Just like the advent of the 21st century, the innovation consistently winds up streaming down to different divisions and over various ventures. Indeed, it has prompted the ascent new hybrid sectors like Fintech and Health-tech. Probably the greatest attribute of these industries is that they are driven by AI and innovation to give unparalleled client assistance. Keeping with the pattern, Block-chain is the following huge innovation trend that offers a great deal of potential to a wide scope of enterprises especially FIN-TECH.

Yearly spending on block chain arrangements will reach about $16B by 2023, as indicated by CB Insights’ Market Sizing Tool.

Block chain dives in which makes it more apt with what startups objectives are. It is estimated that 65% of new businesses today intend to execute block chain by the end of 2020 into their start-ups.

The question is what makes Block-chain so significant, that it is bringing a revolution?

“This is the beginning of the decade of Block-chain and I think in 2020, we’ll start to see the global recognition of crypto assets in the FS industry.” Antonio Senatore, EMEA Block Chain Lead

Block chain is a core technology in FinTech. There is no doubt in saying that Block chain is the backbone technology which is revolutionizing the Fintech industry. And as the financial service industry is moving from exploration phase to application phase, it is very important for the financial institutions or experts to understand the role of Block chain in the Fintech if they want to take advantage of this financial revolution.

HOW BLOCK-CHAIN PLAYS A MAJOR ROLE IN BANKING?

- PWC report, 77 percent of financial institutions are relied upon to embrace block chain innovation as a major aspect of an underway framework or procedure by 2020.

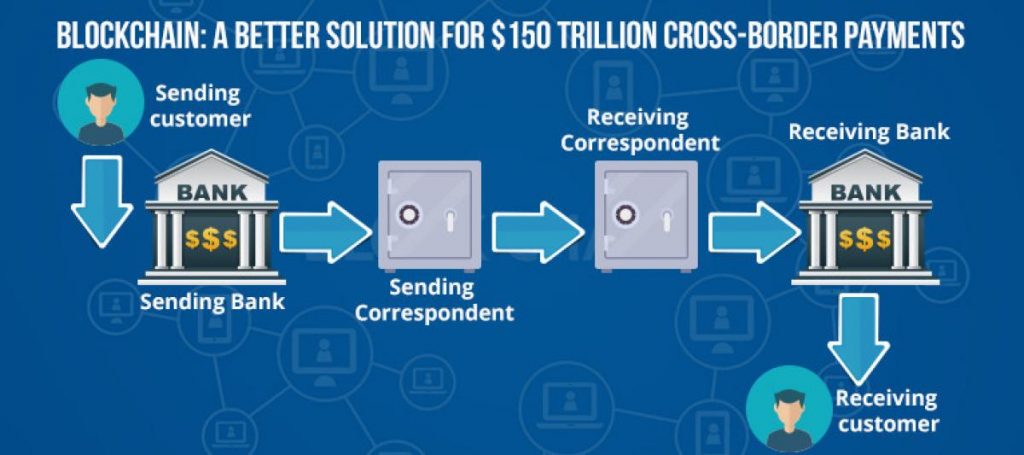

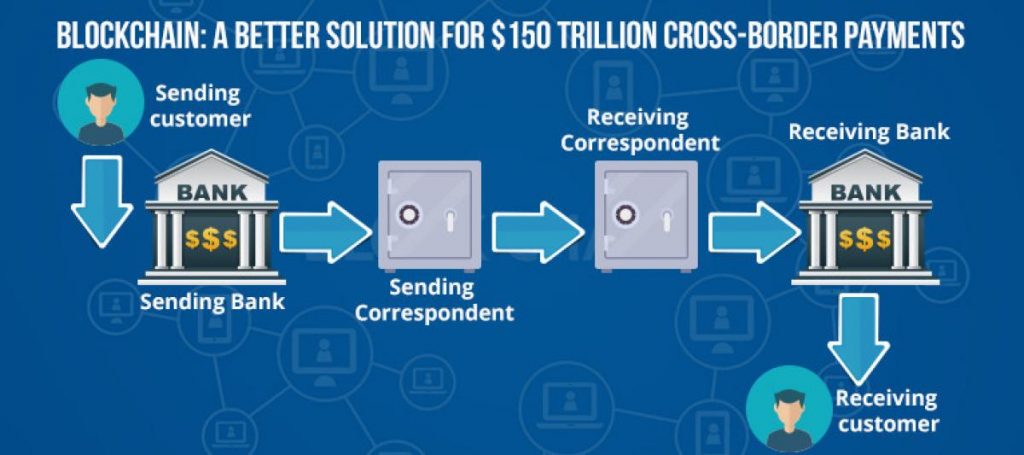

- Block chain innovation permit banks to decrease inordinate administration, lead quicker exchanges at lower costs, and improve its transparency.

- By establishing a decentralized channel (e.g. crypto) for payments, banking institutions can use emerging technologies to facilitate faster payments and lower the fees of processing them.

- According to one source, moving securities on a block chain could save from $17 to $24 million each year in global trade processing costs.

- Block chain eliminates the risk of errors and duplication, and is consequently ideal for refurbishing a range of digital processes. The removal of intermediaries reduces the settlement time to mere seconds and the transaction time to minutes. It also enables transactions to be processed 24/7.

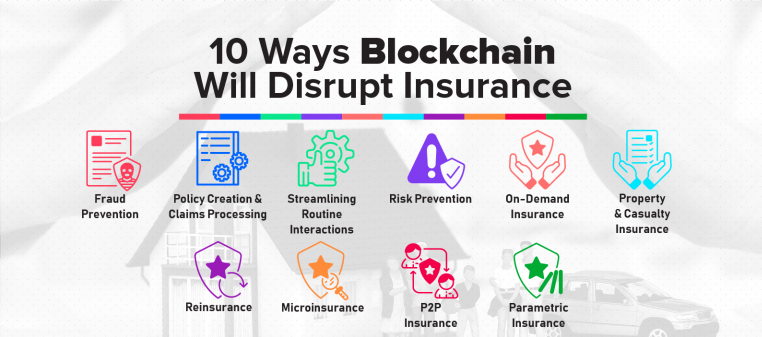

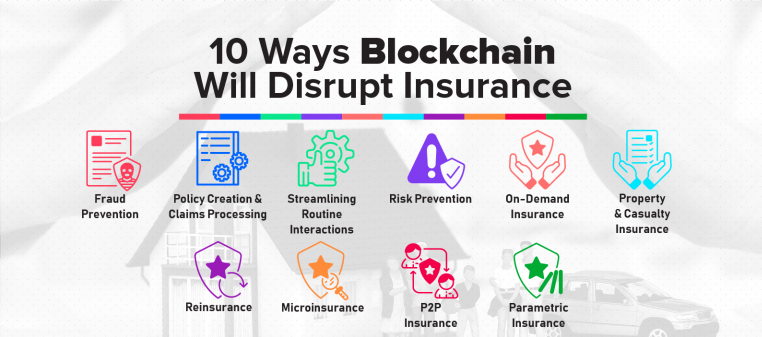

CAN BLOCK CHAIN DISRUPT INSURANCE INDUSTRY?

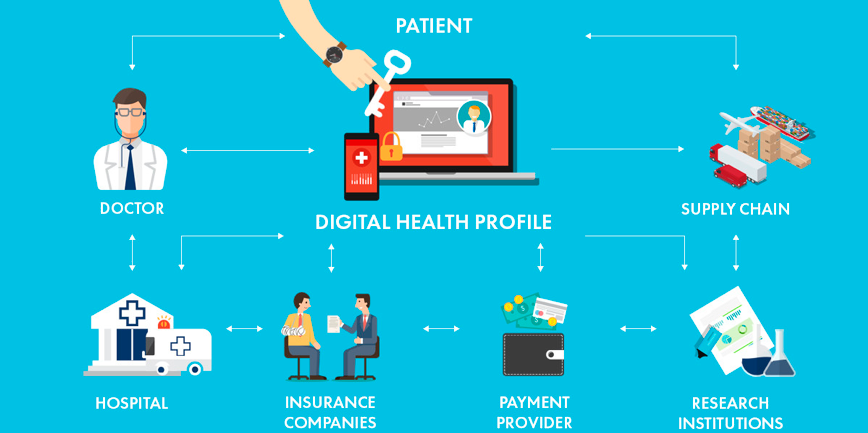

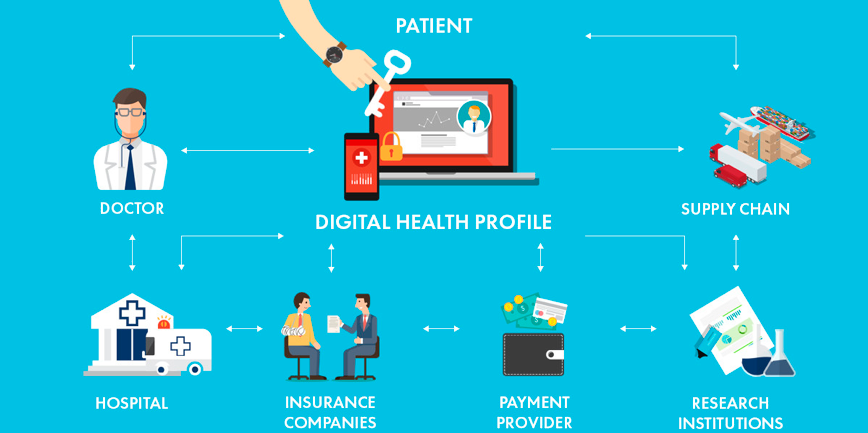

- With the assistance of block chain, clinical records can be encrypted and shared among medical clinics and insurers, internationally too accordingly cutting duplicated and mistaken records, extensive case handling, guarantee dissents and unnecessary tests.

- According to the Accenture Technology Vision 2019 survey, more than 80% of insurance companies claimed they adopted or were planning to adopt the block chain technology.

- Customers will get visibility into what data their insurers have on them, and how this data is processed. Plus, when block chain is combined with machine learning and AI, claim processing can be automated, thus accelerating payouts.

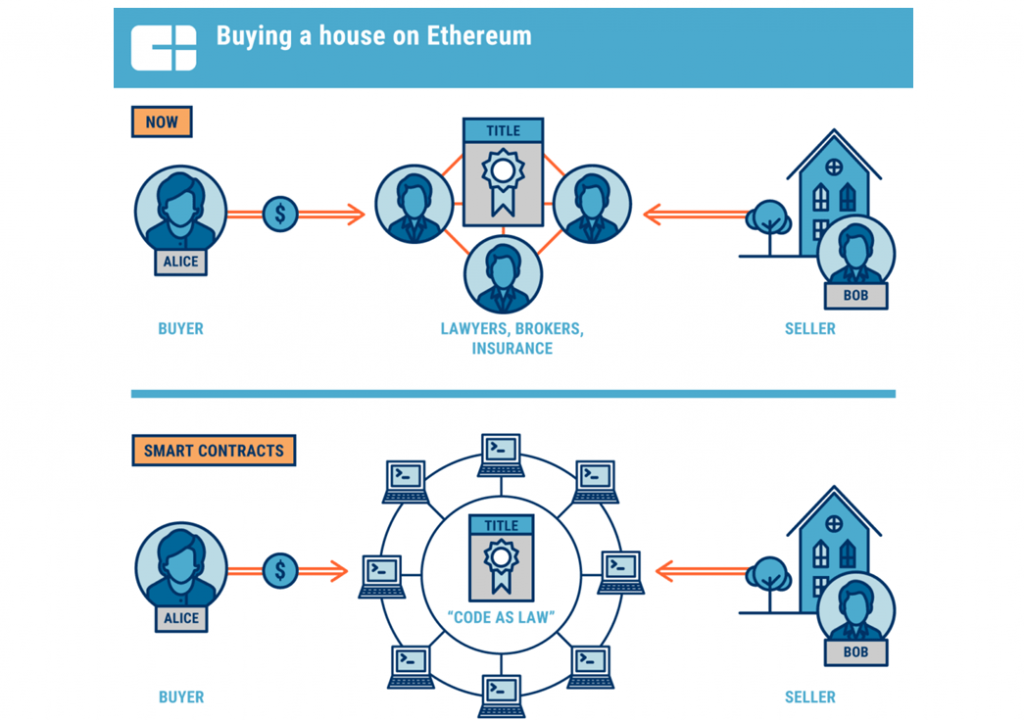

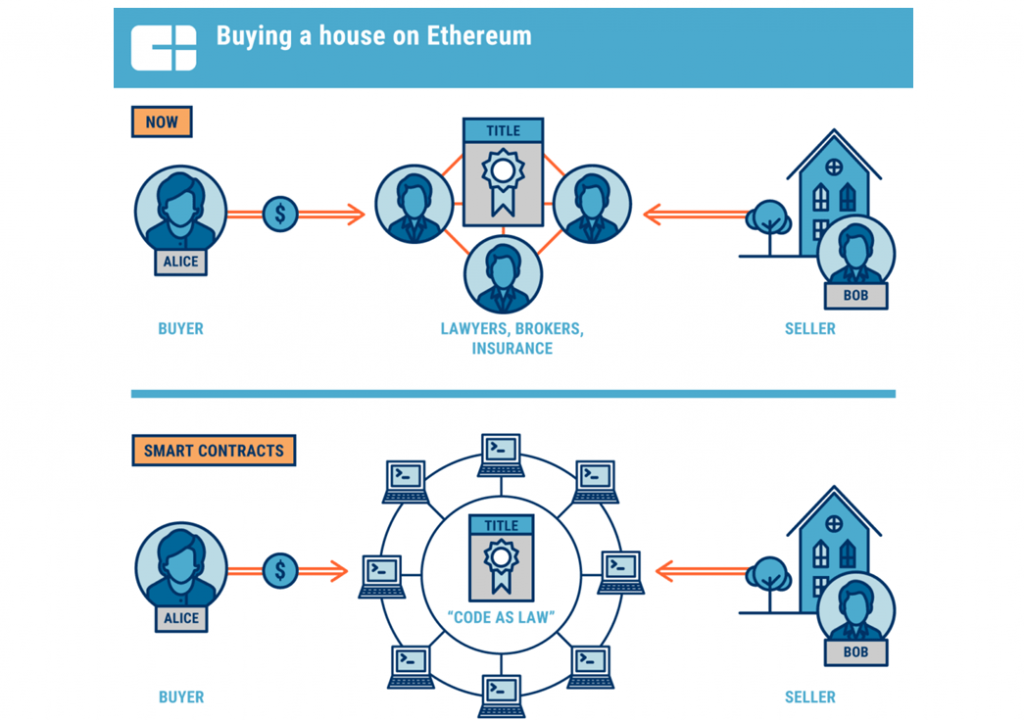

- A shared ledger and insurance policies executed through smart contracts can bring an order of magnitude improvement in efficiency to property and casualty insurance.

- By securing reinsurance contracts on the block chain through smart contracts, block chain technology can simplify the flow of information and payments between insurers and re insurers.

The future of block chain is near and banking isn’t the only industry affected. the Indian crypto community finally won the battle against the Reserve Bank of India (RBI) in 2020, and crypto enthusiasts are celebrating worldwide. This pandemic gave a good upbeat and will see new trends in Block-chain.

A recent World Economic Forum report predicts that by 2025, 10% of GDP will be stored on block chains or block chain-related technology.

TRENDS TO LOOK FORWARD IN 2020

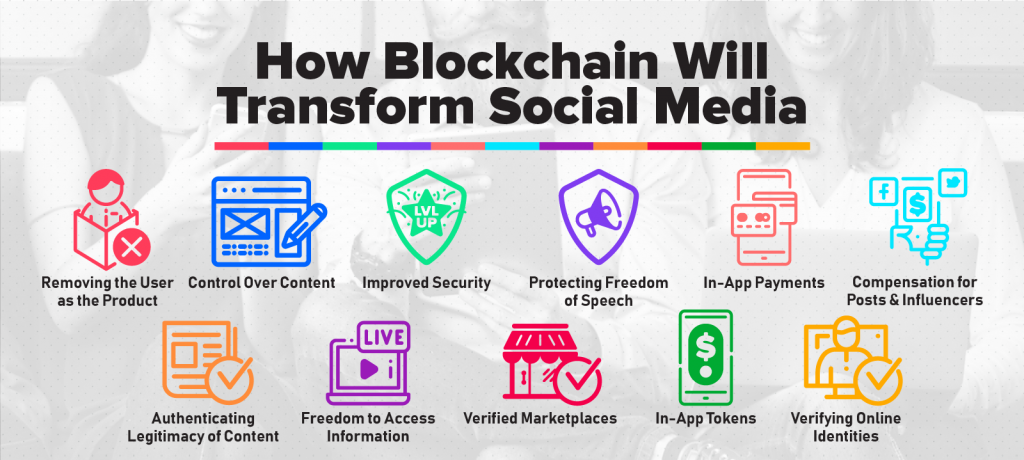

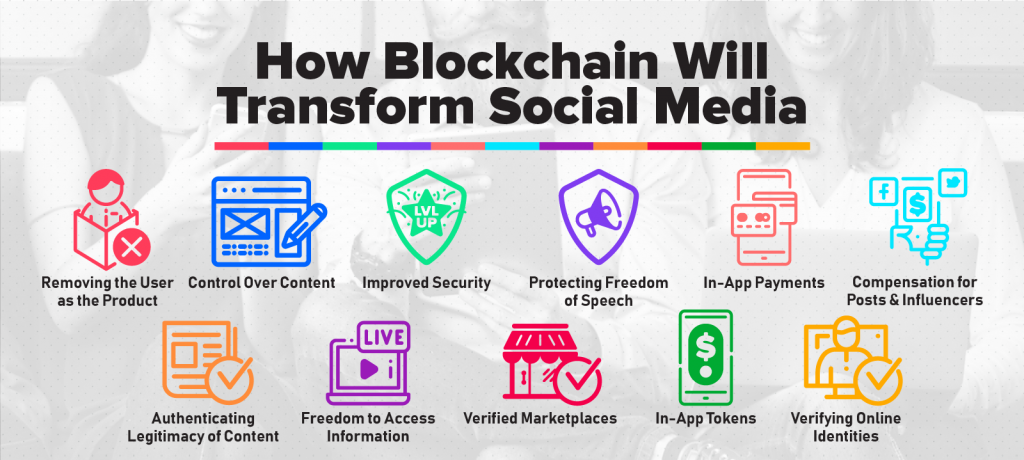

- SOCIAL MEDIA: Block chain applications on social-media will have the option to determine issues identified with known scandals, privacy infringement, information control, and content interest. With block chain applications,all data transmitted on social media will remain undetected and non-duplicate, even after deletion.

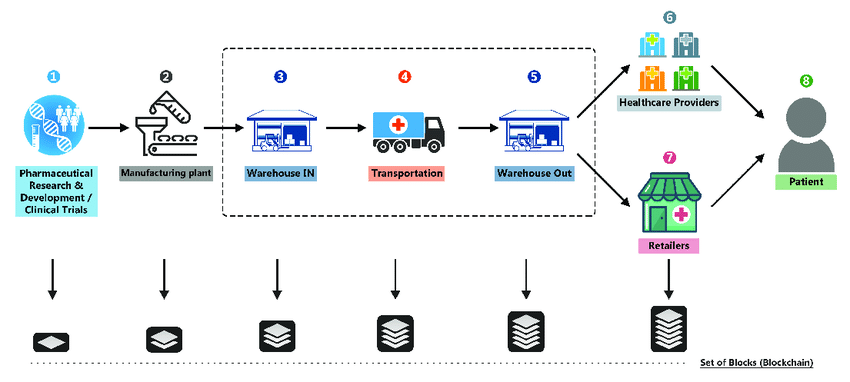

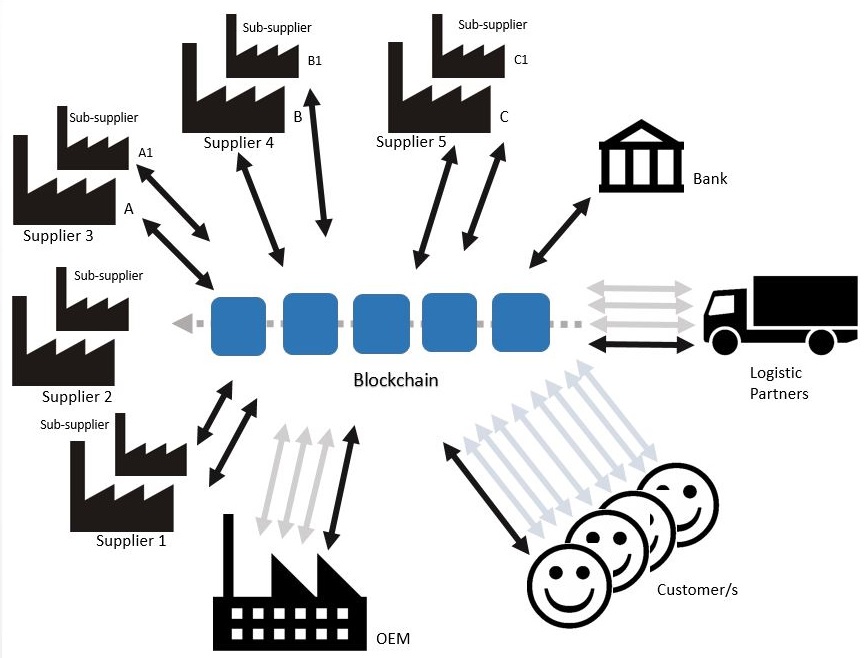

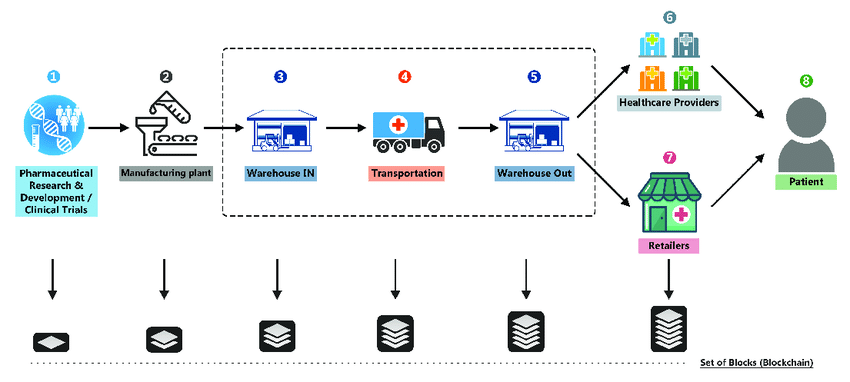

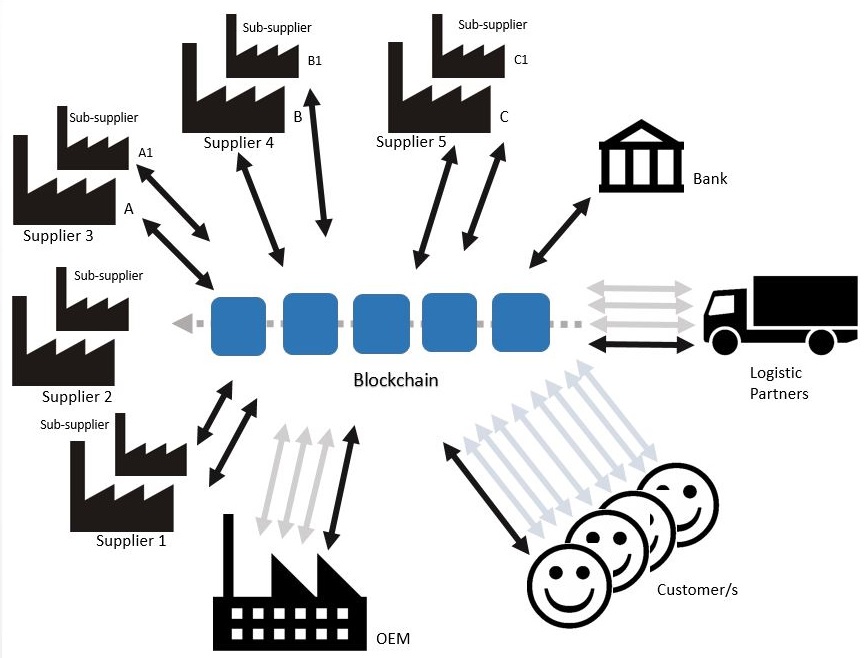

- SUPPLY CHAIN: Companies can use Block chain systems to record product status at each stage of production. The records are permanent and immutable. They make it possible to trace each product to its source. Bitcoin transfers specifically also incur lower fees.

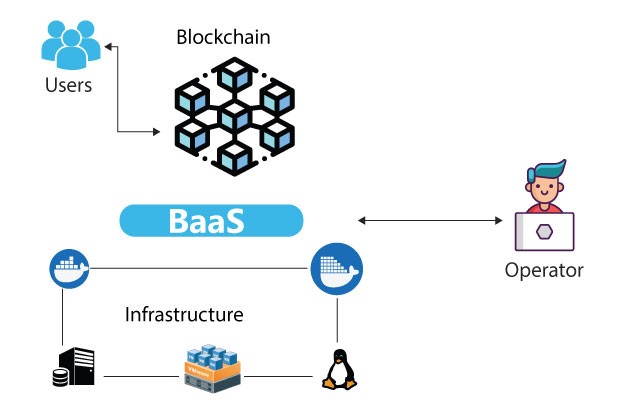

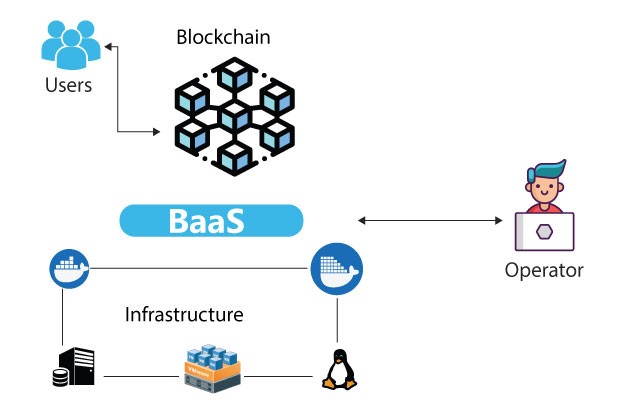

- BLOCK-CHAIN AS A SERVICE(BAAS): This is basically a service provided with the help of block chain, where the consumers can actually use the cloud-based services as a solution to build, and host their block chain solutions, functions and smart contracts. For these service providers, it will charge a fee for the usage of their BAAS platform so that they can deploy it in respect of the needs. What’s more, BaaS is a cloud-based arrangement that permits clients to build up their own computerized items utilizing block chain. These advanced items can be smart contracts, application-driven applications (Dapps), or different administrations that can work with no arrangement necessities for a total block chain-based framework

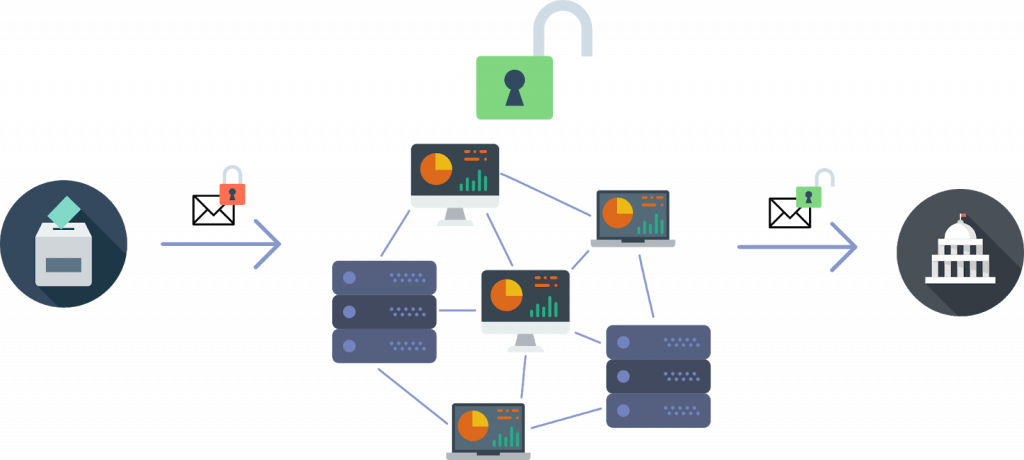

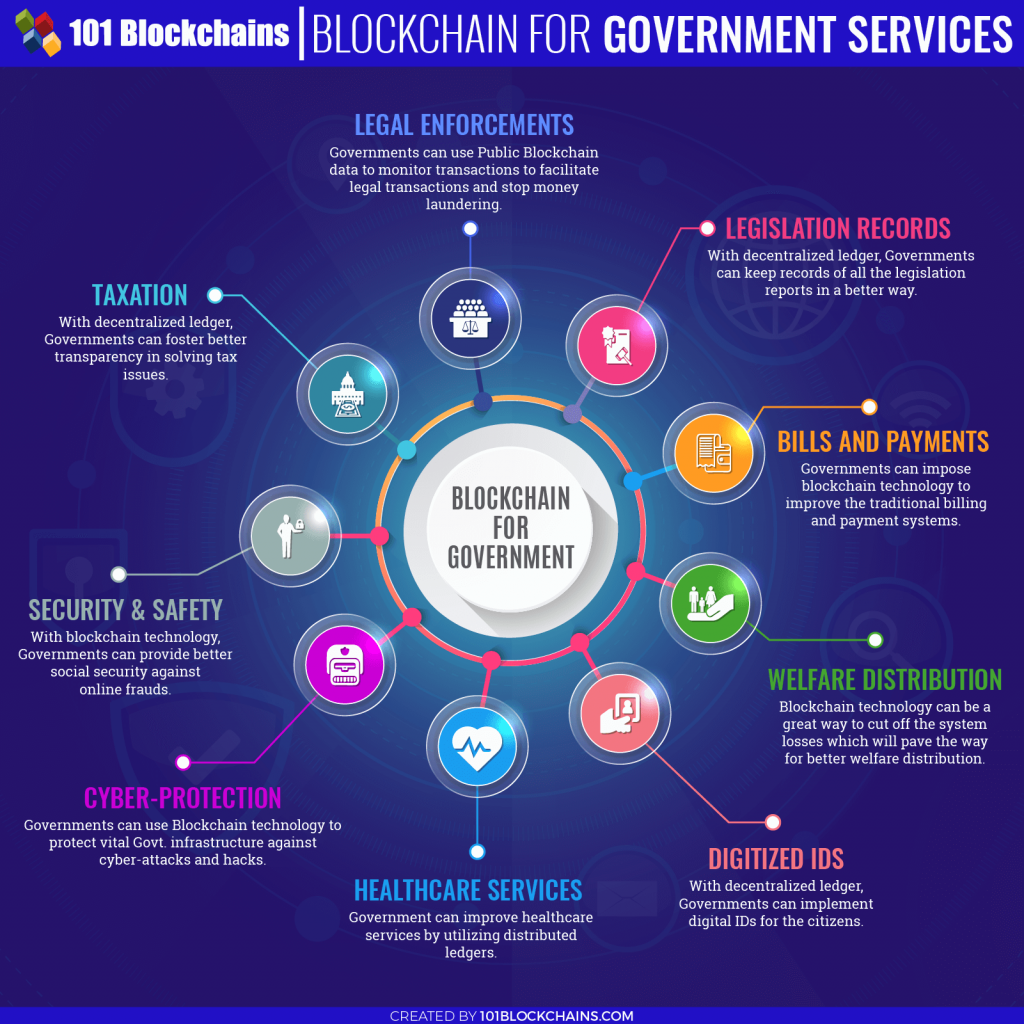

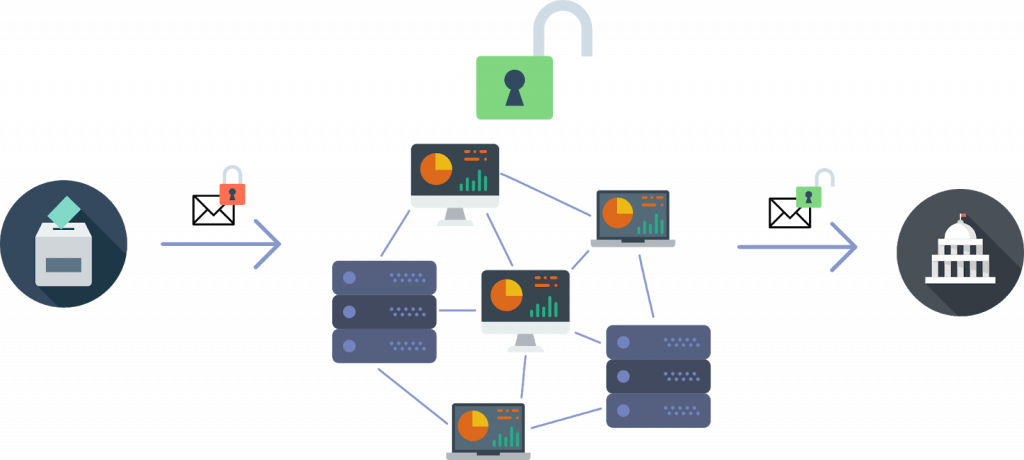

- VOTING: In the future, block chain devices could fill in as a central foundation for casting, following, and tallying votes — possibly taking out the requirement for the recounting by casting out any type of fraud profiles and votes. By capturing votes as transactions through block chain, governments and voters would have a verifiable audit trail, ensuring no votes are changed or removed and no illegitimate votes are added.

- REALTECH: Buying and selling property include a lack of transparency during and after transactions, a lot of paperwork which can lead to possible fraud, and errors in public records. Block chain offers a way to reduce the need for paper-based record keeping and speed up transactions helping stakeholders improve efficiency and reduce transaction costs on all sides of the transaction.

- HEALTHTECH: Use of block chain technology could allow hospitals, payers, and other parties in the healthcare value chain to share access to their networks without compromising data security and integrity.

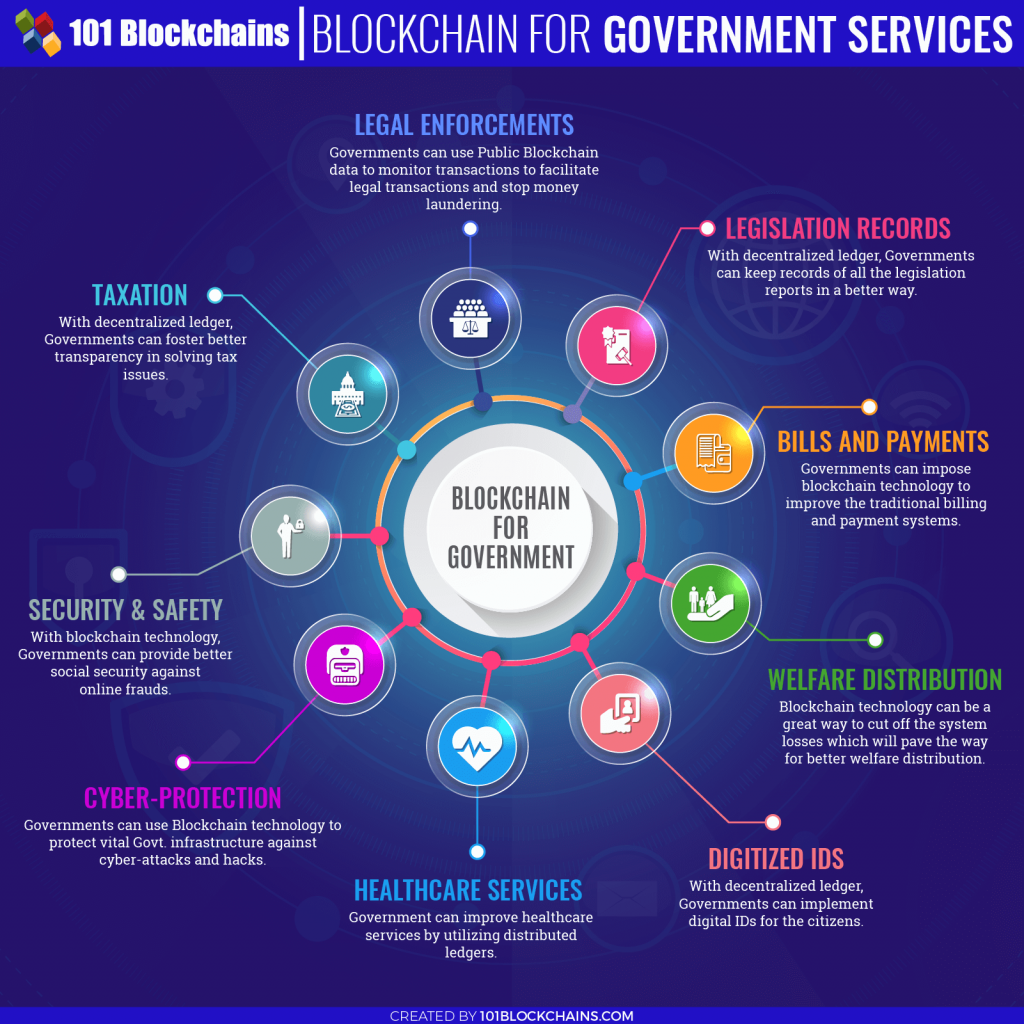

- GOVERNMENT: The management of public services is yet another area where block chain can help lessen paper-based processes, minimize fraud, and increase accountability between authorities and those they serve.

- RETAIL TECH: At present, buyers’ feeling of trust in the retail framework is mostly connected to their trust in the market where their buys are being made. For instance, trust is a key component of Amazon’s prosperity with clients. Block chain could decentralize that trust, connecting it more to the dealers on different market platforms and stages than to the locales themselves.

- HUMAN RESOURCES-On the off chance that work and criminal records were put away in a block chain record, HR experts could smooth out the screening procedure and move employing forms forward more rapidly.

- MANUFACTURING– Utilizing block chain to help advancing frameworks like manufacturing and 3D printing, it can dispense with security vulnerabilities, shield licensed innovation from any theft, and smooth out undertaking the executives, at last assisting the 3D printing and additive manufacturing sectors to grow and scale.

- ECOMMERCE -Block chain technology has the potential to transform e-commerce by lowering transaction costs and tightening transaction security. E-commerce giants such as Walmart, Amazon, and Alibaba have begun exploring block chain technology. For example, Alibaba filed a patent for a block chain-based transaction system in Brazil in March 2020.

APPLICATIONS OF BLOCK-CHAIN:

- YES Bank has facilitated the issuance of a commercial paper (CP) of INR 100 Cr using block chain technology for Vedanta, a natural resources conglomerate.

- National Stock Exchange uses various Block chain solutions for authentication, verification and storage of electronic records in the banking industry and create its KYC utility.

- Delhi-based Sofacle Technologies is a startup which designs and develops block chain-powered enterprise solutions for smart contracts, supply chain finance, insurance, among others.

- PARAM Network, a Bengaluru based start-up is using the block chain solution to cut the cost of e-invoice processing by half and store digital receipts on-chain.

- Somish Solutions is, a startup in India develops and provides block chain-based solutions for applications such as P2P insurance, tokenized fund transfers etc.

- Telangana government joined hands with London-based startup Cognito Technologies for a project, wherein it will leverage block chain technology to come up with credit scores of those from economically weaker sections of society.

- Axis bank announced to use Ripple’s network for cross-border transactions.

CONCLUSION-

According to LiveMint report, “This technology behind bitcoin is now the fastest-growing skill set demanded on job sites. Job growth rates to 2,000-6,000 % and salaries for block chain developers are 50 to 100% higher than regular developer jobs.”

Further More, Initial coin offerings (ICOs) have a far reaching potential for startup subsidizing, which can lead the nation into a block chain center point and a beneficiary of worldwide capital inflows. With positive guidelines, approval and reception of block chain innovation, India can arrive at the phase of huge scope usage, if there is an organized methodology, appropriate administration, environment improvement, talent incubation, and resource allocation. Given these developments, India seems well positioned as a market for block chain to flourish.

Brief Profile

Palak Bhatnagar is a student , pursuing PGDM in Finance and Business Analytics at New Delhi Institute of Management , New Delhi . She is a finance enthusiast , a versatile person who likes to explore . She is a keen learner with an objective to learn and grow.