You might have heard a lot about ESOPs, or Employee Stock Ownership Plans. An ESOP is a type of stock-based compensation plan, in which selected employees have the right to purchase the shares of the company they work for at a pre-determined price after a certain period. In recent years, startups have been using ESOPs intending to retain, motivate, and attract employees. But, the shares of startups are not listed on any stock exchange, you might be thinking, how do you value an ESOP? Well, this article will cover the concept of ESOPs along with tools for valuing ESOPs.

Startups and ESOPs

To better understand the concept of ESOP valuation, let us look at what startups are and what ESOPs are. Startups are small businesses or typically new ventures that are characterized as having a high degree of innovation, risk, and growth. Since startups are new ventures, they usually have limited resources, require competitive employees, and have to compete in the dynamic marketplace. By keeping these factors in mind, startups have started using ESOPs to attract, retain, and motivate their employees which requires limited capital and hence gives a competitive edge over their competitors. This makes ESOPs popular among startups and has been used since the 1960s in the United States. The following section of the article will give a brief overview of ESOPs.

What are ESOPs?

ESOP or Employee Stock Ownership Plans are defined as equity compensation plans that offer employees the opportunity to hold a stake in the company they work for. In practical terms, selected employees under ESOP have the right to purchase the shares of the company at a set price known as a strike or exercise price after a specific period i.e. vesting period. The purpose of ESOPs is to align employees' interests, create a sense of loyalty toward the company, and motivate employees to achieve a higher level of performance. As a result, ESOP is considered a powerful tool used in startups to retain, motivate, and attract employees.

What is the role of ESOPs in startups?

ESOPs have been used since the 1960s in the United States to offer employees an ownership stake in the company. Now, ESOPs have become a highly popular type of stock-based compensation, providing employees with better benefits. The following are some of the benefits of ESOPs for startups.

1. With the help of ESOP, it raises employee morale and adds passion and enthusiasm to employees which drives them to perform better in the company and results in productivity gains.

2. The vesting period of ESOP can serve as an inducement that encourages employees to remain with the company for a longer period. This can result in the retention of the best employees, which will eventually lead to the development of a highly qualified team.

3. It creates an ownership culture and develops a sense of responsibility among employees in the company, which fosters a higher level of dedication and loyalty. As a result, it helps align the interest of employees with the startup.

Key terms ESOP

To better understand the working of ESOP and its valuation, let us look at the key terms associated with ESOPs.

1. ESOP Agreement - An agreement or contract between the startup and its employees that specifies the terms and conditions of the ESOP such as vesting period, strike price, number of shares granted, etc.

2. Strike price/exercise price - The strike price is the price at which shares are to be purchased by employees under the ESOP once they vest. Typically, the strike price is based on the fair market value of the shares which is determined using 409A valuation.

3. Vesting period - The vesting period is the amount of time employees have to wait before they can buy their shares under the ESOP. It could range from months to years, depending upon the terms and conditions of the ESOP.

4. Expiry date - An expiry date is typically the last day that employees can buy their vested shares under the ESOP. It is essential to note that after the expiry date, the ESOP can be terminated or considered void.

How does ESOP work?

Well, from signing an ESOP agreement to exercising the ESOP, it is implemented in a step-by-step procedure. Once the ESOP agreement is signed, the shares are granted under ESOP. Further, the employee must wait until certain conditions are met i.e. vesting period, and thus when the vesting period is completed, they can purchase the shares at the given strike price. This process of purchasing the shares under an ESOP is known as exercising. Therefore, the total number of shares issued varies based on the terms and conditions of the ESOP and the strike price is measured using 409A valuation or fair market value of stocks.

What is 409A valuation in ESOPs?

In general, 409A valuation is the process of determining the fair market value (FMV) of stock in privately held companies. Since ESOPs are equity-based compensation and it offered by privately held companies, the external markets or stock exchange of shares are not involved. In this way, to measure the FMV of stocks, the concept of 409A valuation is used. It is a provision of the Internal Revenue Code (IRC) which requires 409A valuation to be used to measure the FMV of stock in privately held companies. Thus, to set the strike or exercise price, 409A valuation is used.

ESOP valuation

Now that you have a basic understanding of ESOPs and 409A valuation, you are ready to learn how ESOP valuation works. Before we dive deeper into the valuation process, it is important to note that the strike price/exercise price acts as a significant factor in the value of an ESOP. This is because the shares are to be purchased by employees at the strike price which is the sole determinant of valuation. Probably, you might be wondering that is ESOP valuation based on 409A valuations. The answer lies in the fact that to some extent, it is based on 409A valuation, however, other factors as well as methods are used to determine the valuation of ESOPs.

How to value ESOPs?

There are various methods and strategies used to value an ESOP, and each of them works based on a different set of criteria and factors. A startup's ESOP is valued using a variety of techniques and models, including the Black-Scholes model, the Binomial model, and the Monte Carlo model. Essentially, the techniques are based on hypotheses and factors that allow us to determine the value of an ESOP. While regardless of any method, the FMV of shares is essential to the valuation of ESOPs, and thus 409A in this regard is important. As a result, 409A valuation is considered the cornerstone of ESOP valuation.

Methods of ESOP valuation

The following are the commonly used methods of ESOP valuation:

1. Black-Scholes method (BSM) - The ESOP valuation Black-Scholes method is based on the stock options valuation methodology created by Fischer Black, Myron Scholes, and Robert Merton. The model is the most widely used approach for valuing ESOPs in startups or private companies, and it is based on six variables: volatility, type, underlying stock price, strike price, period, and the risk-free rate. The BSM Model emphasizes the idea of hedging while minimizing the associated risks. While the mathematical formula of the Black-Scholes method is given below.

Note: In the above formula, S stands for share price, K is for exercise price, sigma stands for volatility, T stands for time till exercise, and R is for the risk-free rate.

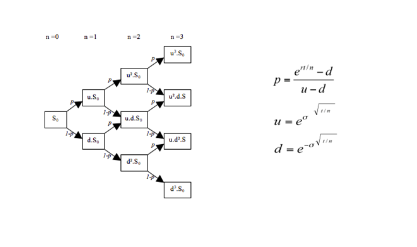

2. Binomial model - Another method for ESOP valuation is the binomial model. The Binomial Model's philosophy is built on the notion of an iterative process that makes it possible to specify nodes between the date of valuation and the ESOP expiration date. It is classified as a risk-neutral technique since it is a path-independent stock option (ESOPs), which means that the ESOP cannot be exercised before the expiry date. As a result, to accurately value ESOP, the Binomial Model can be used. Below given is the binomial model equation that can be used to determine the value of an ESOP.

3. Monte Carlo model - In contrast to other methods, one method for evaluating ESOPs is the Monte Carlo model, which involves identifying the projected share price with the help of experts. As a result, random outcomes of the FMV of stock at a specific period are used to sample the share price from past data. This model is a very flexible approach since it is based on a series of assumptions and it allows us to make adjustments based on the company's current financial situation. In addition to this, regardless of the complexity and the uniqueness of each startup's financial situation, the Monte Carlo model remains a valid choice for valuing ESOPs.

When should you value ESOP?

Startups must make sure to offer full transparency about the fair value of each ESOP, the number of shares being granted, and the procedures for exercising them when creating the ESOP. This means that the valuation should be decided at the time of signing the ESOP agreement. Furthermore, once the ESOP is in place, regular valuations are required so that it is fair to all parties involved. While the valuation can be conducted by an independent third party such as Eqvista to ensure that the valuation is accurate, fair, and consistent with 409A and other regulations.

Conclusion

As you can see, the ESOP valuation process is extremely important for startups. This is because if an ESOP is not properly valued, it can lead to unfair practices as well as inefficiencies in the company.