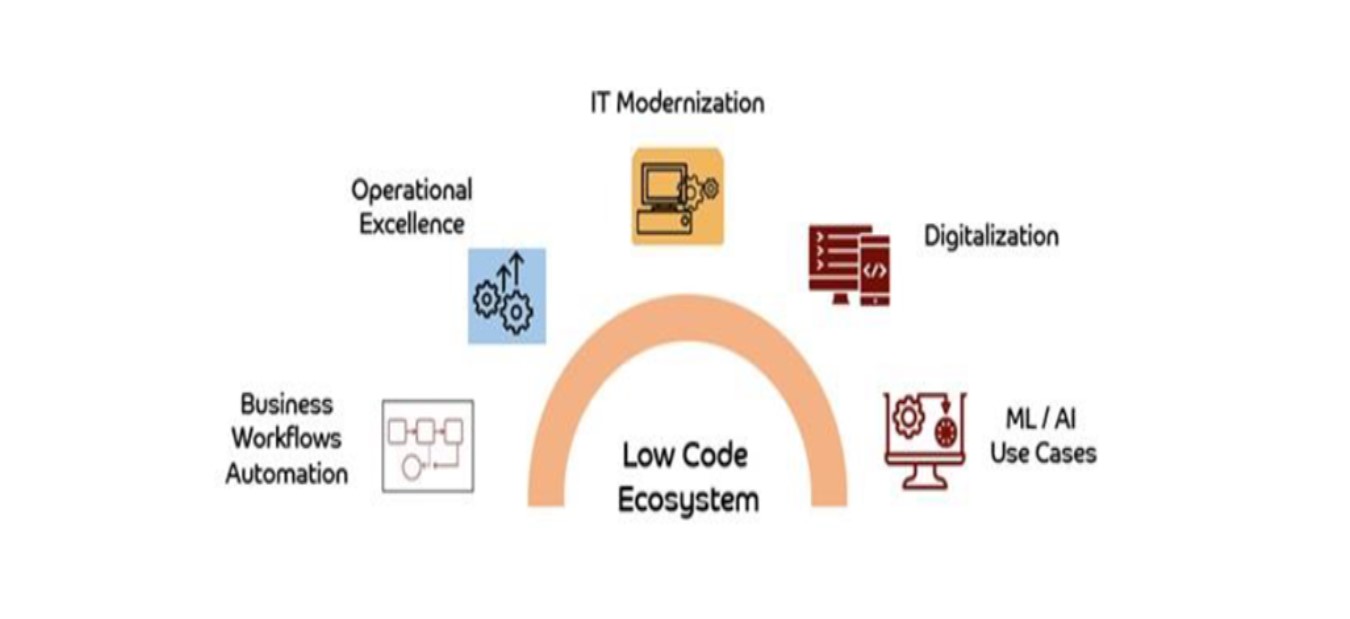

Low Code and No Code Application Platforms provide integrated development environments and visual software development environments that allow enterprise developers, business users and analysts to rapidly develop business applications, without having to hand code or with minimal coding efforts. These platforms cater to various aspects and integration points for standing up business applications, including data sources, business workflows and user interfaces, both web and mobile. In addition, these platforms are now providing advanced features like Data Analytics, Reporting and integration with Machine Learning and Artificial Intelligence (AI).

Low Code Application platforms (LCAP) enable professional developers to quickly build applications by relieving them of the need to write bulk code as in traditional programming like C++, Java, C# and SQL. LCAP also enable business analysts, business front-office colleagues and others who are not software developers to build and test applications rapidly. Many more members of organisations large or small, are therefore empowered to create and deploy applications with little or no knowledge of traditional programming languages.

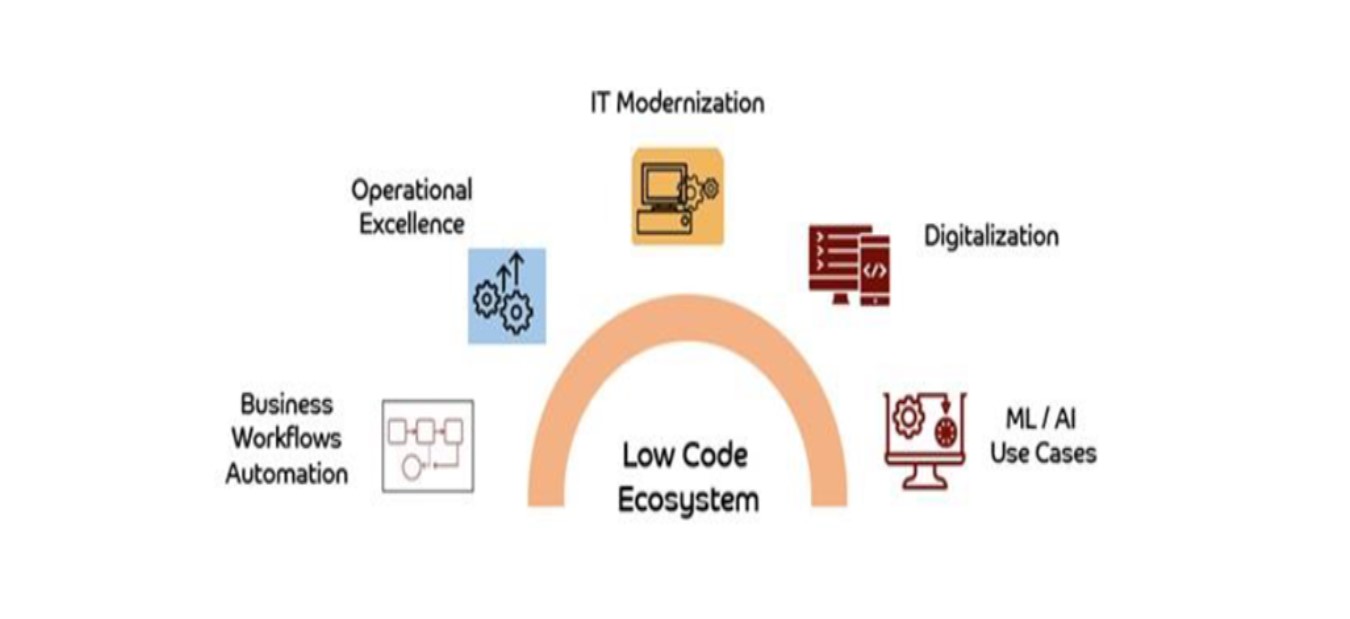

Some key benefits of using Low Code / No code ecosystem are:

• Accelerated and Agile Application Delivery: Low Code applications enable a strong partnership between Technology, Operations, Product and other non-Tech teams. This provides a conducive environment for faster and agile delivery, especially for small to medium sized IT applications. Ultimately, business users get more speed and agility, and end customers get products or services faster.

• Everyone can code: The most powerful and compelling feature of the ecosystem is that it empowers not just developers, but also business users, analysts, and Operations colleagues to develop small to medium business applications using the user-friendly Integrated Development Environment (IDE) and run time environments for rapid application development and deployment to production.

• Integration with existing platforms: Integration is easier via seamless and readily available APIs and connectors for most of industry standard software platforms like Oracle, SQL databases, Salesforce, Workday, and SAP. Also, on-premise connectors are available for faster integration with Cloud solutions like AWS, Google Cloud and Microsoft Azure.

• Integration of Artificial Intelligence and Machine Learning with Low Code Ecosystem: Business users and even the developer community sometime find it challenging to integrate or add machine learning onto their platforms, given the inherent complexity. However, some of the Low Code platforms like MakeML and SuperAnnotate are actively innovating in data sets sourcing, machine learning model development, training machine learning models, and their deployment using the Low Code / No Code programming constructs.

Some use cases of Low Code platforms within the banking industry are:

• Business workflow automation: E.g., credit approval workflows, risk analytics and reporting, compliance checks and workflows

• End User Developed Application remediation and migrating to a centralised technology platform, for instance migrating from Excel, Macros.

• Mobile and digital applications for internal users and external customers

• Data aggregation and reporting for business and senior management across disparate business data sources

• Machine learning models for credit checks, reporting engines, etc.

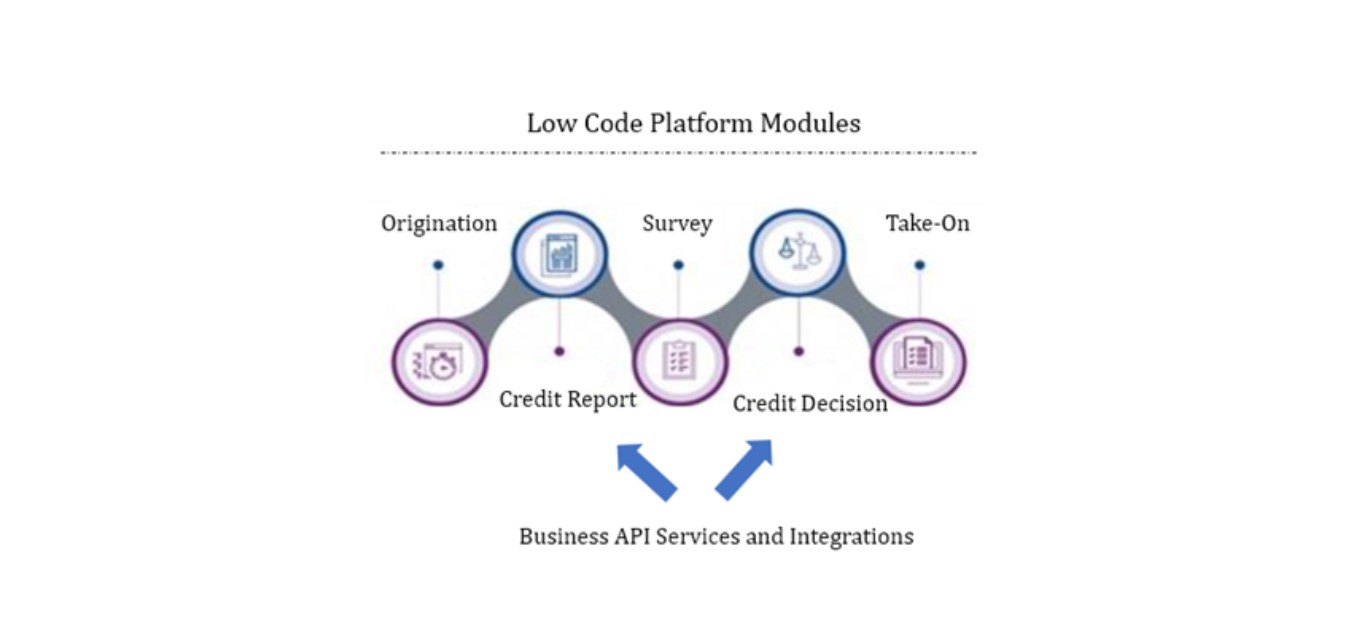

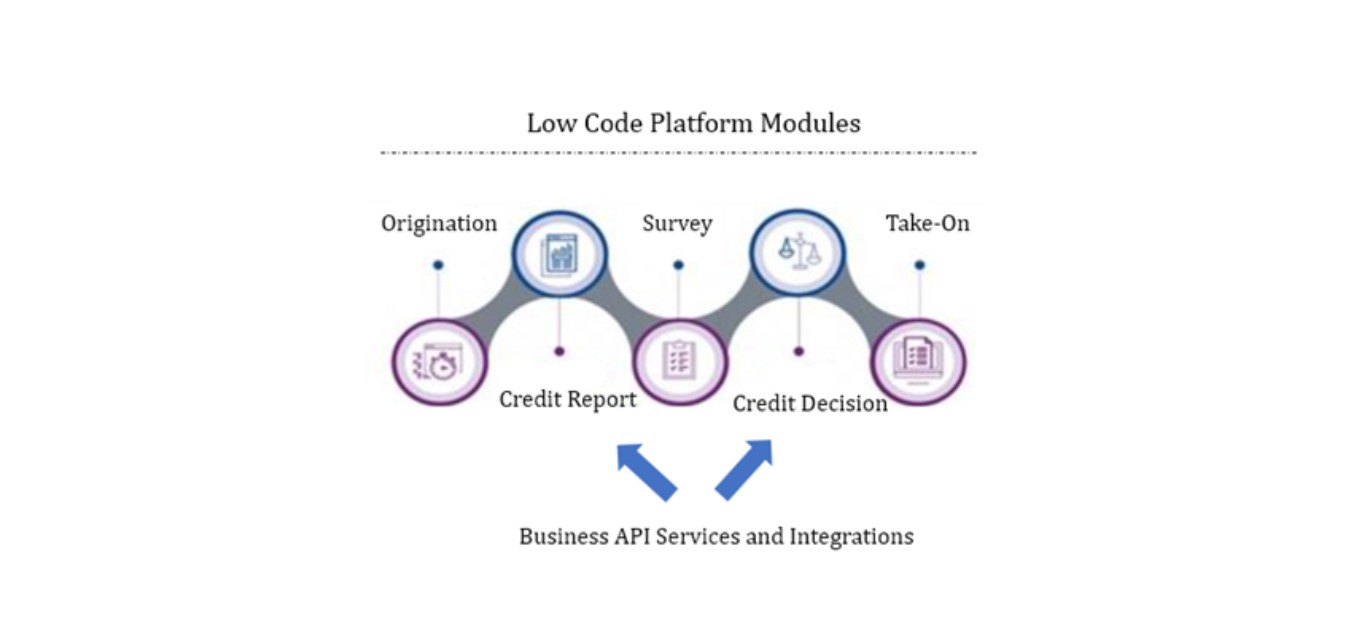

Sample business use case in the banking industry using Low Code Platform:

A specialised lending platform can be created using low code platform by means of leveraging the development of various business components, including customer facing UI screens on mobile apps using low code. Also, the business functionalities for features like fetching of the customer credit score data, processing of the credit scores can be converged using a low code ecosystem. This ecosystem can be enhanced for business decisions like credit decisioning using workflows, feeding the processed loans using a bank’s internal platforms through business API and services.

The key benefit of using a low code integrated development environment is the speed to market as application components like UI screens, business workflows, integrating with internal IT systems including credit, customer databases for history, score, integration with vendor as well as internal applications for General Ledger (GL), Finance platforms can be rapidly developed. Further, ongoing software change, maintenance and speed of change can be better and faster than traditional IT platform.

Low Code platform: Returns on Investment (ROI), Benefits and proliferation in the industry:

As per a study by Forrester in 2022, the return on investment (ROI) of leveraging Low Code is driven by lower costs to develop, maintain and change. The organisations surveyed by Forrester reported reduced average project timelines from 12 months to 3 months. The study also showed that these savings continue to accrue year-over-year. They observed that the Low Code ecosystem facilitated developers, business users and product owners to innovate and develop the product in a more cohesive way, paving way for faster decision making and in turn quicker roll out of the product.

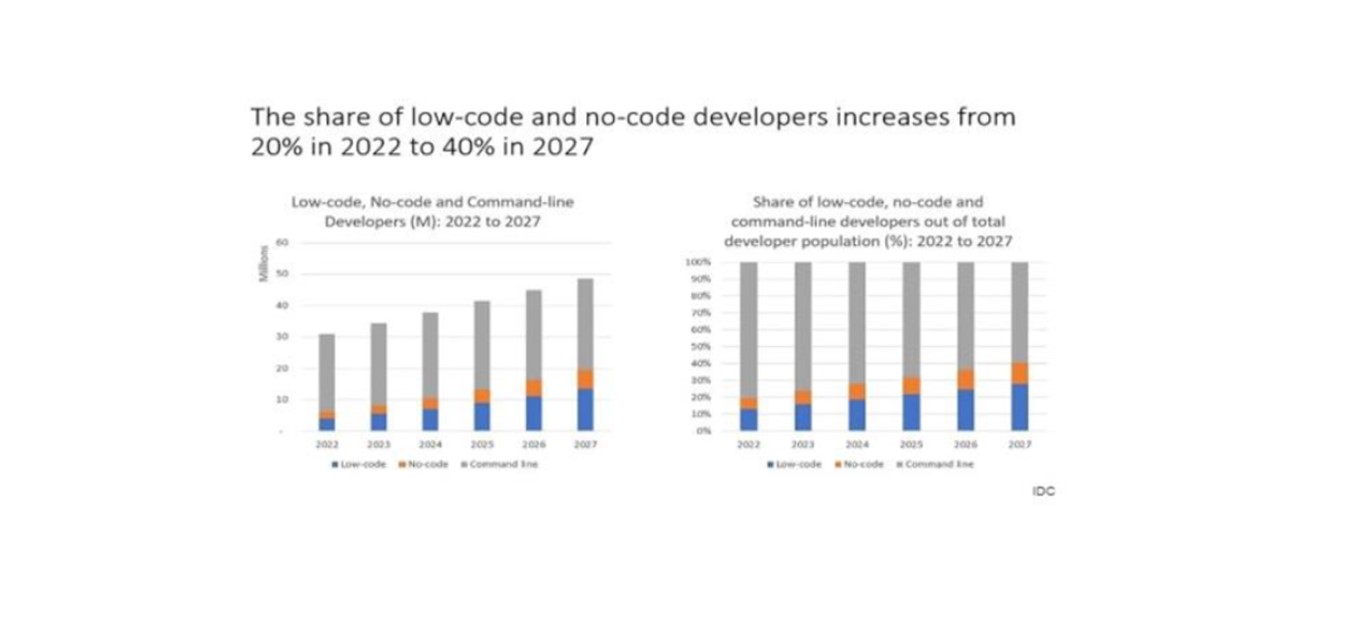

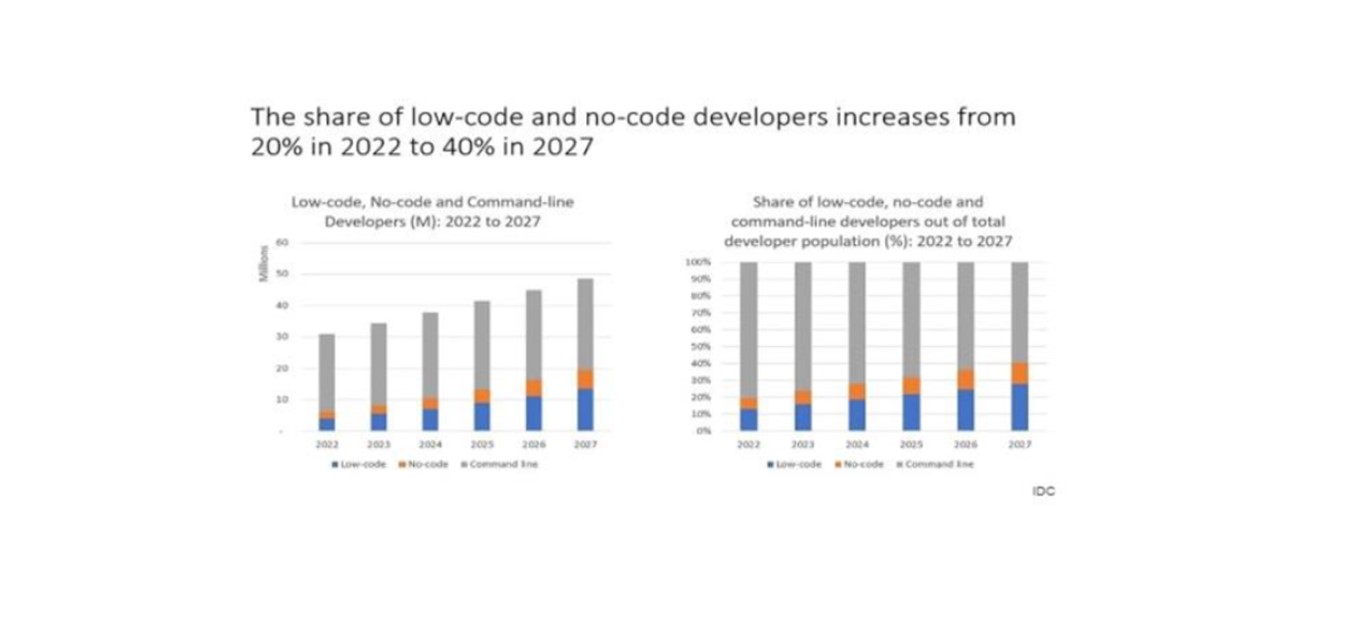

Organisations also saw a decrease in the amount of development work they allocated to their most expensive resources and third-party consulting services, as that work is redistributed to internal IT resources and non-developers, by means of adoption of Low code technologies. In addition, the survey also noted a 25% productivity uptick for enterprise level applications and 12% productivity uptick for departmental or divisional level applications. Gartner has estimated that the Low Code market grew 23% in 2020 to reach $11.3 billion, and then grew to $13.8 billion in 2021.

In addition, Gartner also forecasts the market to reach $30 billion by 2025 and that low-code application development will account for 65% of all application development activity by 2025 for small and medium-sized projects. Also, as per the latest Forrester report, the Low code and No Code platform adoption is estimated to grow 50% YoY.

Some popular Low Code and No Code platforms are:

- Microsoft power Apps

- Appian Low Code platform

- Alteryx products

- IBM Low Code platform

- Salesforce Low Code platform

- Application Express by Oracle

Some caveats before venturing on the Low Code journey:

Given that banking is highly regulated and the technology estate in any large bank is complex, despite the benefits of Low Code & No Code platforms, successful usage requires a well-defined and strategic ecosystem for low code platforms. There should be active partnership with the CTO organisation and other stakeholders such as product and operations teams. At a minimum, controls and checks need to be agreed around the usage of the low code ecosystem. In addition, it is important that the LCAP platforms are looked at holistically within the IT strategy with properly defined architecture, design principles and SDLC governance. Finally, as with all innovations, it is best to start small, run pilots, learn from them and then expand to broader use cases.

References:

- Gartner research paper on LCAP

- Forrester research paper on LCAP

- Geekflare - Low Code platforms for Machine Learning

- ECM Consultants review of Low Code platforms

- ComputerWorld link

- CXO Research link

Author: Vinay L. Bade (Director, Head for Credit Risk Technology, BX India)

Co-Author: Sanjaya Shrestha (Director, India Innovation, RISE India)