The right to repair has evolved from a consumer rallying cry to a seeming inevitability in a growing number of markets. As legislation passes and regulations arrive, manufacturers need to redesign their products and rethink supply chains and customer service. However, this also offers companies an opportunity to create new business models and demonstrate sustainability in their offerings.

When talking about sustainability, most of us think about reuse and recycling; extension of life isn’t always top of the agenda. But now, regulators in some of the world’s largest markets are beginning to put more pressure on firms to look at product life extension through customer-enabled repair.

Regulators are beginning to put pressure on firms to look at product life extension through customer enabled repair

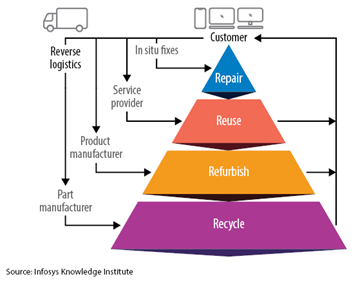

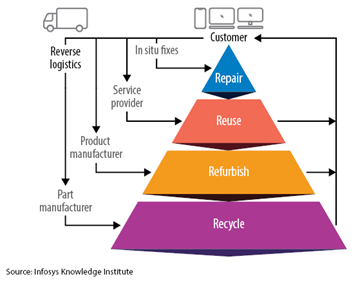

There are two ways to extend the life of a product. It can be sent back to the manufacturer and refurbished to be resold. Or it can be repaired for the customer, who retains ownership of the product. It is this latter option that is arguably the most effective way to reduce environmental impact. This is because products can be repaired at the customer’s own location, reducing the carbon footprint of the logistics required to return products to recycling centers and their processing (see Figure 1).

This so-called “right to repair” for the customer is starting to enter into legislation. Right to repair is the concept of allowing end users, consumers, and businesses to repair devices they own without any legal or technical restrictions. A limited right to repair is already in place in the U.K. and in a few U.S. states, and further expansion seems likely. U.S. President Joe Biden recently ordered the Federal Trade Commission to create national right to repair regulations. The movement is also gathering momentum in the European Union. To prepare for this new landscape, manufacturers need to design their products for repairability, empower their customers to fix problems, and develop an ecosystem of local parts suppliers. This will create both turmoil and new opportunities. At the very least, companies will need to cover the potential losses to revenue from new product sales. However, increasing the access to repair will provide a way to boost sustainability efforts, which are already scrutinized heavily by investors, customers, and other stakeholders.

Figure 1. Repair at the customer’s location generates the smallest logistics cost and emissions

Customers and investors valuing sustainability

Sustainability is driven by more than regulatory pressure and environmental concerns. There is an impressive market for goods made in sustainable ways, with customers often willing to pay a premium. Consumer online searches for sustainable goods increased by 71% globally during the past five years, according to an Economist Intelligence Unit report commissioned by the World Wildlife Fund.1 Market research firm Nielsen expects sustainability-minded shoppers to spend up to $150 billion on sustainable consumer goods by 2021, with growth at four times the rate of conventional products.2

Investors are interested too. Sustainable investment strategies account for one-third, or $17 trillion, of the money under professional management in the U.S. in 2019.3 This spend is on an upward trend, growing from $12 trillion in 2018 and $8.7 trillion in 2016.

The gold standard for manufacturers is to make sustainable and responsible products. A responsible product uses the optimal resources and, once created, offers the lowest possible total cost of ownership (TCO). Initiatives for responsible manufacturing in an enterprise improve the manufacturer’s profitability. Once sold, a responsible product keeps the TCO at a minimum for the end customer.

Circularity and repairability

Despite the incentives, implementing right to repair is difficult. The biggest challenge stems from the growing complexity of products, including large amounts of embedded electronics and software. Manufacturers worry about giving their customers access to repair for multiple reasons — loss of revenue as it cannibalizes new product sales; misuse or copying technology, design, or intellectual property (IP); and safety when hazardous materials are involved. Also, some products are created with planned obsolescence in mind.

Still, these concerns are not enough to offset policymakers’ insistence on sustainability and consumers’ demands for greater control over their property. These right to repair frameworks often require manufacturers of consumer electronics and other goods to build their products in ways that allow customers to repair them on their own. This movement aims to make spare parts, tools, manuals, and diagnostic information available to customers and to enable repair centers to increase product life spans.

The extension of product life will clearly lower revenue from the sales of new goods. But it provides the ability to generate new revenue as well. Post-sale service, spare parts sales, upgrades, retrofits, exchanges, and end-of-life material management could offset the impact in the long run.

Right to repair frameworks require manufacturers to build products in ways that allow customers to repair them on their own

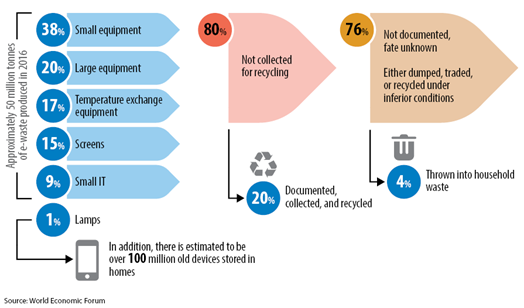

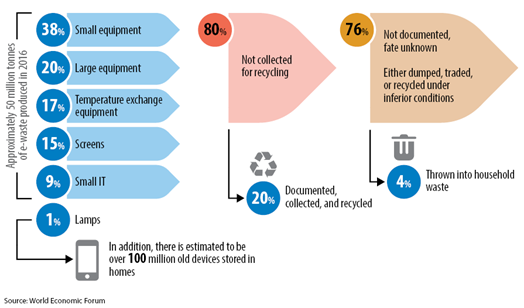

The most obvious potential for right to repair is in consumer electronics. These products are often thrown away in environmentally unfriendly ways. E-waste is worth $62.5 billion of material value annually, according to the World Economic Forum. But only 20% of it is handled appropriately (see Figure 2).4,5 Yet, the concepts of right to repair are equally applicable for automotive, aerospace, and other industries.

Figure 2. Where global e-waste flows

Where manufacturer responsibility ends

This new focus on product life cycles is forcing companies to rethink their obligations. Extender producer responsibility (EPR) is a guiding principle that can help create more sustainable economies.6 EPR advocates that manufacturers assume significant responsibility for their products beyond manufacturing and post-consumer sales — all the way to disposal or treatment. EPR incentivizes manufacturers to include in a product’s price the cost of repair across a product life cycle, and it often includes circularity. This creates incentives to keep a product competitive by minimizing its TCO. EPR is fast becoming a legal requirement in various countries and in some U.S. states. And it’s a matter of time before these regulations expand further.

Factors affecting the repairability debate

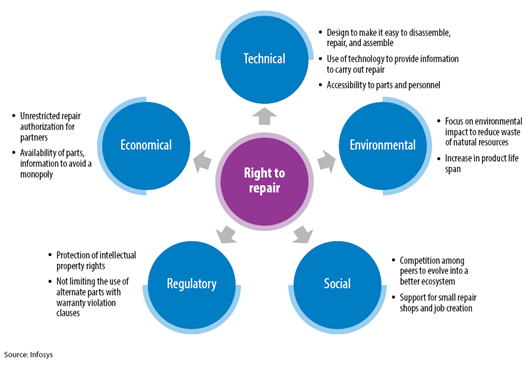

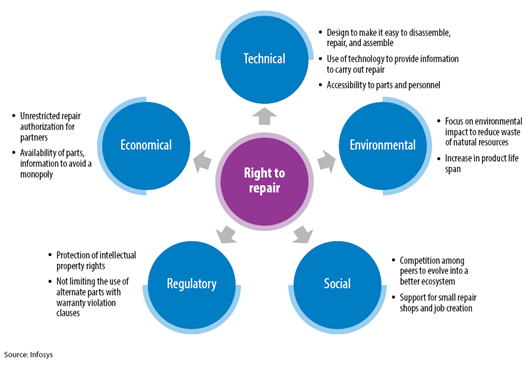

Repairability campaigns have a relatively simple goal but require several factors to be successful. Those include technical, environmental, social, regulatory, and economic aspects (see Figure 3). Each puts pressure on manufacturers. But when implemented effectively, these factors complement each other and drive the campaign in unison.

Figure 3. Strategic considerations for right to repair

Technical. Technology is the most recent driver for repairs, empowering customers with information that helps them fix products. Those resources include online videos, FAQs, and chat tools. Unfortunately, companies have designed products that are challenging to disassemble and repair — often by design. Access to information and spare parts is frequently withheld as a deterrent. Digital technologies like smartphones and augmented and virtual reality (VR) offer visual instructions to carry out repairs. Rolls-Royce, for example, launched VR-based immersive maintenance software recently to train technicians in aircraft engine repair. As the technology matures and becomes more affordable, consumers can expect such training kits for installation and repair.

Environmental. Environmental concerns have been a major driver of repairability efforts in some regions, particularly Europe. But green advantages have actually been an ancillary benefit of some traditional industry practices. In the automobile sector, easy-to-do repairs such as the replacement of filters and oil, for example, help reduce pollution by maintaining vehicle quality. Caterpillar has remanufactured its used parts since 1973. Cummins uses an environment-friendly ultrasonic cleaning process for its used parts and restores them to the original specifications. These examples — applicable to other industries too — save valuable natural resources, such as the energy and water required to make new parts.

Social. The right to repair promotes competition within an industry and offers employment for small repair shops in local communities. When repair becomes a legal requirement, manufacturers will compete to offer ease of repair for their products, along with the necessary tools, spares, and service, to tap into those business opportunities. Repair shops will not be limited to one specific manufacturer and can open up the market across brands.

Regulatory. Manufacturers have made access to product repair challenging in order to protect their IP, including product design, materials used, and manufacturing procedures. In a world with increasingly connected devices, data security and cybersecurity are other issues that also have complicated access to repair. New initiatives like embedded encryption for onboard software and edge computing are needed to meet regulatory requirements while still providing the right to repair.

Economical. Some companies have created monopolies by restricting authorization to repair their products. These businesses often limit the availability of spare parts, specialized tools, and technical information. Such practices lead to increased inflation, while opening the market removes information asymmetry and can slow inflation.

Implementing the right to repair

With the increased focus on sustainability and impending regulations, it is time for producers to turn the right to repair into new business opportunities. Apple, for example, has expanded its free, independent repair provider program to 200 countries recently for its out-of-warranty products.7 It has provided access to genuine spare parts, repair information, and tools for trained technicians. Expanded from its iPhones to MacBook computers, the program is now building an ecosystem of trained repair technicians and creating new revenue streams from spare parts.

Electronic goods in the spotlight

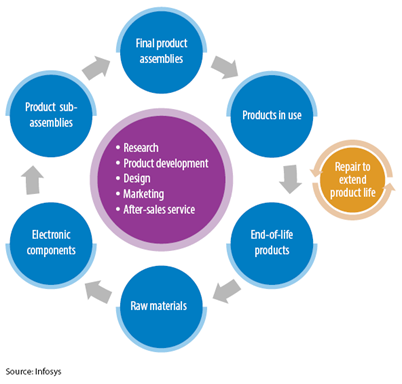

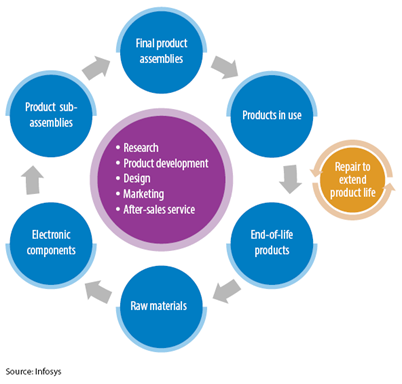

Electronic goods manufacturers will feel the greatest effects from impending U.S. right to repair regulations. These companies will soon need to reimagine the flow of products and how they interact with customers. The circular supply chain model for electronic goods in Figure 4 shows the distinct product phases in the outer circle, with value-added processes in the center. When the final products reach the end user, the repair process loop extends the product life.

Figure 4. Circular product flow for electronic goods with repair to extend useful life

The extension of the life of consumer products opens up new markets for parts and services. The aftermarket segment has traditionally been much more profitable than the sales of new products. However, its share of revenue has been a low percentage of the total revenue. Repair is an opportunity to increase this share.

The following recommendations can help product manufacturers adopt repairability — and profit from the change.

Design for repairability. Products should be created for ease of repair from the time they are conceptualized. A modular, shared approach to design makes it easy to identify and either fix or replace only the specific malfunctioning part.

Adopt repair standards. Companies should adopt universal standards in their design. These universal standards and common formats, across manufacturers and products, are essential to making repairs easy, widespread, and accessible for consumer goods. The European Union recently proposed legislation to make the USB-C port a standard for electronic devices, which will force changes for companies like Apple that use proprietary ports.

Implement localization and part traceability. Companies should manufacture spare parts locally to reduce the carbon footprint from shipping. The traceability of critical components also allows businesses to quickly track these parts for reuse and local self-sustainability when there is a critical need.

Unbundle hardware and software. To protect the copying of onboard software, some product-makers bundle it with hardware and make it difficult to access. While it is necessary to protect the IP rights of manufacturers, bundling the hardware and software hurts repairability. Instead, manufacturers need to develop new security designs and encryption strategies to protect their interests and let consumers repair product hardware or software individually. Encryption of embedded software prevents its copying and manipulation.

Several leading companies have already begun to experiment with right to repair. For instance, Microsoft recently announced it would make it easier for customers to repair its products. The company says it will conduct a study to look at ways to increase access to information and parts by the end of 2022, and thus reduce its electronic waste and overall environmental impact.8

Microsoft’s decision to offer ease of repair to its customers is a signal of what to expect in the coming years. As more companies become environmentally conscious, the right to repair will be a critical topic for many business leaders and in a large number of industries. And since repairability will require a near reinvention of some enterprises, leaders can’t wait until the last possible minute. Early movers who make the necessary changes stand to benefit from the vast opportunities, rather than suffer from the game-changing consequences.

References

- The global eco-wakening: how consumers are driving sustainability, Cristianne Close, May 18, 2021, World Economic Forum.

- Was 2018 the year of the influential sustainable consumer?, Dec. 17, 2018, Nielsen.

- Sustainable investing basics, The Forum for Sustainable and Responsible Investment.

- A new circular vision for electronics, time for a global reboot, Jan. 24, 2019, World Economic Forum.

- The world’s e-waste is a huge problem. It’s also a golden opportunity, Guy Ryder and Zhao Houlin, Jan. 24, 2019 World Economic Forum.

- Extended producer responsibility, Organization for Economic Co-operation and Development.

- Apple’s Independent Repair Provider program expands globally, March 29, 2021, Apple.

- Microsoft just became the first big company to commit to right to repair, Brianna Provenzano, Oct. 7, 2021, Gizmodo.

Originally published at Infosys Knowledge Institute | The Right to Repair and A New Era of Sustainability

Click through to know more about Infosys Sustainability Practice

About the Authors

Manoj Rajan - Principal Consultant, Infosys

Ramachandran S - Manufacturing and Engineering Lead, Infosys Knowledge Institute