This is the first of the multi-part blog series titled ‘DIGITAL ENTERPRISE TRANSFORMATION, INDIA PARADIGM’ and covers the State of Technology Adoption in India from a Digital Spending standpoint.

"Digital transformation is not simply about ‘lifting-and-shifting’ old IT infrastructure to the cloud for cost-saving and convenience. Organizations adopt new technologies to redesign and redefine relationships with their customers, employees and partners, which includes modernizing applications and creating new business models, products and services"

- Bikram Singh Bedi, Managing Director for India region at Google Cloud

Amongst the many adversities that the pandemic brought with it, technology found a plethora of opportunities in the form of increased consumption trends in - digital commerce, digital payments, digital content consumption, WFH-related infrastructure, smart devices, etc. – which pushed global technology spend (excl. hardware) to over $1.7 Tn in 2021, growing at ~9% y-o-y. Further, corresponding figures for 2022 are expected to be $1.8 Tn at 6.5% growth. In 2021, the global sourcing market also saw considerably higher growth at 12-14% touching $238-243 Bn.

Concomitant to the macro-level factors, at the enterprise level too organizations continue to double down digital investments to not just combat Covid-related challenges but leverage the various benefits of digital transformation (DX) such as reducing costs, increasing efficiency and effectiveness of processes, etc. Further, Indian end-user enterprises are upping the ante in the ‘digital game’ by not only increasing adoption of mainstream digital technologies such as Cloud/Edge Computing, Artificial Intelligence/Machine Learning (AI/ML), Internet of Things (IoT), Cybersecurity, Big Data Analytics (BDA), etc. but also testing waters with nascent digital technologies, such as Web 3.0, Metaverse, Quantum Computing, etc. to innovate and scale at warp speed. To upscale and attain higher levels of digital maturity rapidly, enterprises across the globe are adopting a two-pronged strategy – Deploying Skilled Talent as well as Increasing Technology Investments.

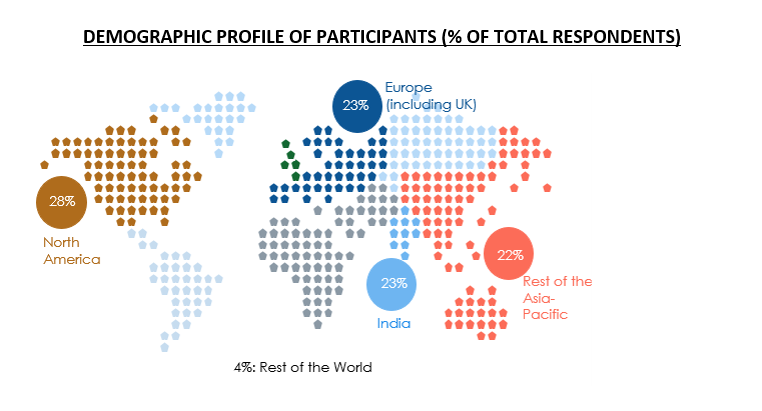

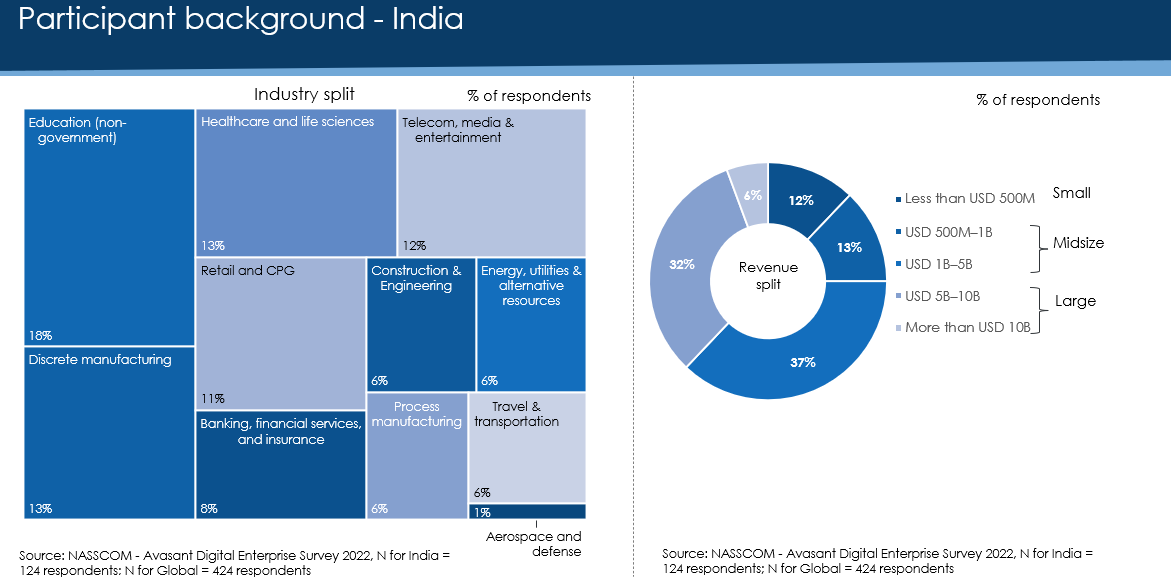

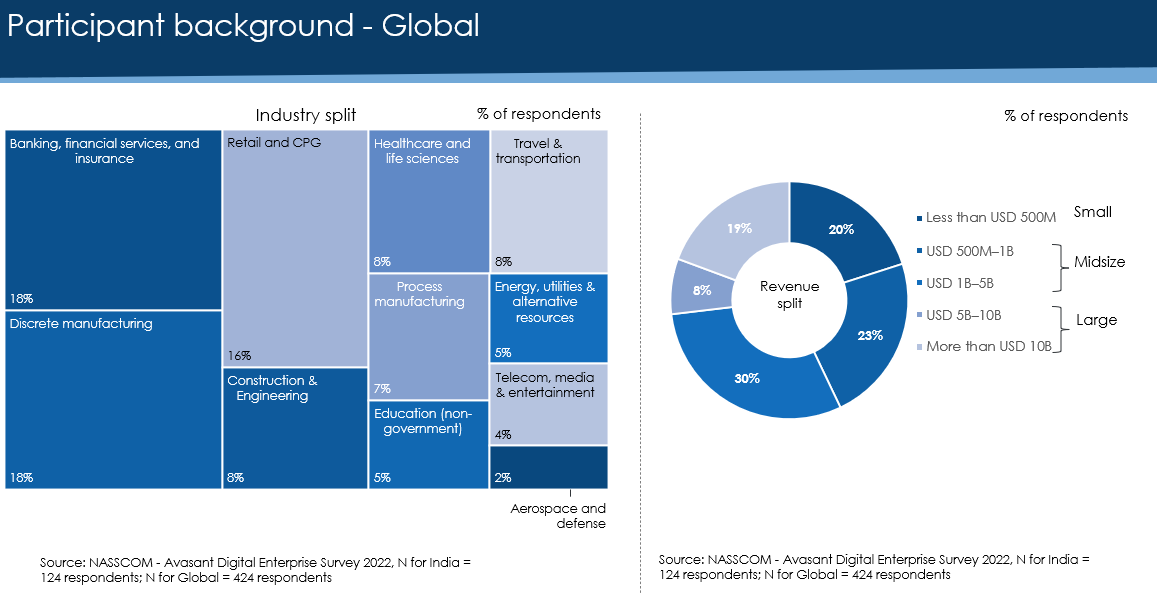

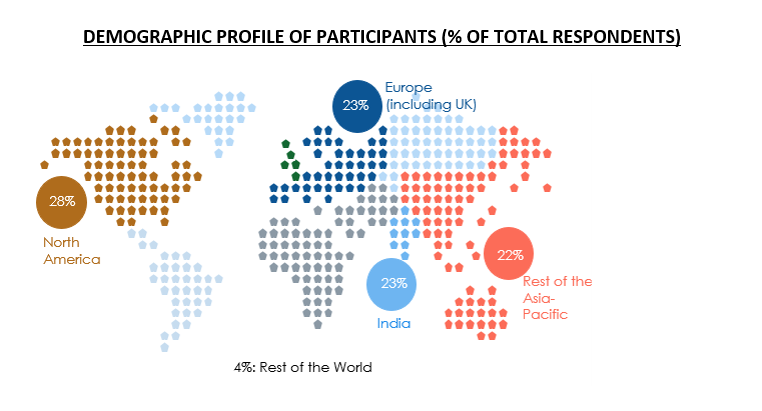

In order to assess the impact of an accelerated, broad-based, integrated and scalable approach towards digital technologies at an overall global level and delineate key characteristics of highly mature digital enterprises, NASSCOM and Avasant formulated the “The Digital Enterprise Maturity Index”, which forms an integral part of the “DIGITAL ENTERPRISE MATURITY 3.0: Boosting Business Resilience through Technology” Report published in July 2022.

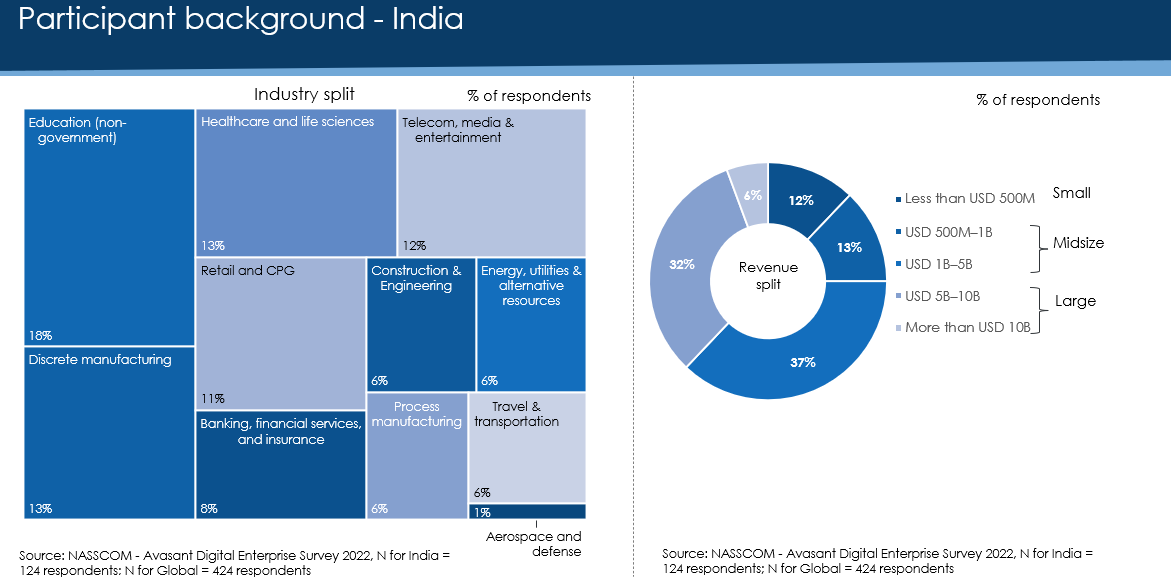

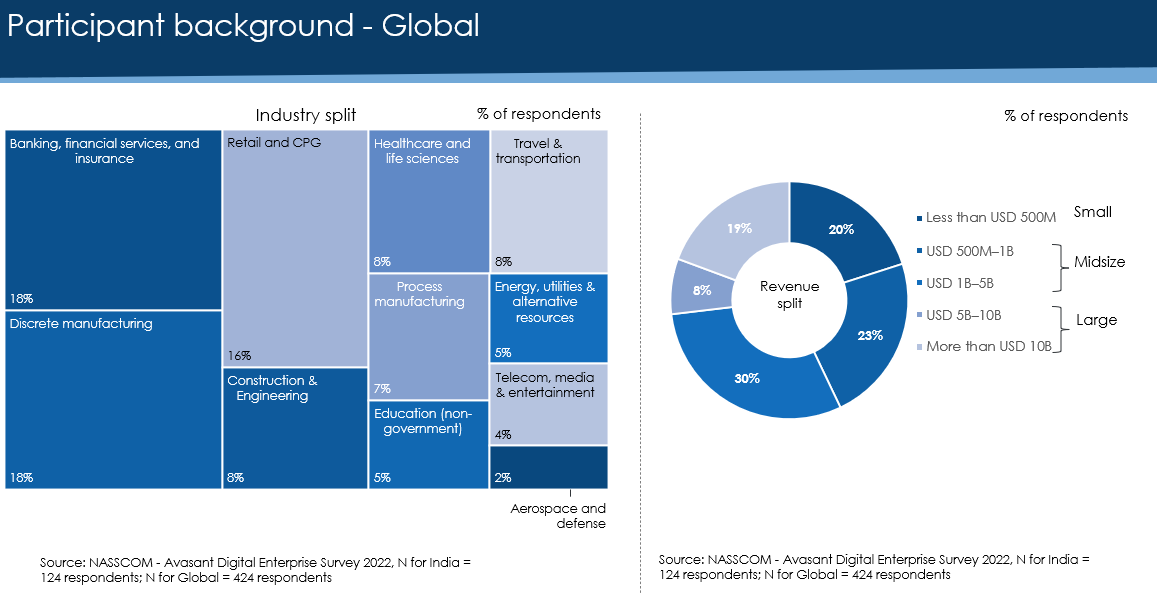

Shadowing the model adopted in the above-mentioned report from an India perspective, I have compiled a blog series that captures the core insights related to India, culled out of the findings of our “Digital Enterprise Survey” conducted in May’2022, which gathers the end-users’ perspective on digital transformation in their respective organizations globally. This study provides an in-depth analysis of practices by 124 Indian and 424 global end-user enterprises across 11 sectors, positioned at varying levels of digital maturity, by comparing and contrasting them across 5 major themes –

- State of Technology Adoption, including digital spending, allocation of digital budgets, digital contracts, business process digitalization, distribution of workflows on Cloud, etc.

- Digital Talent

- Hybrid Work Models

- Digital Maturity

- Outlook

DIGITAL SPENDING

KEY HIGHLIGHTS:

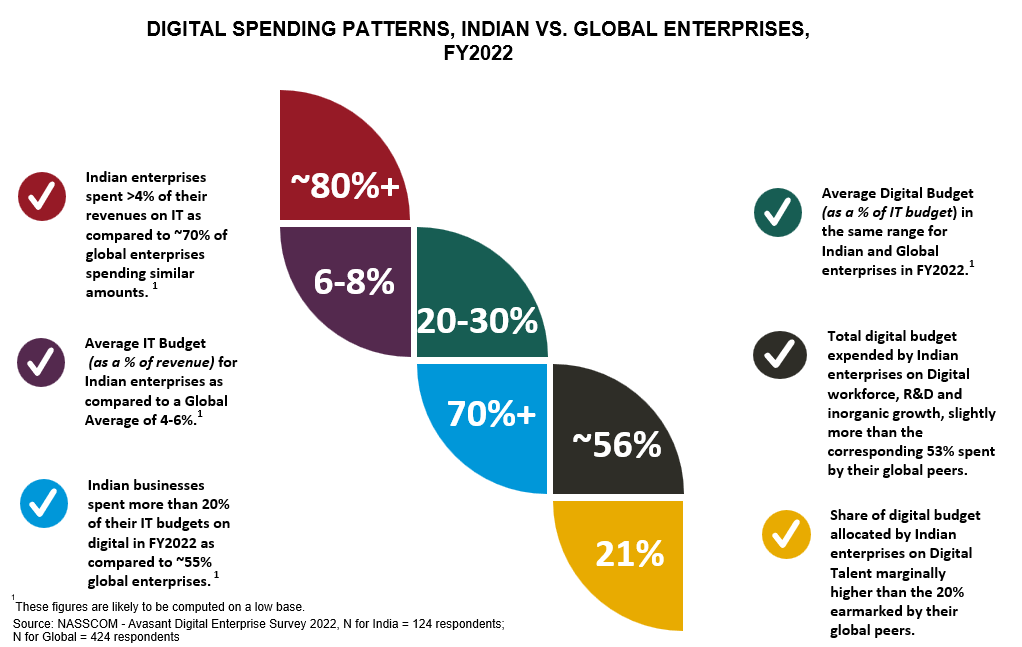

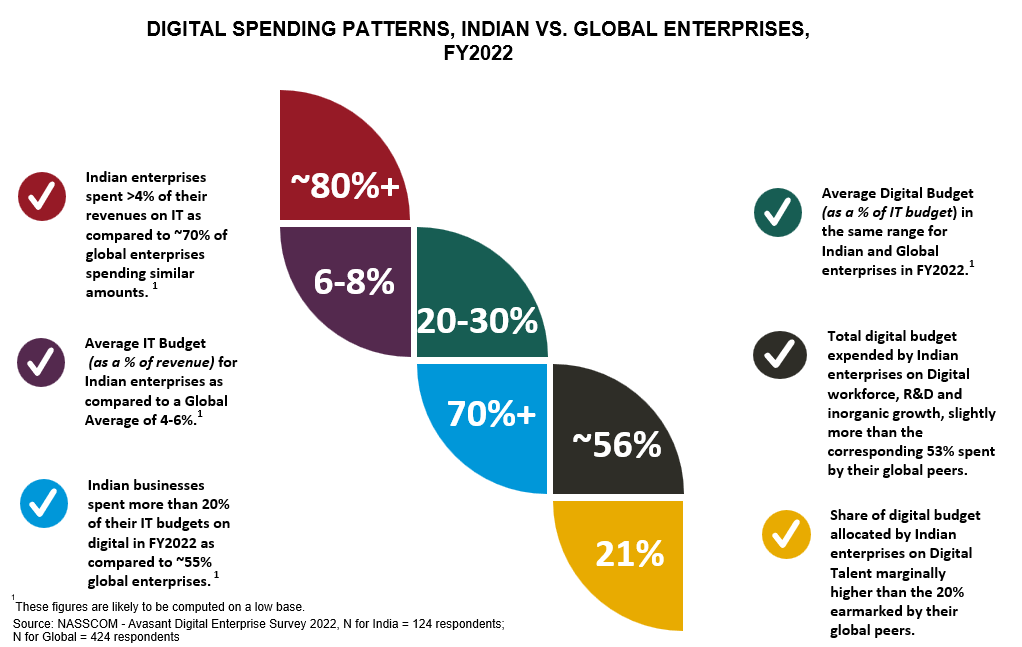

1. Indian end-user companies are willing to spend more on technology in FY2022, continuing the spending spree from the previous year

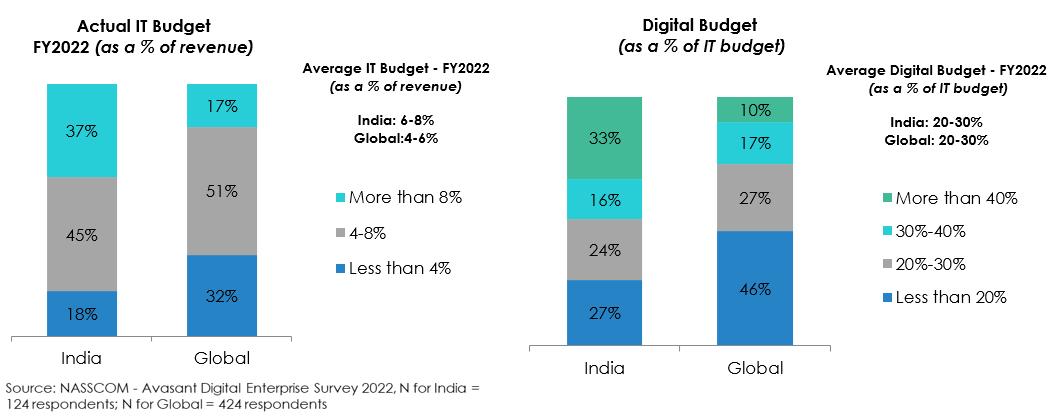

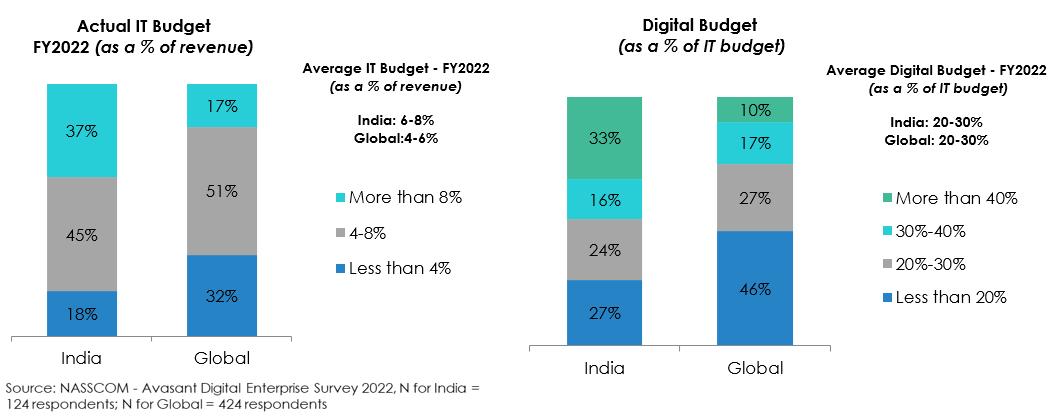

Even in 2021, as per the NASSCOM Enterprise CXO Survey 2022, over 80% of the CXOs of end-user enterprises had indicated a spend of over 4% of their revenue on technology. Hence, Indian enterprises seem to be consistently doubling down on tech investments to drive growth. The average IT budget (as a % of revenue) for Indian enterprises is slightly higher than their global counterparts in FY2022, even though on a low base.

2. Indian companies are accelerating spend on digital transformation in FY2022

Indian enterprises are augmenting their spending on technology and digital initiatives to not just swiftly climb the steep learning curve as digital technologies are evolving by the minute, but also attain a certain level of maturity so as to stay competitive in the digital transformation game.

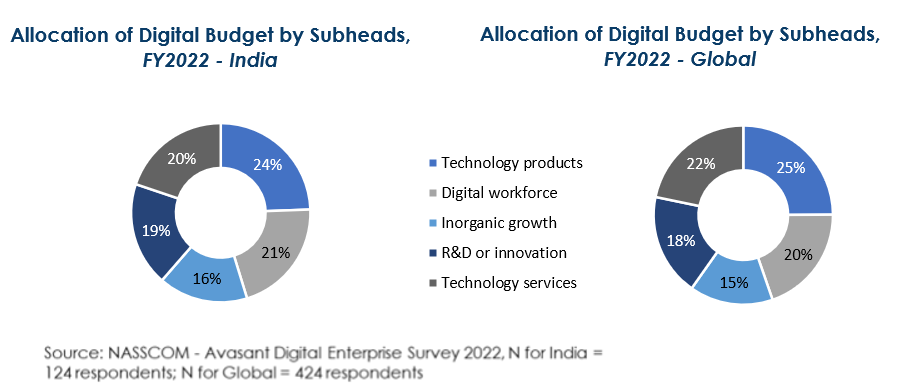

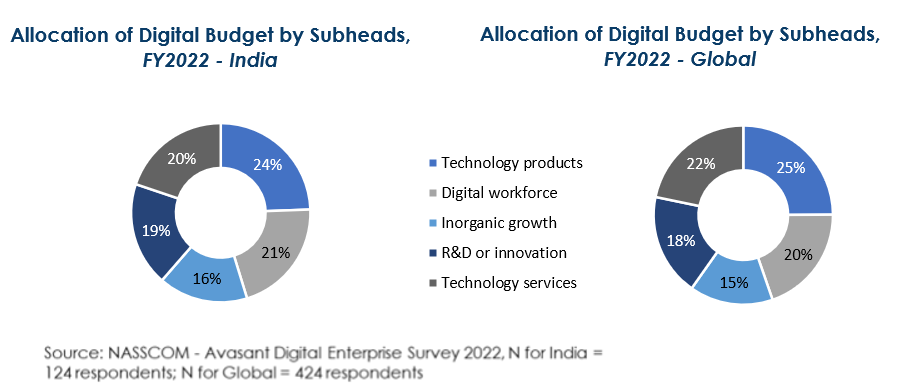

3. Indian enterprises willing to spend slightly more on Digital workforce, R&D and inorganic growth than their global peers

Indian enterprises are spending marginally higher amounts on hiring, training, and retaining digital talent as compared to their global counterparts. While the world is battling for digitally skilled talent and dealing with the repercussions of ‘Great Resignation’ and ‘Quiet Quitting’, India is probably feeling the heat a bit more than the global enterprises as employees contemplate multiple job offers and moonlighting.

Global companies are contrarily, spending more on technology products (including high-performance infrastructure, software products, connectivity devices, and IoT devices) and Technology services (including managed services, subscription/licenses, and advisory services). Nearly 47% of the total digital spend of Global enterprises was allocated to tech products & services as opposed to 45% for Indian enterprises in FY2022.

Further, while the increasing expansion of India’s digitalization efforts and changing consumer spending patterns (rise in the share of digital wallets), has enlarged the share of digital hires required in the overall recruitment pie of non-IT organizations, the supply of such talent remains limited, compelling companies to spend more to acquire and retain high-quality talent amidst the rising war for talent.

In terms of R&D/innovation spending, Indian companies are still playing ‘catch-up’ with the world and hence, are looking to up the ante on digital R&D spending. Overall, India’s six-notch jump in the Global Innovation Index 2022 (World Intellectual Property Organization (WIPO)) rankings to 40th position signals a concerted effort to increase the R&D spending in the country and Indian businesses are following suit by experimenting with emerging digital technologies, such as Web 3.0, Metaverse, Quantum Computing etc. as they continue to bolster the adoption and implementation of mainstream digital technologies, such as Cloud, Cybersecurity, AI/ML, BDA, etc., to build future-ready solutions.

With respect to inorganic growth, large Indian organizations are increasingly looking to acquire companies/startups with tech capabilities. For instance, in Jan 2022, Reliance Retail Ventures Ltd., the retail unit of Reliance Industries Limited (RIL), acquired a majority (54%) stake in Addverb Technologies, an Indian robotics startup for $132 Mn to turbocharge its automation efforts. Today, Addverb’s automation and robotics solutions such as robotic conveyors, pick-by-voice software, and semi-automated systems are being utilized in RIL’s warehouses, boosting the latter’s digitalization initiatives.

Thus, Indian enterprises are betting big on digital investments and tech transformation to leverage multiple benefits in the form of boosting efficiency, mitigating costs, augmenting revenue growth, developing/modifying operating models, increasing flexibility & transparency, streamlining business processes such as supply chain management, customer service, sales & marketing, etc., enhancing customer experience (CX), enabling employee engagement & experience (EX), building organizational culture, and gaining competitive advantage.

In my upcoming blogs, we will explore key trends in areas such as digital contracts, business process digitalization, distribution of workflows on Cloud, digital talent, hybrid work models, different dimensions of digital maturity and projected outlook for FY2023 with respect to Indian end-user enterprises.

For more information on Digital Transformation and Digital Enterprise Maturity, please refer to the report downloadable at the following links:

NASSCOM Website: https://nasscom.in/knowledge-center/publications/digital-enterprise-maturity-30-boosting-business-resilience-through

NASSCOM Community: https://community.nasscom.in/communities/digital-transformation/digital-enterprise-maturity-30-boosting-business-resilience

Earlier versions of the report can be downloaded from the following links:

A NEW ORDER OUT OF CHAOS-BUILDING A FUTURE READY ORGANISATION-https://community.nasscom.in/communities/digital-transformation/new-order-out-chaos-building-future-ready-organisation

REIMAGINING INDIAN ENTERPRISES' TECH LANDSCAPE IN A DIGITAL-FIRST WORLD – A NEW ORDER OUT OF CHAOS- https://community.nasscom.in/communities/digital-transformation/reimagining-indian-enterprises-tech-landscape-digital-first

DEFINING THE DIGITAL ENTERPRISE - MAR 2020 -https://community.nasscom.in/communities/digital-transformation/defining-the-digital-enterprise-mar-2020.html

Sources:

1. NASSCOM Strategic Review : The Technology Sector in India 2022 Report

2. DIGITAL ENTERPRISE MATURITY 3.0 - Boosting Business Resilience Through Technology