Global Capability Centers (GCCs) have become a strategic asset for multinational companies seeking to leverage vast talent pools, innovation capabilities and operational efficiencies across the globe. However, the presence of pre-existing business entities in the geographic region introduces both opportunities and challenges, particularly in terms of maintaining the right balance between leveraging this presence and ensuring the GCC's autonomy. Especially in the context of matrixed organizations that have multiple bifurcations in terms of geographies/markets, these decisions are crucial in the GCC’s ability to function as a strategic asset.

This blog post explores when to capitalize on an existing business setup and when to establish independent operational frameworks to safeguard the GCC’s unique strategic objectives.

Inception

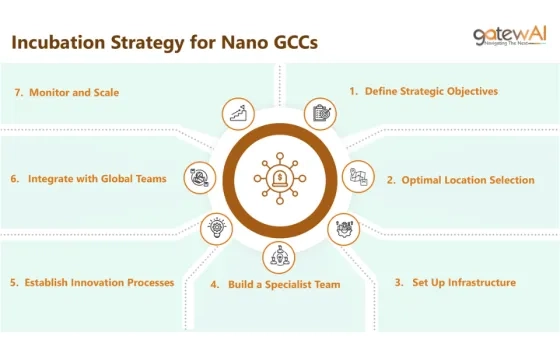

The inception phase is critical in establishing a GCC. This initial stage requires precise strategic decisions to effectively set the foundation for the GCC's future operations. Key activities include establishing a legal entity (or not), selecting a location, developing infrastructure, and forming a core team. Utilizing existing business resources within the region can streamline these processes, enhancing efficiency and reducing both costs and market entry risks. However, it is vital to ensure that these existing resources align well with the GCC's unique needs and strategic objectives.

Decision Framework

1. Criteria for Leveraging Existing Business Presence:

- Alignment with GCC Goals: Utilize existing infrastructure if it supports the strategic objectives of the GCC without necessitating significant adjustments. This includes the ability to leverage existing legal entities, compatible facilities, technology infrastructure, HR and administrative processes.

- Advantages of Utilization: Leveraging suitable existing setups can expedite the GCC launch, diminish initial costs, and mitigate market entry and regulatory compliance risks.

2. Criteria for Establishing New Infrastructure:

- Misalignment with Strategic Needs: If the existing infrastructure does not support the GCC's technological requirements or strategic ambitions, or if it limits potential growth and innovation, it should not be leveraged.

- Benefits of New Investments: Building new facilities and systems tailored to the GCC's needs ensures operational effectiveness and strategic independence. This approach prevents inefficiencies and performance compromises that could result from adapting an unsuitable existing setup.

Strategic HR Considerations

In establishing a GCC, it's essential to strategically design the organization's structure and human resource (HR) policies to ensure operational effectiveness and maintain cultural integrity. This involves creating organizational hierarchies, setting salary benchmarks, and formulating promotion and policy frameworks. Such structures not only define the internal dynamics of the GCC but also its integration with the broader multinational organization. A key consideration here is, irrespective of the industry classification of the organization, the GCC competes with several other technology organizations and its peers in its ability to attract and retain talent – something that is often overlooked!

Decision Framework

1. Criteria for Leveraging Existing Business Structures:

- Alignment with GCC Goals: Adopt existing organizational designs, salary structures, and HR policies when they align with the GCC's culture and operational objectives. This approach is advantageous if the existing frameworks have successfully attracted and retained talent and are competitive in the local market.

- Advantages of Leveraging: Using established structures can provide consistency across the enterprise, foster a cohesive culture, and expedite the operational ramp-up by setting clear career paths and expectations for employees.

2. Criteria for Establishing New HR Frameworks:

- Unique GCC Objectives: Develop new HR frameworks if the GCC aims to foster innovation or requires specific types of talent that the existing structures do not support. This is particularly relevant if the GCC operates in cutting-edge fields or needs to attract a different kind of talent.

- Benefits of Customization: Tailoring salary benchmarks, promotions, and policies can position the GCC as an attractive employer within its specific domain, encouraging a culture of innovation and attracting niche experts vital for strategic objectives.

Governance

Governance within a GCC is pivotal, serving as the structural backbone that connects the GCC with the multinational headquarters. It ensures alignment in business practices across borders, maintaining operational integrity, compliance, and accountability. Governance involves setting up decision-making processes, accountability frameworks, and compliance checks that resonate with the parent company’s ethos while considering local market nuances.

Decision Framework

1. Criteria for Leveraging Existing Governance Structures:

- Alignment with Operational Needs: Utilize existing governance frameworks when they align with the GCC’s operational requirements and uphold global corporate standards. This is beneficial if these structures provide strong compliance and oversight mechanisms that can be extended seamlessly to the GCC.

- Advantages of Leveraging: Employing proven governance models from the parent company enhances accountability and ensures adherence to corporate policies. It also simplifies management oversight and facilitates efficient reporting and communication with the headquarters, reducing the risks of non-compliance with international standards.

2. Criteria for Developing Bespoke Governance Models:

- Need for Flexibility and Innovation: Develop custom governance structures if the GCC operates in a dynamic sector requiring rapid innovation and decision-making, or if it needs greater operational flexibility.

- Benefits of Customization: Tailoring governance to the specific needs of the GCC empowers it to act more independently, fostering a nimble environment conducive to innovation and local market engagement. A bespoke model ensures that governance supports the GCC’s unique objectives without becoming a bottleneck in the decision-making process.

Domain and Skill Development

For a GCC, building domain expertise and enhancing workforce skills are essential to achieve strategic alignment with the multinational's global objectives. Domain building focuses on acquiring and nurturing relevant technical and business knowledge, while skill building involves continuous enhancement of the workforce's capabilities through targeted training and ongoing education.

Decision Framework

1. Criteria for Leveraging Existing Training Frameworks:

- Alignment with GCC's Competencies: Utilize established training and development frameworks when they match the GCC's core competencies and focus areas. This is advantageous if the training programs are comprehensive, current, and have proven effective within other units of the multinational.

- Advantages of Leveraging: Adopting proven training resources ensures the GCC's workforce is well-prepared and maintains consistency with the broader talent development goals of the multinational. It also saves time and reduces costs by minimizing the need to develop new training materials.

2. Criteria for Developing Custom Training Programs:

- Specialization in Emerging Technologies: Develop bespoke training programs when the GCC's focus areas involve new domains or cutting-edge technologies, which are not covered by existing frameworks.

- Benefits of Customization: Tailored training initiatives address specific skill gaps and establish the GCC as a center of excellence within the multinational. This approach attracts top talent and fosters a culture of innovation, positioning the GCC as a leader in its strategic domains.

Management of Fiduciary Functions

Fiduciary functions within a GCC are critical, encompassing financial management, accounting, and regulatory compliance. These functions ensure that the GCC operates within both the local legal frameworks and the broader financial policies of the multinational corporation. Effective management is crucial for mitigating financial risks, maintaining accurate financial reporting, and preserving investor and stakeholder trust.

Decision Framework

1. Criteria for Leveraging Existing Fiduciary Practices:

- Alignment with GCC’s Requirements: Utilize the existing business's fiduciary practices when they comprehensively meet the operational and regulatory needs of the GCC. This includes alignment with established financial management systems, accounting practices, and compliance processes.

- Advantages of Leveraging: Leveraging existing practices can ensure consistency in financial operations across the enterprise, simplify the integration of global financial results, and adhere to international financial reporting standards. This approach reduces the setup time and resource investment required to establish new fiduciary functions, facilitating a swift and efficient operational start for the GCC.

2. Criteria for Developing Custom Fiduciary Functions:

- Unique Operational Needs: Develop bespoke fiduciary functions if the GCC’s financial operations, regulatory environment, or business model substantially differ from the existing business. This is necessary if the GCC engages in unique transactions, operates in a sector with specific financial regulations, or requires new technologies for financial management.

- Benefits of Customization: Tailoring fiduciary functions helps the GCC manage its finances accurately and comply with local regulations effectively. This specialized approach ensures financial integrity and compliance, protecting the organization against specific financial and legal risks associated with its operations.

Management of Reporting and Approval

Reporting and approval channels are integral to the operational structure of a GCC dictating decision-making, information flow, and accountability. Effective channels ensure alignment with the multinational corporation's strategic goals while providing the flexibility to address local challenges and opportunities.

Decision Framework

1. Criteria for Leveraging Existing Channels:

- Alignment with Strategic Objectives: Leverage existing reporting and approval frameworks when they support the operational efficiency and strategic alignment of the GCC with the broader corporate objectives. This is particularly beneficial when existing structures promote transparency, facilitate communication across geographies, and ensure timely decision-making.

- Advantages of Leveraging: Utilizing established channels can streamline processes, reduce duplication of efforts, and maintain coherence in decision-making and risk management across the multinational. This helps in integrating the GCC more closely with the overall corporate strategy and maintaining a uniform approach across different locations.

2. Criteria for Developing Custom Channels:

- Need for Autonomy and Agility: Establish customized reporting and approval mechanisms if the GCC operates with significant autonomy, especially in innovation-driven tasks or localized projects that deviate from the parent company’s traditional scope. This is necessary when the GCC’s work demands rapid decision-making or if it operates in a highly dynamic sector.

- Benefits of Customization: Tailored channels allow the GCC to respond quickly to local market demands and technological changes, enhancing its effectiveness and enabling it to pursue unique objectives. Creating independent reporting lines to specific departments at headquarters or forming a local advisory board can help balance autonomy with integration into the broader strategy.

Strategic Risk Management & Compliance

Risk management and compliance are essential elements in the operational framework of a GCC. These functions ensure that the GCC operates within both the legal and regulatory confines of its host country and the internal policies and industry standards of the multinational corporation. Effective risk and compliance management not only protect the organization from legal and financial repercussions but also enhance operational reliability and maintain the company's reputation.

Decision Framework

1. Criteria for Leveraging Existing Frameworks:

- Alignment with GCC’s Needs: Utilize established risk management frameworks and compliance protocols when they align with the GCC's operational needs and regulatory requirements. This is beneficial if the existing frameworks are comprehensive and have proven effective in other units of the multinational.

- Advantages of Leveraging: Leveraging proven frameworks ensures that the GCC adheres to high standards of corporate governance and regulatory compliance. It maintains consistency across the multinational, minimizes risks of non-compliance penalties, and protects the organization's reputation by ensuring operations meet the multinational's established standards.

2. Criteria for Developing Custom Frameworks:

- Unique Operational and Regulatory Challenges: Develop bespoke risk management and compliance models if the GCC faces unique operational risks or regulatory requirements that differ from those encountered by other regions where the company operates. This includes handling sensitive data under stringent regulations or navigating unique environmental or financial compliance challenges.

- Benefits of Customization: Tailoring risk and compliance strategies ensures the GCC can effectively manage local specificities and comply with regional laws without compromising operational efficiency or legal integrity. This proactive approach allows the GCC to respond swiftly and adaptively to changes in the regulatory landscape, positioning it better to manage potential risks before they escalate.

Conclusion

Establishing a GCC in a country of business operation requires a multifaceted strategic approach that balances leveraging the advantages of an existing business presence with the need for operational and strategic autonomy. Multinationals must thoughtfully evaluate each operational aspect of the GCC—from the foundational setup to intricate compliance details—to ensure that the center not only benefits from local synergies but also thrives as an independent entity aligned with global objectives.

The decision to either integrate with existing structures or establish new ones should be guided by the specific needs of the GCC, its strategic goals, and the local market dynamics. While existing resources and frameworks can provide a robust starting point, reducing initial costs and alignment times, the unique functions of a GCC may demand tailored solutions to effectively meet its objectives and maximize its value within the multinational framework.

Ultimately, the success of a GCC hinges on finding the right mix of integration and independence. This balance ensures that the GCC can leverage the multinational’s global strengths while fostering the innovation and agility needed to excel in a competitive market. By carefully navigating these decisions, companies can harness the full potential of their GCCs, turning them into pivotal assets that drive global strategies forward.