Introduction

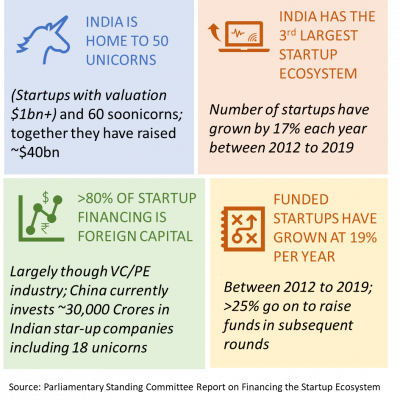

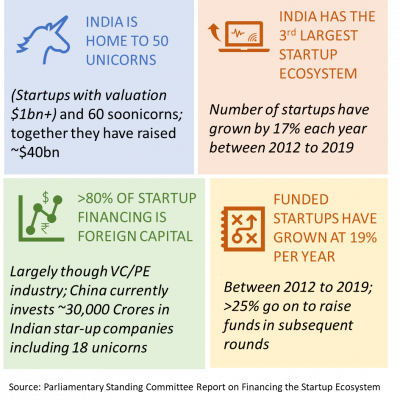

On 9 September 2020, Parliamentary Standing Committee on Finance (PSC) headed by Shri Jayant Sinha presented its report on ‘Financing the Startup Ecosystem’ to the Honorable Speaker, Lok Sabha. The PSC looks at various topics including financing the innovation ecosystem.

The Startup India initiative, managed by the Ministry of Commerce, Department for Promotion of Industry and Internal Trade (DPIIT) was launched on 16th January, 2016 with an objective to build a strong ecosystem for nurturing innovation and startups in the country that will drive sustainable economic growth and generate large scale employment opportunities. Since then, various taxation reforms such as reduction in corporate tax rate, exemption from payment of Minimum Alternate Tax (MAT), abolishment of Dividend Distribution Tax (DDT), 100% deduction of profits for start-ups for up to 3 out of 10 years, and administrative reforms such as start-up cell for grievance redressal and simplified assessment procedures have been provided to the startup ecosystem in India.

The report recognizes the enabling nature of the startup ecosystem towards flow of high-impact innovations into the economy leading to creation of jobs and wealth. Moreover, access to finance is one of the major roadblocks for the growth of startup ecosystem in India. Keeping in view that startups and innovators are driving the next wave of innovation and new ideas need support and financing now more than ever, the role of Private Equity/ Venture Capital, larger companies, High Net-worth Individuals (HNI), family offices, and other institutional investors needs to be encouraged.

In furtherance of this, the report recommends certain measures that will act as a catalyst to enhance liquidity in the market and boost capital influx in the economy, which is a critical requirement to tide over the liquidity crunch during the ongoing Covid-19 crisis. Although the recommendations of the Committee are not binding, they hold significant importance in formulating future government actions.

Recommendations

- Abolish Long Term Capital Gains (LTCG) Tax for all investments in startup companies made through Collective Investment Vehicles (CIV) for at least next two years.[i] After 2 years, Securities Transaction Tax (STT)[ii] may be applied to CIVs so that revenue neutrality is maintained. Startups in this case will be as per the designation granted by DPIIT.

The committee has added that once the pandemic period concessions are lifted, CIV capital gains should be taxed at the same rate as listed securities.

This has come in response to startups’ ask for removing disparity in taxation of LTCG for domestic investors (@20%) versus foreign investors (@10%) as well as the disparity in LTCG tax for investment in listed securities versus unlisted securities.

- Setting-off management fees on returns to investors, i.e., AIF management fees will be deducted before computing capital gains. Currently, any services availed by an AIF located in India (even if it comprises of overseas investors) are liable to GST. GST paid on fund management fee becomes a sunk cost, thereby impeding investments in India.

However, Ministry of Finance is of the view that as per the place of supply provisions under GST, place of supply of such service is in India. It does not violate principle of destination-based consumption tax under GST Law.

- Mobilisation of Domestic Institutional Funds:

The Committee recommended several measures to encourage large financial institutions in India to invest a portion of their surplus into domestic funds, in order to bring in additional domestic capital for startups. This has come in furtherance of reducing India’s reliance on foreign investment (especially from the US and China).

a. Pension Fund Regulatory and Development Authority (PFRDA) and National Pension Scheme (NPS) may be encouraged to invite bids from professional fund managers for running a fund-of-funds program. Small Industries Development Bank of India (SIDBI) would be eligible to participate as well.

b. Remove restrictions such as minimum corpus of AIF as an eligibility criterion for pension fund investment and requirement to invest only in listed AIFs.

c. Major banks should come together to float a fund-of-funds. Furthermore, the current exposure limits applicable to banks need to be enhanced and permission be granted to invest in Category III AIFs also.[iii]

d. Insurance companies (both life and non-life) must be given latitude to invest in fund-of-funds by Insurance Regulatory and Development Authority of India (IRDAI) as well as directly in Venture Capital (VC)/ Private Equity (PE) funds along with a higher exposure cap.

e. Investments by insurance companies in AIFs must be carved out under a separate category while calculating the applicable exposure limits and must not be clubbed with other investments under ‘unapproved investments’.

f. Foreign Development Finance Institutions may also be encouraged to participate with local asset management companies to set up fund-of-funds structure or direct VC/PE funds, particularly in social impact, healthcare and venture/startup sectors.

4. Expansion of Sectors under Foreign Venture Capital Investor (FVCI) route: sectors in which FVCIs can invest should be expanded to include all sectors where Foreign Direct Investment (FDI) is permitted. Currently, it is permitted only in certain sectors, such as, biotechnology, IT related to hardware and software development, nanotechnology etc. This is a move towards attracting capital in the country thereby boosting the economy.

- The committee recognized the need to allow issuance of hybrid securities, which bear characteristics of both debt and equity under the FDI route. It recommends that this can be done for at least a limited period of time to enhance fund-raising capabilities. Currently, foreign investors/pooling vehicles are allowed to invest only in equity capital or instruments which are compulsorily convertible into equity under the FDI route.

- To reduce dependence on foreign capital, the committee recommends creating several large domestic growth funds powered by domestic capital to support India’s unicorns, including the expansion of SIDBI Fund-of-Funds. These funds should be managed by sector-specific qualified management teams.

- The committee recommends that SEBI should allow VC funds to invest in Non-Banking Financial Companies (NBFCs) and allow NBFCs to list on stock exchanges to be able to draw in a larger investment pool. This will help in providing more access to capital by NBFCs.

- The committee recommends that the exemption from income on investments made by Sovereign Wealth Fund of foreign governments before 31 March 2024, subject to the investment being held for a period of at least 36 months as per the Finance Act, 2020, should be provided to long-term and patient capital invested across all sectors. Currently, this exemption is applicable only for infrastructure related projects.

- The committee recommends that the Department of Economic Affairs should set up an expert committee to provide pricing guidelines to government authorities. Currently, pricing guidelines prescribed under the various laws and regulations by SEBI, Income Tax Act, Companies Act, Foreign Exchange Management Act (FEMA) have no consistent valuation approach and create interpretational complexities.

- To expand the sources of capital for startup financing, the committee recommends that companies and LLPs should be allowed to invest in startups without being classified as NBFCs by the RBI. Currently, a listed company may be qualified as NBFC if their assets or income from financial assets exceeds 50%.

As per the recommendation, only debt-free companies will be allowed to invest in startups. This will ensure that companies and LLPs cannot use borrowed funds for further investments. Their investments will have to be made by either through equity contributions from investors or through internal accruals.

Additionally, LLPs should not be classified as a Collective Investment Scheme (CIS) by SEBI, as long as they have less than 20 members.[iv] Currently, there is not cap on the number of members to be able to qualify as a CIS.

Industry engagement

To take positive actions in certain areas, the committee encourages the industry to submit the following:

- Proposal on ‘Mid-Market Permanent Capital Vehicles/Permanent Capital Vehicles’, in the context of creating permanent sources of capital for the startup ecosystem.

- Concept note on the issues pertaining to insurers’ investments in AIFs, to be submitted to IRDAI.

Trust you will find the update useful.

Please reach out to garima@nasscom.in or tejasvi@nasscom.in in case you have any suggestions/ feedback.

[i] CIVs are entities that are created to enable investors to pool their funds for investment, such as angel funds, Alternate Investment Funds (AIF) and investment LLPs.

[ii] STT is a direct tax levied on sale and purchase of securities that are listed on a recognized stock exchange in India.

[iii] Category III AIFs are funds which employ diverse or complex trading strategies, such as hedge funds.

[iv] CIS is an investment scheme where individuals pool their funds for investment and sharing return as per a pre-determined arrangement.