The Fintech industry continues to make progress in delivering personalized experiences by leveraging customer data. However, to manage vast datasets, ensuring regulatory compliance is more critical than ever. With the global financial analytics market projected to reach $23.04 billion by 2032, institutions must balance innovation with increasing regulatory complexities. As regulations tighten and customer expectations rise, efficient data management is essential for compliance and insight-driven decision-making.

The Role of Data Engineering in Finance

Data engineering for finance plays a crucial role in shaping scalable architectures, optimizing compliance processes, and enhancing decision-making capabilities. With 1.7 billion unbanked adults, financial institutions must harness data engineering to create customized financial products that promote inclusion. This blog explores the complexities of data engineering solutions for financial compliance, highlighting their benefits and best practices for tackling industry-specific challenges.

Critical Hurdles Faced by Financial Institutions

In the finance industry, institutions encounter various technical and operational hurdles that complicate finance data management. These challenges are heightened by ensuring compliance, protecting sensitive information, and maintaining high performance in real-time environments. Key challenges include:

1. Complex Regulatory Compliance: Financial institutions operate under stringent regulatory frameworks such as GDPR, CCPA, Basel III, and SOX. Compliance is critical, with non-adherence resulting in severe penalties and reputational harm, making it imperative to establish transparent data lineage, audit trails, and secure access across vast datasets.

2. Data Security and Privacy: Financial data, including transaction records and customer information, is susceptible. Protecting this data requires robust encryption, access controls, and secure storage solutions that can scale alongside increasing data volumes.

3. Scalability in High-Volume Environments: The finance sector produces extensive real-time data from trades, transactions, and customer interactions, requiring robust and scalable infrastructure to process high-frequency data streams efficiently. With global data production projected to reach 175 zettabytes by 2025, financial institutions must adopt horizontally scalable architectures to meet growing demands.

4. Data Quality and Integration: Financial institutions gather data from various sources, including legacy systems and third-party applications. Combining this data into a cohesive financial platform while maintaining high quality requires sophisticated transformation and cleansing techniques to ensure reliable insights.

5. Real-Time Data Processing for Decision-Making: Critical operations like fraud detection and risk management require instantaneous decision-making. Achieving this demands a system capable of real-time processing, as traditional batch processing methods fall short in these scenarios.

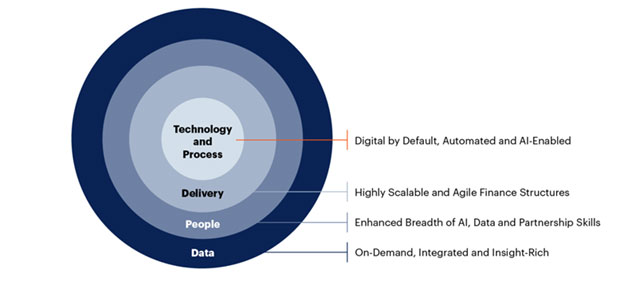

Source: Gartner

Best Practices for Data Engineering in Finance

Institutions must implement advanced technical practices that ensure robust data architectures and streamlined workflows to effectively manage the complexities of data compliance and scalability in the finance sector. Some of the best practices include:

1. Automated Data Governance: Automating data governance enables consistent enforcement of policies and compliance standards across the data lifecycle. Using tools like Apache Atlas or Collibra, institutions can implement frameworks that include automated metadata tagging, data lineage tracking, and policy execution, reducing manual intervention while maintaining regulatory compliance.

2. Adopt Scalable Cloud Architectures: Adopting scalable cloud architectures allows financial institutions to dynamically adjust resources based on workload demands, ensuring efficient performance. Implement serverless computing (AWS Lambda, Azure functions) and container orchestration (Kubernetes) to facilitate elastic resources provisioning, supporting horizontal scaling to handle high-throughput transactions while maintaining low latency and availability.

3. Implement Advanced ETL Pipelines: Implementing advanced ETL pipelines enhances data processing efficiency and accuracy. Design ETL pipelines using Apache NiFi or Apache Airflow for real-time data ingestion and transformation. Employ Change Data Capture (CDC) strategies to ensure accurate data replication and synchronization across multiple data sources and targets, minimizing latency and inconsistency.

4. Enable Real-Time Analytics: Businesses can access insights for immediate decision-making in critical scenarios with real-time analytics. Utilize stream processing frameworks like Apache Kafka and Apache Flink for low-latency data ingestion and processing. This setup enables complex event processing (CEP) and real-time analytics for operations such as fraud detection and risk management, ensuring timely responses to emerging threats.

5. Conduct Comprehensive Data Quality Checks: Conducting comprehensive data quality checks ensures reliable datasets for downstream processes. Integrate AI-driven data quality tools like Trifacta or Informatica data quality for automated profiling and cleansing. Implement validation frameworks to monitor data accuracy, completeness, and consistency, guaranteeing high-quality datasets for compliance and reporting purposes.

Noteworthy Success Stories in Financial Data Engineering

Data engineering has profoundly impacted various financial institutions, enabling them to optimize processes and meet stringent regulatory requirements. Here are a few examples illustrating its impact:

Risk Management at JP Morgan

JP Morgan Chase, one of the largest financial institutions in the world, leveraged data engineering to enhance its risk management strategies. The bank implemented a robust data pipeline that aggregated vast amounts of data from diverse sources, including market data, transaction records, and historical financial data. Using advanced analytics and machine learning models, JP Morgan identified potential risks in real time, allowing for proactive management. For instance, their systems predicted market fluctuations and assessed credit risks associated with loans and investments. This transformation improved decision-making and helped comply with stringent regulatory requirements. The bank's ability to quickly analyze and report risk exposures significantly enhanced its resilience against financial uncertainties.

Fraud Detection at PayPal

PayPal made significant strides in fraud detection by implementing sophisticated data engineering techniques. By developing an integrated data architecture, PayPal collected and analyzed transaction data from millions of users globally in real time. Employing machine learning algorithms, PayPal detected fraudulent activities by identifying patterns and anomalies that deviated from typical user behavior. For instance, if a transaction appeared unusual based on a user's historical data—such as an atypical location or transaction amount—the system triggered alerts for further investigation. This proactive approach minimized losses from fraudulent transactions and enhanced customer trust and satisfaction. By ensuring quick and accurate fraud detection, PayPal adhered to regulatory standards while maintaining a seamless user experience.

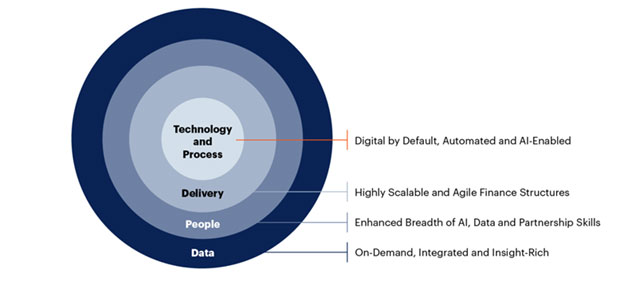

Crafting Comprehensive Data Engineering Solutions for Finance

Financial institutions must consider inculcating the following components in their data engineering process for optimum results:

1. Data Consulting: Conduct architectural assessments and augment data pipelines to ensure alignment with enterprise data management standards. This approach enhances integration and compliance workflows through established data governance practices, improving data utilization and enabling informed decision-making across financial systems.

2. Data Modeling: Utilize advanced schema design and normalization techniques to create scalable data models within data lakes and warehouses. These models support efficient data retrieval and robust analytics, ensuring consistency and accuracy in reporting across multiple data sources.

3. Data Governance: Implement automated governance frameworks using tools like Apache Atlas or Collibra to ensure comprehensive data lineage, policy enforcement, and compliance tracking. This architecture promotes data integrity and security through role-based access controls and audit trails, reducing risks associated with data breaches.

4. Data Ingestion: Develop scalable ETL (Extract, Transform, Load) pipelines with technologies such as Apache Kafka and Apache NiFi for seamless aggregation of heterogeneous data sources into a centralized repository. These pipelines support high-throughput data ingestion, essential for real-time analytics and operational efficiency in finance.

5. Data Quality: Integrate data quality frameworks leveraging AI-driven tools such as Trifacta or Informatica Data Quality to perform automated data profiling and anomaly detection. Establish strict validation rules and continuous monitoring mechanisms to ensure data remains consistent, aligned, and accurate with business metrics, thus supporting reliable analytics and reporting.

Conclusion

Effective data engineering solutions in finance are crucial for ensuring compliance, security, and scalability. By addressing challenges like data silos, regulatory complexities, and poor data quality, financial institutions can leverage data engineering solutions to improve operational efficiency and mitigate risks. Adopting best practices in finance data management means prioritizing agility, advanced analytics, and robust governance.