From the sudden surge in the popularity of green finance to the pervasive impact of ESG factors on consumers and their purchasing decisions, the world is advancing towards extending business cases to build a solid ESG strategy.

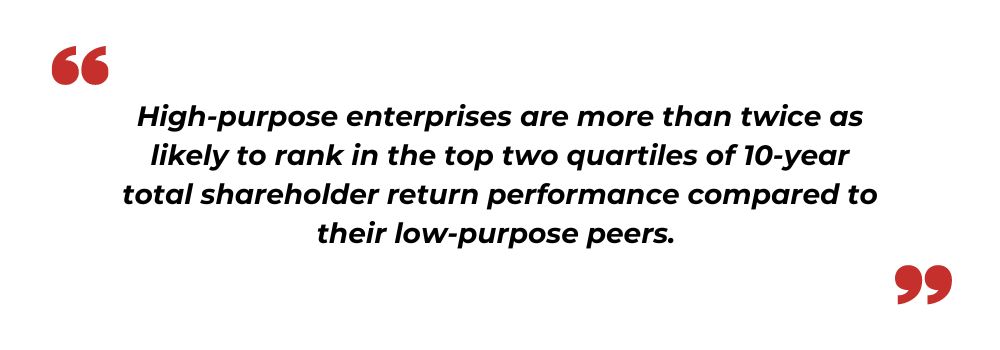

With companies facing a turbulent economic landscape, and the planet encountering a growing climate emergency, businesses are rethinking their traditional operations frameworks that are more focused on shareholder profit. Today the challenge lies in identifying purpose-led businesses that shoulder a wider set of responsibilities. However, embracing these responsibilities does not need to be to the detriment of success. Solely embarking on a sustainability journey could help in gaining a competitive edge.

Getting Started on the Sustainability Journey

The global COVID-19 pandemic fueled conscious consumerism. Organizations started doubling down their commitment to delivering net zero or carbon-neutral emissions. Companies became more attuned to societal and consumer concerns and their own governance with sustainability and social responsibility. As a result, consumers' perspectives started shifting to greener companies. This has increased the adoption of environmental, social, and governance (ESG) strategies as a competitive advantage.

Organizations are opening up to the idea of starting their sustainability journey by including tools that help gain the overall assessment of their policies, business values, and current ESG impact. While it is a hard journey to undertake alone, it could be more beneficial and impactful if businesses together make this into a larger movement. To reduce their carbon footprint, businesses are setting up sustainability departments to allocate a portion of their operations as well as funds to developing sustainability strategies.

Investing Resources in Sustainable Operations is More of a Need than an Option

The rising climate change crisis is predicted to negatively impact business operations in the future. Taking into consideration today's urgent problems caused due to the pandemic, including supply chain and manufacturing disruptions, investors are raising concerns about how prepared businesses should be to deal with global turmoil and other potential environmental disasters. Investors want to understand the steps companies are undertaking to improve their resilience to such impacts.

Building a successful sustainable business begins internally. Initiating conversations about business values is likely to have significant benefits on employee motivation as well as engagement. Millennial and Gen Z workers are scrutinizing to align their personal values with those of their employers or organizations. Setting out an intentional approach to ESG issues can assist organizations in improving their recruitment processes as well as boosting their employee satisfaction.

There are countless resources and articles available that can encourage and guide organizations in creating an impacting framework to make informed investment decisions. At the core of all ESG decisions and developments lies a five-step process. It involves-

-

Defining ESG targets & goals

-

Assessing the current state of operations and developing a strategic plan

-

Aligning the ESG values with like-minded partners

-

Implementing proactive changes in the processes

-

Reporting data & insights

Businesses that do not prioritize investing in environmental sustainability will likely lose any competitive edge they may have had. Owing to these circumstances, many investors are now searching for companies willing to commit their resources to align profit with purpose.

.jpg)

The 'S' in ESG is a Priority for Employee-Related Practices

For some businesses, sustainability offers a new way to attract as well as retain talent. It is garnering major focus after the post-COVID and the Great Resignation. However, employees care more about the way businesses interact with their internal and external communities. Socially responsible businesses are perceived as ones that understand the connection between relationships and profitability and implement frameworks that value and nurture key relationships. Therefore, investors are viewing businesses that engage in questionable labor practices or ignore shifts in cultural expectations as riskier options.

Improving the diversity of corporate boards is an initiative that is characterized as a social responsibility aspect of ESG practices. Enterprises can take it a step further and incorporate the company diversity hiring practices into senior leadership compensation. McKinsey’s Diversity Wins report highlighted the need for a strong link between profitability and board diversity, inclusive of both gender diversity along with ethnic and cultural diversity.

Establishing Purpose-Driven Governance

Investors are becoming more attuned to good governance. While they are interested in the bottom line, they equally care about building a work environment that is diverse, equal, and inclusive. One that supports human rights is responsible for employee development and is equally attentive to other environmental and social issues.

The COVID pandemic brought to light the significance of programs that care for employees. The pandemic led to worker shortages; employee well-being programs gained significance, and we integrated strong tools for maintaining a well-balanced workforce into the company framework.

Enterprises without strong governance practices are likely to suffer from a lack of structure that encourages accountability. Organizations that fail to align their governance policies and practices with purpose-driven values risk devaluing their corporate brand and integrity.

Making ESG a Competitive Advantage Metric

Environmental, social, and governance (ESG) topics are gaining center stage in the corporate agenda. Many organizations that are mired in old ways of thinking are now perceiving ESG as compliance or corporate responsibility. This has led to the hiring spree of chief sustainability officers who are mobilizing organizations to adopt a sustainability lens. While they have equity and inclusion on their scorecard, they are still trying to build equity and inclusion into their culture and business. They are employing the ESG agenda to guide the organizations into making their biggest strategic decisions.

A comprehensive ESG plan and good scores are significant not only for the environment, society, and governance but also for building an image of being sustainable leaders. ESG performance helps in improving the capital cost and attributes this to the following factors:

-

Top line growth

-

Efficiencies that help in reducing cost

-

Transparent relationships with regulators

-

Talent acquisition as well as retention

For businesses to gain a competitive advantage, they must commit to developing their ESG resources, knowledge, and planning along with execution.

Key Highlights

-

ESG factors are expanding beyond boundaries and shaping access to capital, purchasing decisions of the consumer, and supply chains.

-

Aligning business values with the team can help businesses in boosting employee motivation and recruitment success.

-

Developing an intentional ESG strategy enables enterprises to gain a competitive advantage in the growing markets.

-

While sustainability concerns are not going away anytime soon, a solid ESG strategy can help organizations to be the first mover and gain a competitive advantage.

Incorporating ESG Into Business Strategies

Prioritizing ESG is no longer an option for organizations. The ones who want to be competitive and profitable are incorporating sustainable strategies at the very core of their policies. However, the best approach to integrating ESG practices varies depending on the company. Moreover, ESG strategies can conflict with other operational goals if not assessed holistically. With the most effective practices built on brand values in place, businesses are taking advantage of the strategies and behaviours of stakeholders who are willing to support their vision of a sustainable framework.

All boards can take one step to incorporate ESG objectives into their company strategy rather than viewing them as an isolated entity. Establishing a corporate reporting system for ESG problems is another effective way to develop stronger ESG-driven strategies. Mandating certain levels of reporting and making it available to investors and stakeholders will also contribute to creating transparency and, ultimately, gaining greater trust.

Companies that incorporate environmental, societal, and governance issues into their operational policies and programs are being positioned well among their competitors. By filtering corporate and social goals through an ESG lens, businesses can attract investors and other influential stakeholders, thereby aligning their company's purpose with their profitability.

Making a move towards a sustainable future is a win-win because it is: better for business, people, as well as the planet. With today’s climate threats giving rise to an uncertain tomorrow, businesses need to seize the chance to make a significant difference and gain a competitive advantage by establishing themselves as sustainability leaders.

.jpg)