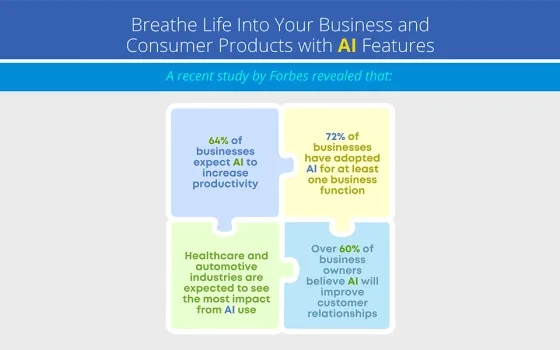

We all know data runs the world. The question is, can you align insurance with data?

Data has always been at the heart of insurance. Although the modern commercial insurance industry may have begun with premiums calculated over a cup of coffee, it has now embraced a long list of more sophisticated analytical techniques, ranging from statistics to generalized linear models.

AI in underwriting is the new shiny object in town. Let’s cover if there’s any merit to the hype. AI/ML can help uncover new insights from previously underutilized data, including unstructured data like text, speech, and images. It allows for using additional data during underwriting that would otherwise be unavailable or very difficult to obtain.

Challenges in Manual Underwriting

What is the need for AI in underwriting? Here we talk about the challenges in manual underwriting that can be overcome using AI and machine learning models.

1.Lengthy Process

Even though it is rightly said that manual underwriting can offer a personalized touch, the procedure is incredibly drawn out. Additionally, compared to AI in commercial underwriting, the accuracy and speed of manual underwriting are not that reliable.

2.Increased Complexity

Customers avoid manual underwriting because of the lengthy manual form-filling processes that increase the complexity. It includes the intricate fine print, underwriting errors and omissions, long return times, higher premiums, lack of product customization, and predictive services.

3.Decreased Efficiency

Risk variables, attached with every new application, become difficult to assess precisely when done manually. The complexity of the process makes it one of the most resource-intensive insurance processes. It affects the efficiency and productivity of the organization adversely.

4.Inefficient Pricing

Price inefficiencies, quality problems, and possible procedural errors characterize manual underwriting. Manual underwriting is prone to errors when developing risk profiles or determining the level of risk necessary for each individual.

These drawbacks highlight how manual underwriting is a difficult task. Next-generation insurance organizations are already implementing AI in underwriting for efficiency. What are the benefits of AI in underwriting?

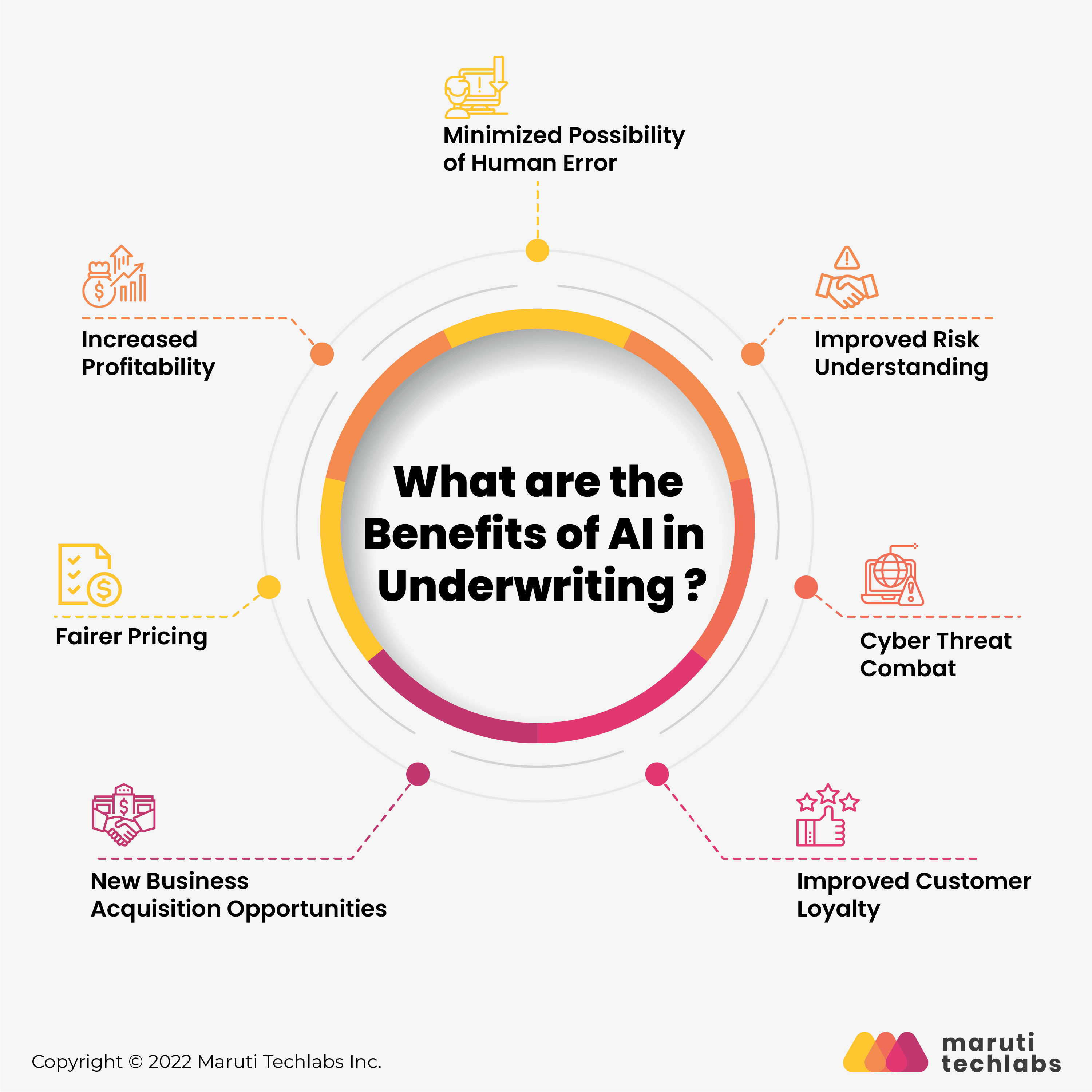

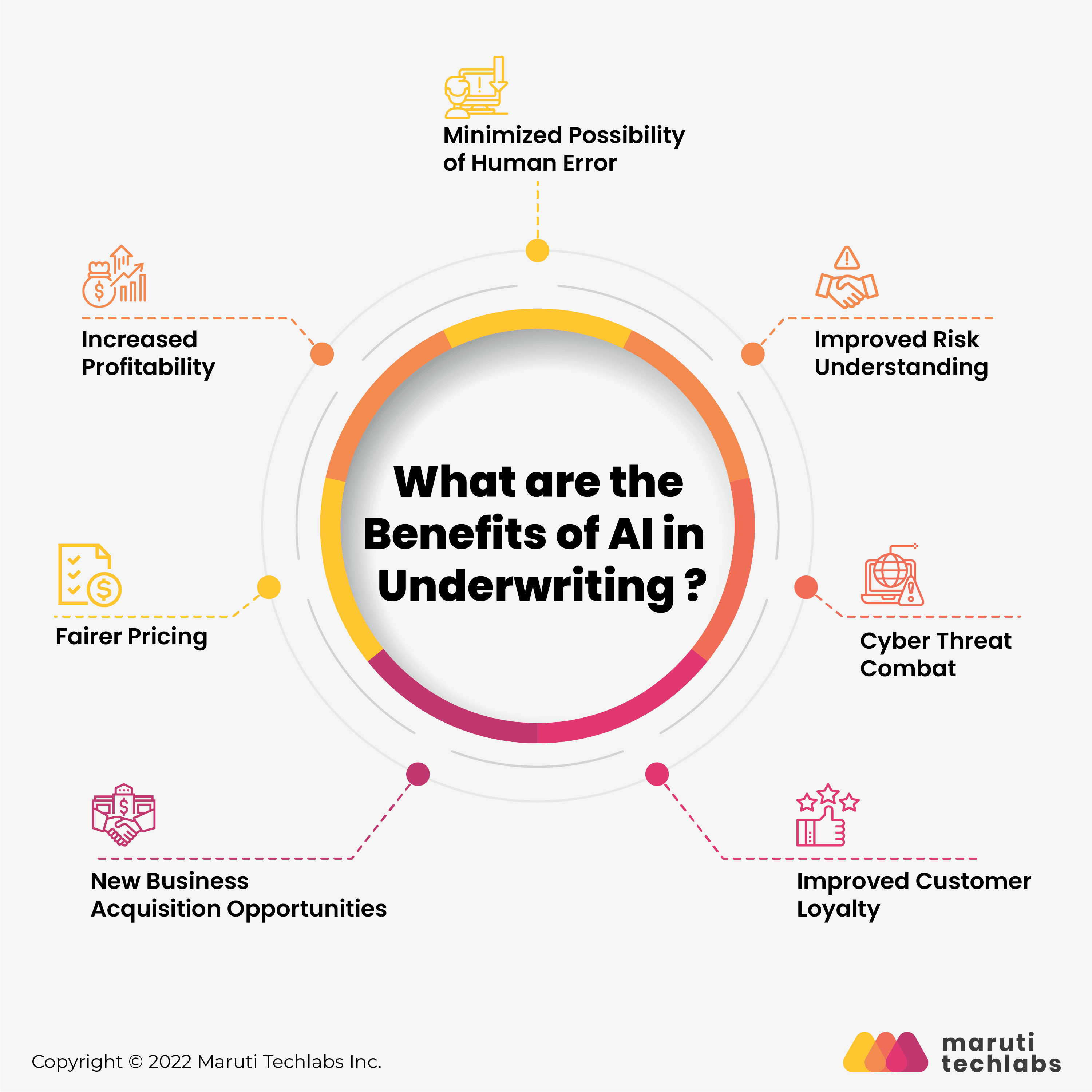

Benefits of AI in Underwriting

1.Minimized Possibility of Human Error

Despite how wise and rational humans are, there is usually a possibility of mistakes. This is where underwriting modernization plays a crucial role. AI in insurance can combine massive datasets in various formats, making them less prone to errors.

A human underwriter can evaluate the results and then make an informed choice based on the data after they apply preset identification and models. AI is algorithmically bound to be self-reliant and learn from previous mistakes. AI in underwriting saves time and is more efficient and scalable.

2.Improved Risk Understanding

Insurance underwriting best practices involve various data sources. Access to these data sources can be broadened and enriched with the help of AI in underwriting, which can improve risk assessments.

Insurance companies already see positive outcomes from adopting AI, like introducing predictive analytics models and algorithms, big data, and machine learning in their departments. These solutions help reduce time-consuming due diligence procedures.

3.Cyber Threat Combat

Cyber threats in businesses are increasing. The risks connected with cybersecurity further increase as more businesses adopt cloud-based infrastructure. For insurers, keeping up with them is a never-ending struggle.

Systems based on machine learning for fraud detection can keep up with these emerging dangers. It should eventually be able to anticipate new cybersecurity dangers before they materialize. The future of underwriting is AI-assisted, which brings along better security and more advanced insurance coverage features.

4.Improved Customer Loyalty

With AI in underwriting, insurers can improve the client experience during the sales process and foster loyalty from the beginning. Insurance companies can develop a long-term retention roadmap based on individual account servicing, lucrative pricing models based on risk-sharing, and practical loss control tactics by automating low-complexity duties. It frees up underwriters for more complex customer interactions.

Leading commercial insurers are already upgrading their underwriters' skills to enable them to take on more high-value responsibilities. In addition, they are implementing AI-based platforms to speed up the underwriting process and post-sales services.

5.New Business Acquisition Opportunities

Since we know that AI in underwriting integrates into larger insurance value chains, insights from centralized data lakes can enable cross-platform visibility and generate new cross-sell opportunities. This empowers them to provide a better customer experience.

Integrated AI-driven systems enable underwriters to contact clients with a customized plan before submitting an application. For instance, underwriters can have a holistic view of the customer's journey by tracing their queries to the NLP-powered chatbot. Through this, underwriters can take into account various concerns of the customer.

6.Fairer Pricing

According to a McKinsey report, a small business owner looking for commercial property and casualty insurance reportedly received coverage amounts from five different carriers that varied by an astonishingly 233% for almost the same risk. The losses from the commercial line alone cost businesses like AIG $75 million daily. This scenario illustrates the price inefficiencies plaguing the commercial insurance space. The inability to capture the risk profile accurately results in losses.

Automated underwriting provides better risk visibility in such cases. The underwriters, who serve as knowledgeable gatekeepers in charge of course corrections, recommend the best pricing options and coverage terms.

7.Increased Profitability

By assisting underwriters in producing lower loss ratios, quotes that convert better, and eventually optimizing the total resource usage in underwriting, AI in underwriting contributes to profitability. As a result, insurers must leverage automated insurance for high-impact reforms to be profitable.

Companies can use an AI-assisted underwriting transformation roadmap to lower their expense ratios and create a better employee experience. The role of an underwriter expands as a business builder and value-adder in an AI-powered insurance organization.

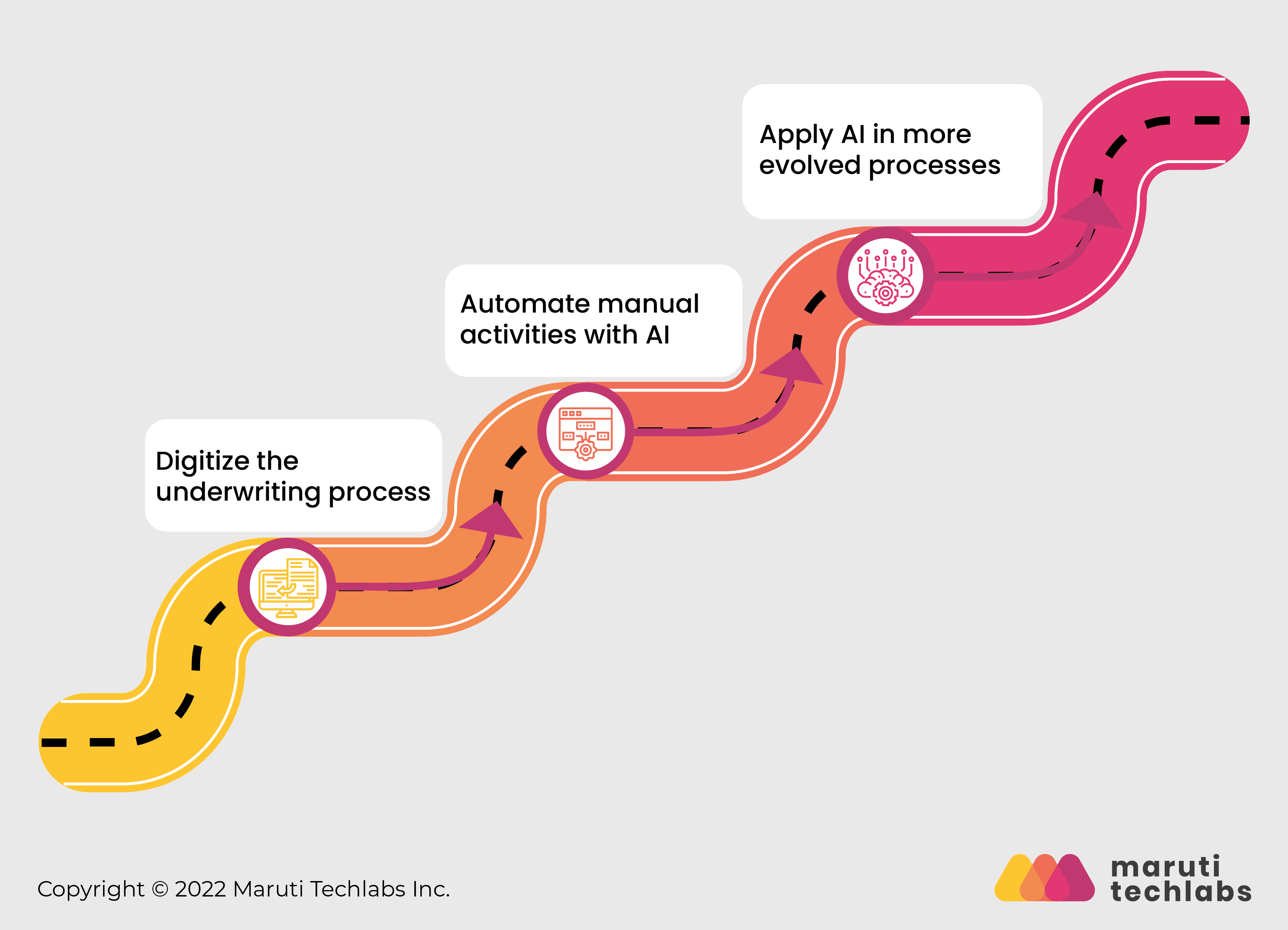

Roadmap to Integrate AI in Insurance Underwriting

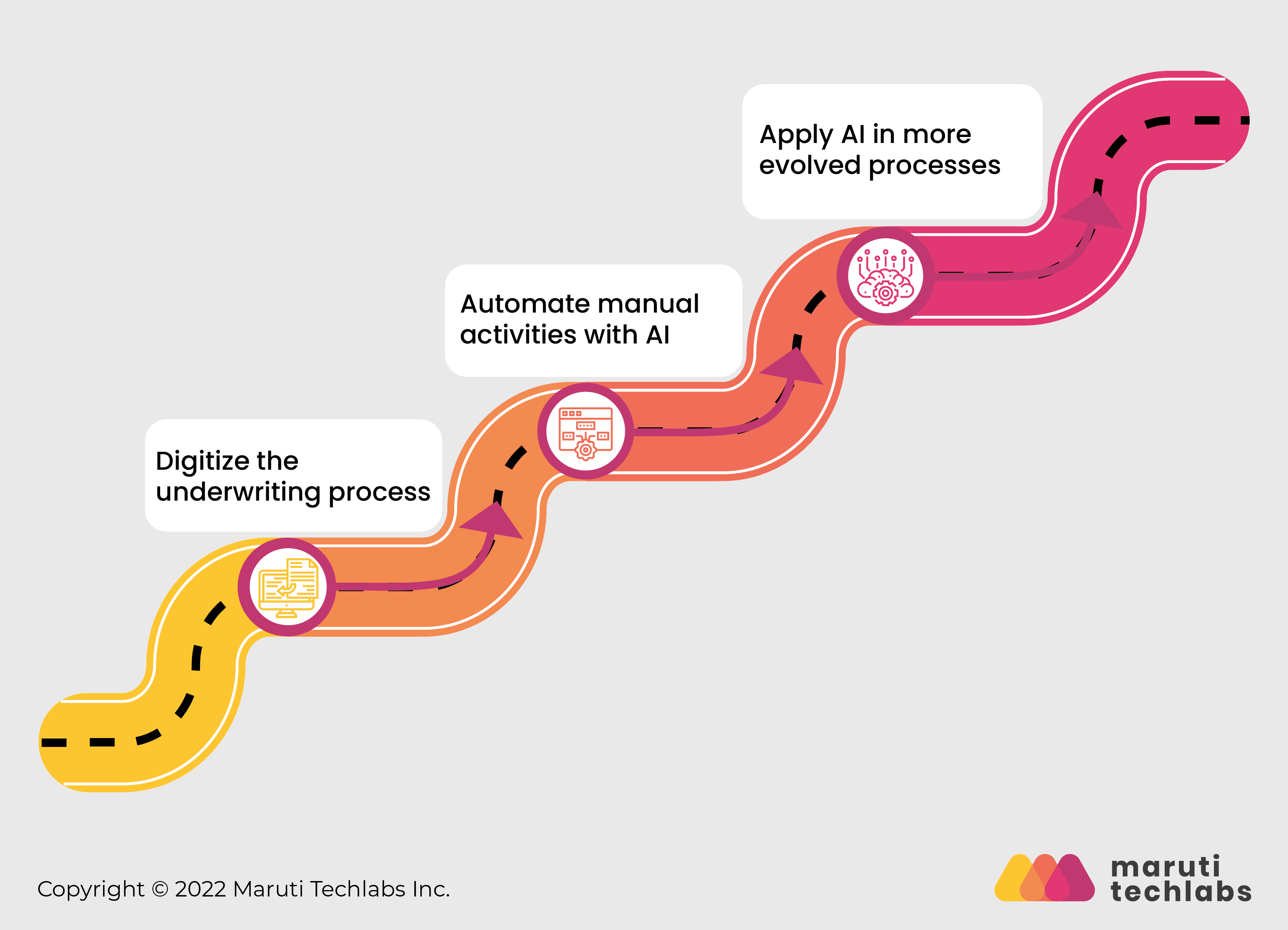

The roadmap to integrate AI in underwriting involves the following steps:

1. Regulate and digitize the underwriting process

- Start with conducting process audits which would help you identify the roadblocks.

- Redesign different processes as required. It could be done by incorporating essential feedback to adjust the processes till appropriate efficiency levels are achieved.

- Standardize procedures, lay down SOPs, and create performance standards. You can digitize paper-based processes.

2. Automate manual and repetitive activities with AI

- Here, AI operates as a subordinate to humans. It assists in data collection, calculation, and presentation.

- Based on these inputs, human workers can improve their underwriting judgments.

3. Apply AI in more evolved processes

- Here, AI acts as an independent entity, leading the underwriting process.

- AI performs research and analysis to make judgments that call for contextual and factual understanding.

- Human underwriters act as supervising agents that check for process compliance and quality assurance.

AI in Underwriting Automation Journey

Insurance companies prefer to modernize underwriting from purely manual workflow to automating different aspects. Commercial insurers can now use AI in underwriting as part of a comprehensive solution. There are three main stages of the automation journey.

1.Prefill

AI in underwriting can help in populating data. Computer algorithms can help insurance companies prefill application data for minor commercial risks by mining various data sources, including unstructured data. This information can provide classification suggestions and risk characteristics that impact premium and claim costs. Human underwriters can then evaluate this information more easily without searching the web for relevant underwriting standards.

2.Selective Automation

Some insurance sectors can be selected for automated underwriting, depending on the insurer's risk appetite. In this case, prefilled application data is automatically compared to the insurer's underwriting standards to decide whether it can be accepted or if more information is needed. The insurer's business logic is used to automatically apply credits or debits, and a quote can be generated.

3.Full-blown Automation

With the knowledge gained from step two, insurers might choose additional classes of businesses to push through the accelerated pipeline or incorporate different companies into the automated workflow to further automate their operations. AI in underwriting would still require manual intervention, even in a completely automated environment.

Lastly, insurers can choose additional business segments based on step two to drive automation deeper across their operations. What is important to remember here is that AI in underwriting would still require manual intervention, even in a completely automated environment.

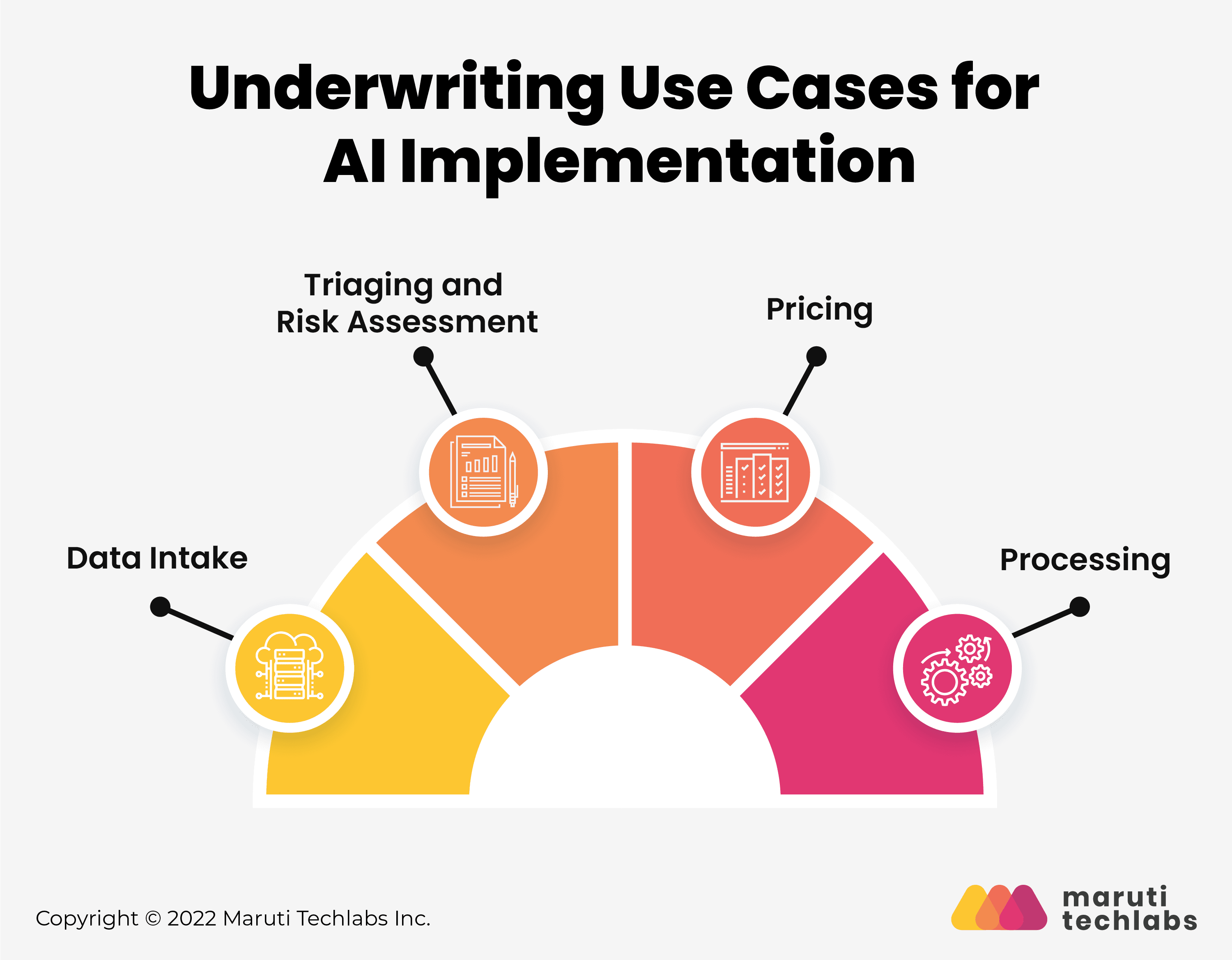

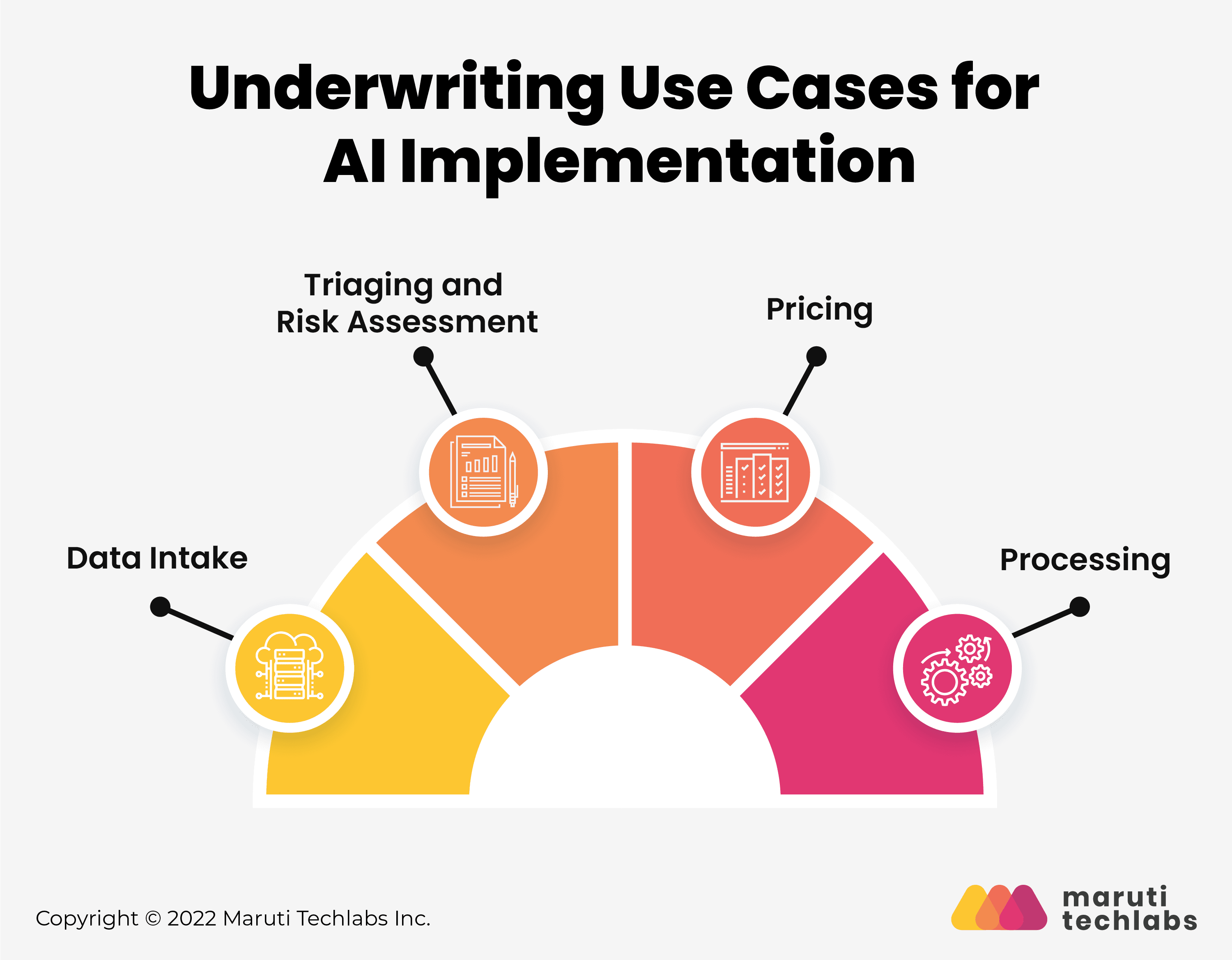

AI for Underwriting Modernization - Use Cases & Applications

1.Data Intake

The advantages of conventional RPA in insurance and intelligent automation must be strengthened for real-time underwriting technology. Software or technology can take over the process of compiling data from many sources instead of a human insurance underwriter.

Data collection becomes quicker and more accurate when moving to an automated data management system. Intelligent technologies like optical character recognition and NLP can be used to read documents, process text, extract necessary data, and ultimately deliver valuable information to the underwriting process.

Hence, AI in underwriting makes the intake of data easier.

2.Triaging and Risk Assessment

Bulk data needs to be examined and modified accordingly to gain insights into risk characteristics. The triage of this data is supported by intelligent automation that uses rules and artificial intelligence (AI).

Underwriters' knowledge has led to the development of rules that can categorize information and guide customers to the best product for their requirements. AI reduces the workload of human underwriters by handling the evaluations of lower-value policy submissions.

Underwriters' expertise will enable the intelligent automation solution to speed up the approach toward real-time insurance underwriting by coaching the AI in underwriting on these decisions.

3.Pricing

AI and machine learning can construct pricing models for policy based on risk variables and client attributes. In short, it can suggest the policy pricing that will provide the highest return.

You can use the policies created by conventional underwriting to develop pricing algorithms. The efficiency of developing pricing models using historical data depends largely on data analytics skills and intelligent automation solutions.

4.Processing

Conventional RPA and intelligent automation solutions can handle the administrative tasks involved in the insurance underwriting process. It is possible to extract data from various backend platforms that track and manage policies and claims into the required formats for compliance and governance tasks.

As a result, you can control the overall workflow for policy underwriting. This makes it possible to underwrite simple policies more quickly and provide a better experience for customers.

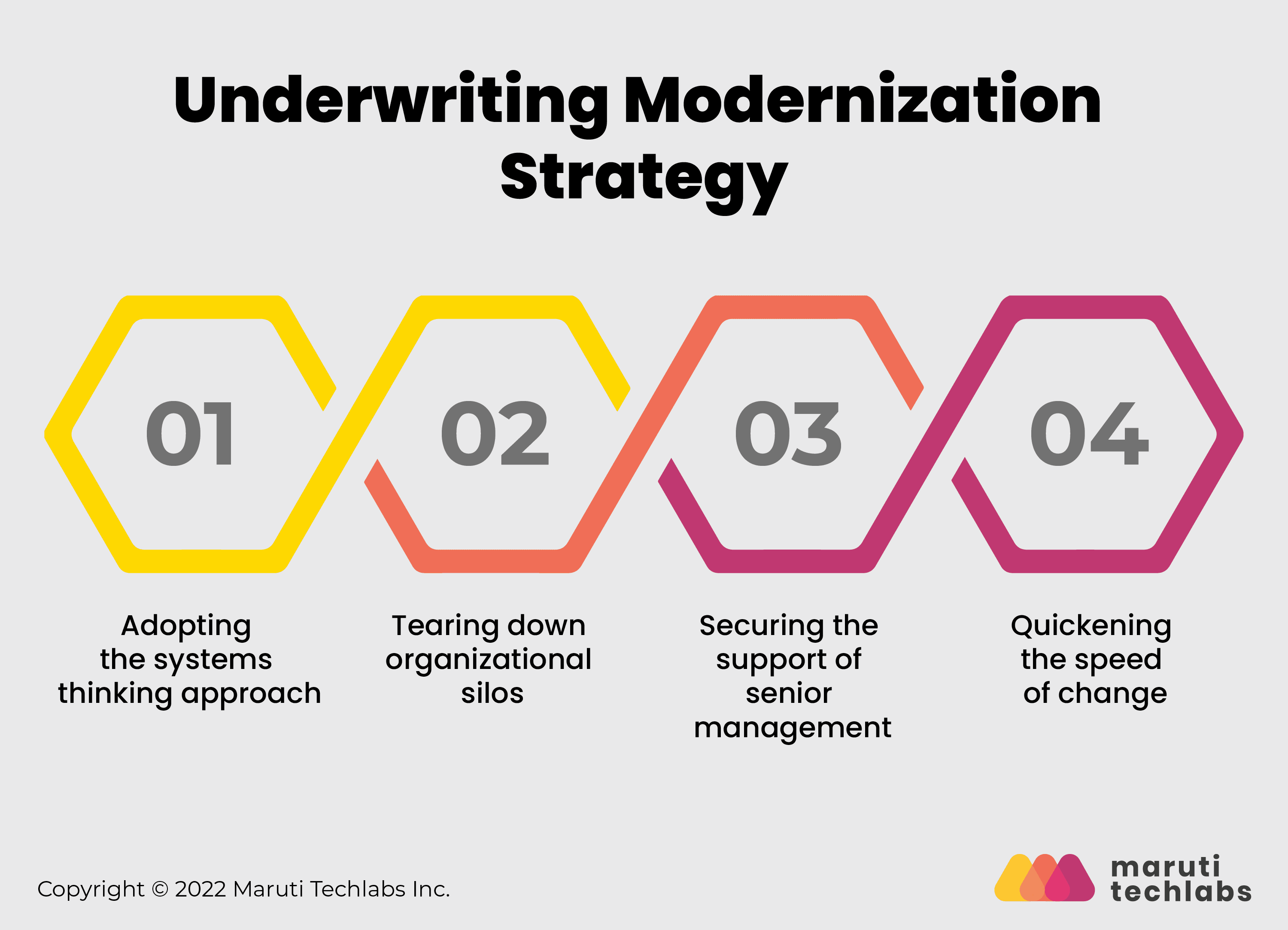

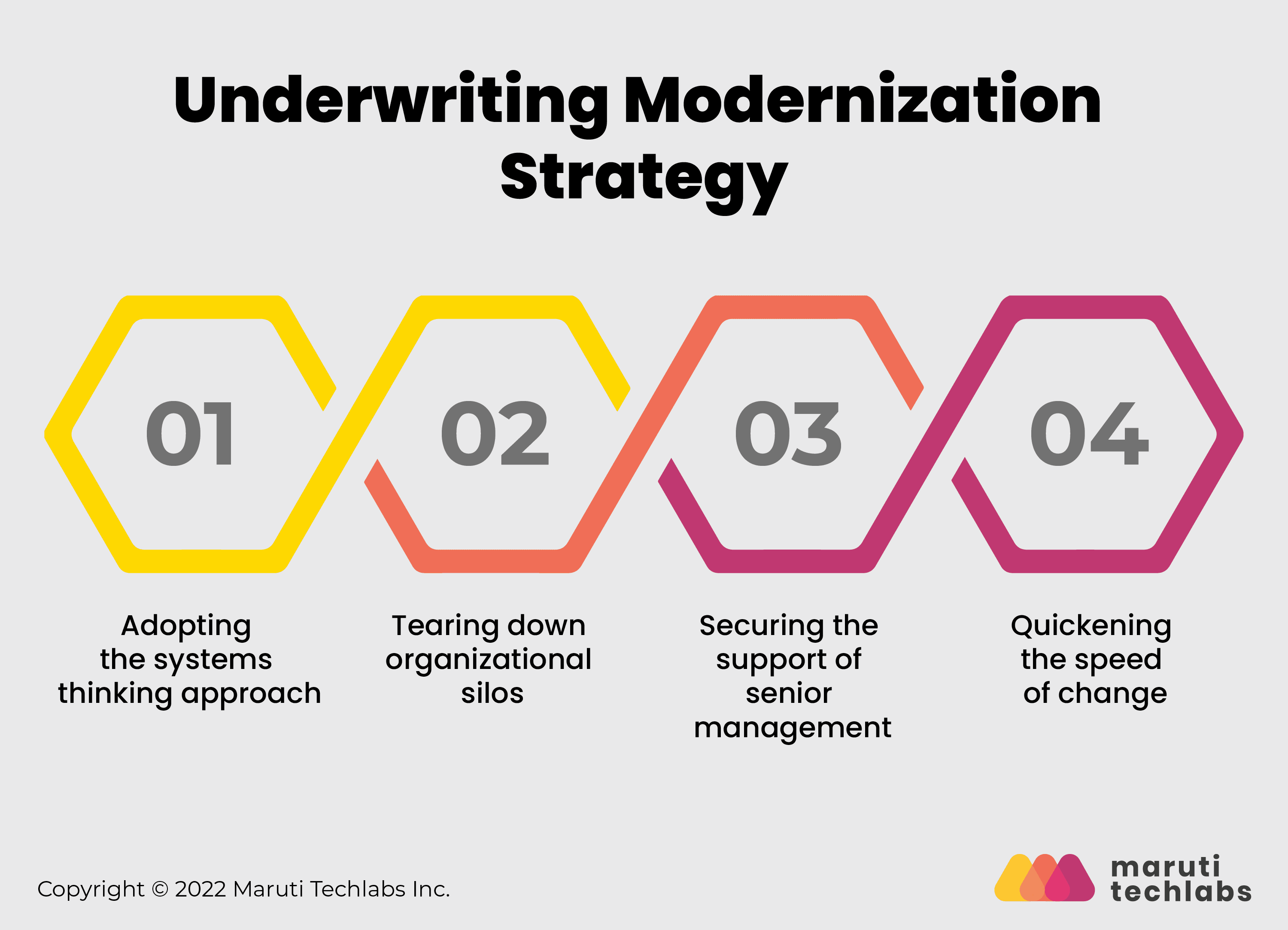

Underwriting Modernization Strategy - 4 Steps

To successfully modernize the underwriting and customer onboarding process, businesses must be restructured, and agile principles must be used.

The four most crucial elements for this are:

1.Adopt systems approach

Businesses must adopt systems thinking to fully comprehend how different components interact and function in the process. The method must be easy to understand and simple to submit, for example, and gather needs.

Additionally, insurers must be given top priority underwriting standards to pick the bare minimum of information required for risk assessment and decision-making.

The most important aspects when adopting a systems approach are-

- Submission and Requirements Gathering

The procedure needs to be revised to be easy to understand. The question set needs to be simplified so that only the most critical data is gathered and filled in automatically.

- Underwriting Decision Process

Prioritizing underwriting standards will help insurers gather the bare minimum of information required to evaluate risks and make judgments. Strong audit and risk controls and test-and-learn feedback loops should guarantee continuous efficacy. Automate as many elements as possible; quick human review is necessary for non-automated scenarios.

Electronic or voice signatures can digitize paper files and analog procedures. Electronic transmission of policy papers and digital modes of payments help digitize processes.

- Product Development and Rate Filing

Companies must reduce the one to two-year product development cycle—which relies on outdated technology and waterfall queues—to a few months or weeks.

2.Break down silos

Coordinating numerous departments, including underwriting, actuarial, product development, distribution, IT, risk, legal, and compliance, is necessary for successful transformation. Newer roles, including data science and advanced analytics, need to be frequently introduced.

Traditional departmental handoffs and siloed operations will not be successful. Delivering a successful transformation program requires committed, cross-functional teams. The team must share responsibility for achieving organizational goals. Team incentives and career advancement options should be included in the overall program's performance.

Breaking down silos in the insurance industry requires cross-departmental collaboration.

Conflicts between perspectives may also arise. Staffing such teams and fostering healthy conflict are challenging tasks. By appointing employees who already have full schedules, other initiatives may suffer. Empowering your teams to operate in the right direction without much external intervention ensures smoother operations.

3.Bring changes from the highest level

An underwriting-driven transition can take most insurers two years or longer, even with a quick pace. Some releases may be many weeks or months overdue, and certain aspects of the project can exceed the budget.

Actual buy-in from the company's senior leaders is necessary to maintain momentum, resources, and conviction. A traditional project or pilot program approach will not provide the right environment for innovation. The boardroom must understand that the transition, whatever it entails (be it complete or hybrid), will fundamentally alter how underwriting and onboarding are provided. The program will only be successful with solid conviction, distinct goals, and open communication from the key stakeholders.

4.Fast-track the pace

The main goal of road maps and other strategies while incorporating AI in underwriting should be to show tangible successes for the customers and field every quarter. Delivering bite-sized features to the market is necessary, followed by quick course corrections if something needs to be fixed. Longer-term projects (such as data lake efforts and legacy systems migrations) should be divided to fit into these release cycles.

For AI underwriting to move beyond a buzzword, product development must be reduced from years to months and even weeks. Forward-looking businesses have shortened the development cycle—from concept to launch—to as little as 16 weeks.

The project cycle is not linear; it has several fluid feedback loops to keep processes going on while encouraging cross-team collaboration. Successful execution needs agile processes that are significantly faster than the pace of most insurance companies' regular large-scale initiatives.

Bottom Line

Everything discussed so far, including the challenges in manual underwriting and AI's advantages, raises the question, "Why now?" Insurance companies reluctant to adopt AI in underwriting strategies stand to fall behind in both short and long-term goals.

Wider and deeper datasets, the ability to generate value from data, and the talent to manage and communicate it internally and externally could help competitors get ahead, leaving those who lag at a disadvantage.

Soon, laggards could fall off of preferred lists of distribution partners and see their higher-skilled talent recruited by more proactive competitors, both within and outside the insurance industry. It could create a negative spiral that would be difficult to reverse.

On the other hand, those insurers who integrate AI into their underwriting while also providing their talent with the opportunity to develop new skills will see a positive feedback loop.

Keeping the underwriting modernization process as a priority is going to be beneficial for organizations. They may win the most lucrative business and long-term clients and have an upbeat underwriting crew that contributes to the company more strategically. This could give them a competitive advantage that is difficult for others to match.