GST implementation back on 1st July 2017 was a game-changing event for the entire nation. The new tax regime was brought up with the aim to reduce the burden of the government as well as the taxpayer. Thinks are not yet sorted as GST still needs to be renovated for becoming an ideal tax compliance mechanism in the country.

A lot many amendments are proposed under GST for making it an ideal tax mechanism, here is the list of those activities:

E-Invoice Facility

The government has recently shown a green flag to E-invoicing in India. The utility has already been adopted on trial basis by the businesses with an annual turnover of Rs. 5 Crore or above (on https://einvoice1-trial.nic.in/ & https://einv-apisandbox.nic.in/ ) and the system is soon going to be effective for business with an annual turnover of Rs. 1 Crore ( w.e.f. 1 April 2020 ) all over India. While the government is still testing the legitimacy of the provision and is introducing real-time changes in e-invoicing, the taxpayers are offered an offline utility for preparing e-invoice (invoice, debit note and credit note) without the need of ASPs and GSPs.

Though the offline utility will be a trial version and valid for a limited period having its own API program to interact with the government’s E-filing portal.

However, each company has to practice certain activities:

- A clear insight into the legal aspect of the change

- Knowledge of the current invoice mechanism and proposed invoice mechanism

- Aware of the changes and importance of those changes

- Aware of the changes in ERP and understanding the importance of those changes

- Effectively implementing those changes in your invoice process

- Monitoring the process and bringing in the necessary process

- User Testing and sign off

- Regular investigation of the process

It is highly recommended to get well-versed with the applicability and features of the tool and wait for the updations that are made by the governing body to make e-invoicing an ideal mechanism.

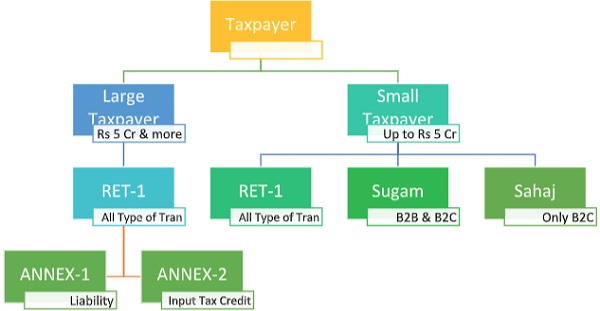

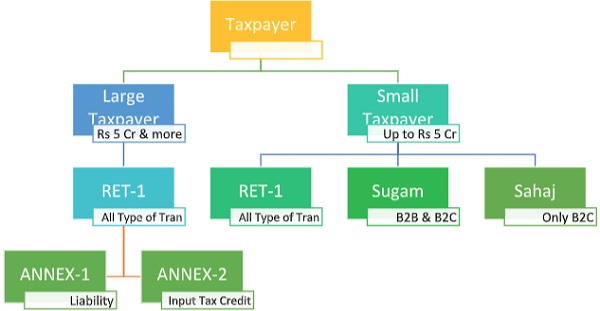

Newly Proposed GST Return Policies

Following the implementation of e-invoicing, most of the details in Annexure 1 will be auto-populated except the information of imports and transaction for which tax is paid using RCM (this information need to be uploaded). Likewise, most of the transactions of Annexure-II will come auto-populated which will further be subject to approval or rejection by the supplier. Rectification of errors is only possible when the supplier makes changes in his GSTR 2A. Taxpayers with an annual turnover of Rs. 100 crore or more need to upload all the documents in Annexure I ((Outward Supply, imports and transactions on which tax paid on RCM).

The mechanism is under development. Here the tax[payer needs to make sure that all the inward supply invoices are duly uploaded at the supplier’s end (in GSTR 2A). Here the taxpayer needs to coordinate with the supplier to assure the regular upload of invoices, also the acceptance of invoices or any error in the invoices.

The Input Tax Credit (ITC) under the new tax policies will no longer be availed by the recipient rather it will be auto-credited in the electronic cash ledger of the recipient purely based on the approved transactions visible in Annexure II of GST RET 1. So clearly earlier the traditional methods of availing the credit based on overall matched invoices or 110% of matched credits or 120% of matched will no longer be practices.

Taxpayers opting for the GST SUGAM scheme will have to file the returns on a quarterly basis, this will freeze their ITC for two months which may lead to immediate liquidity issues on the taxpayer’s end.

It is important to note:

Departmental Notices by Centre:

- Lakhs of GST recovery notices are sent from Centre’s end for defaulters whose taxes or return filing is due (Pan India).

- Centre to investigate the taxpayers whose declared liability is different from paid liability. The centre is rightful of extracting Rs 36,000 Cr on account of mismatched liabilities.

- The centre is rightful of extracting the refund of Rs 37000 Cr from the taxpayers where credits were taken on invoices for FY 18 & FY 19 but were time-barred.

- Centre to identify the taxpayers that are accused of claiming more than 10% of the credit due in GSTR 2A; Rs. 46,000 of extra credit is already claimed by the taxpayers unethically.

In several cases of mismatch in the data while availing the ITC, the tax department has issued notices (Form ASMT-10) seeking reasons for the mismatch in the given information. As per the norms in section 16(4) of CGST Act, 2017, ITC can be availed by the taxpayer if he/she fulfils the below-mentioned criteria:

1. If he/she furnishes the receipts of Goods and Services.

2. Tax invoices in possession

3. Proof of paid tax.

4. Statements of Filed GST Returns

Non-Applicability of the Notices:

- Taxpayers who are accused of claiming 20% or 10% more than actual credit in GSTR 2A have received the notices that are unjustified and also the restrictions on availing such credit is contradictory to GST law.

- Many notices do not have a DIN number that is mandatory.

- The indirect tax department has sent notices to thousands of firms who have claimed ITC after the due date for the same.

- Companies have claimed ITC for FY 2018-19 the deadline for which was September 2019. The department has directed such taxpayers to reverse their transactions and has also imposed a penalty on wrongly claimed ITC.

- ITC can be availed by the firms on the taxes paid by them while purchasing the raw materials. The credit is either adjusted with the future tax liabilities or is credited to the electronic cash ledger of the recipient. The notice by the department said that no assessee is allowed to avail the taxes after the due date for filing the returns.

Laws Regarding Interest on Delayed Filing of Returns

Changes were brought in Section 50 of CGST Act 2017, details of which are as follows:

- Taxpayer liable for paying taxes under provisions of Income Tax Act fails to pay the tax within the prescribed time limit will have to pay the interest on delayed or non-payment (with the interest not more than 18% of tax dues).

The interest on tax for supplies made during a tax period and mentioned in the returns in accordance with the laws of section 39, except the returns that are furnished after the commencement of section 73 or section 74, shall be imposed. The interest shall be imposed on the portion of tax that is paid by debiting the electronic cash ledger.

- As mentioned in the law, interest shall be calculated starting from the succeeding date of the due date on which tax was to be paid by the taxpayer.

- The taxpayer found guilty of claiming excess or undue ITC under sub-section (10) of section 42 or has claimed excess reduction or undue reduction on outward supplies under sub-section (10) of section 42, is liable to pay the interest on claiming the wrong reduction. Interest rate in such a case shall not exceed 24% as notified by the government.

- The department has not yet notified the taxpayers whether the interest liability will be paid through cash, the GST department has started issuing notices for delayed return filing on gross tax liabilities.

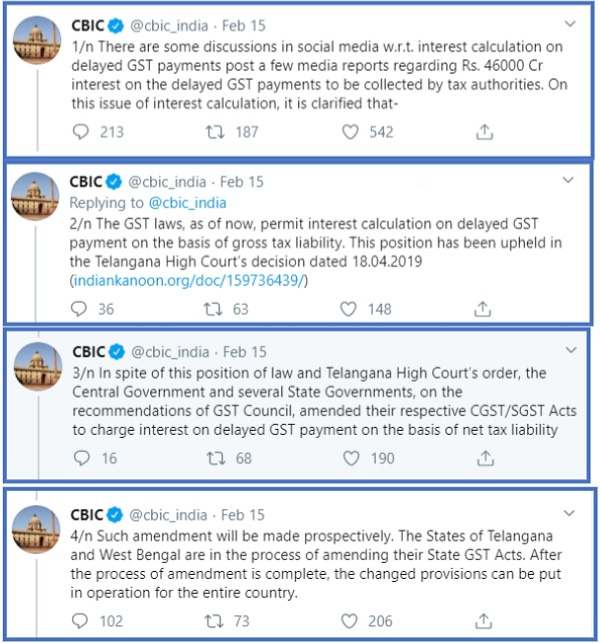

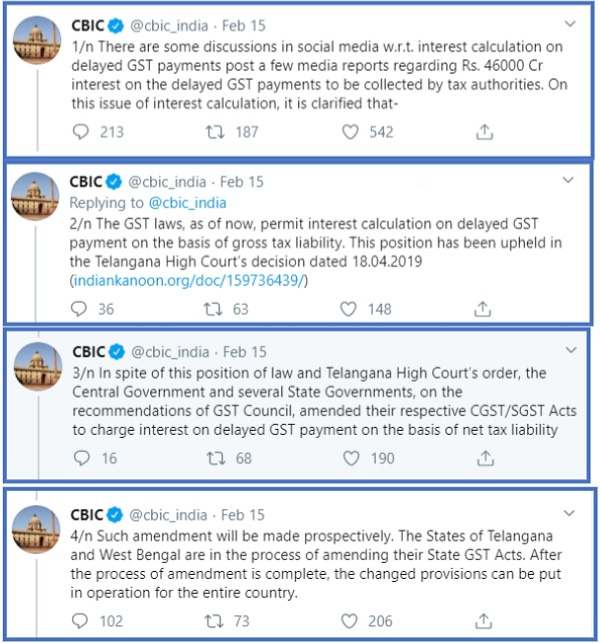

Here are the tweets by CBIC related to interest on filing of returns:

Quote

- Section 50 is applicable in the situation interest is levied on belated tax payments and not on ITC as ITC available with the Department is not belated. The law is only applicable in the state of deprivation and not in the case where the State has sufficient funds to credit to the assessee.

- According to the Hon’ble Madras HC, the proviso of Section 50(1) in which the interest is levied only on the cash payments that was inserted w.e.f 1 April 2019 needs proper amendments so that it is operative in respect to the earlier situations.

- High Court rejected the appeal of the Telangana High Court as in the case of Megha Engineering and Infrastructures Ltd. The amendment was only meant till the stage of press release when Division Bench passed the order. Unfortunately there is still no progress related to the recommendations of the GST council. So, we cannot interpret Section 50 in the light of the proposed amendment.

As a result, the Writ Petitions were allowed, and the Impugned Notices were set aside.

Un-Quote

It is important to reply after discovering the correct delay in GST payments and the interest (18%) paid on that tax liability through electronic cash ledger.

Notices Related to Departmental GST Audit

Authorities have sent notices to several taxpayers commanding them to conduct audits for the period in between July 2017 to March 2018. In some cases the audits are asked till March 2019 (depending on non-filing of annual returns).

Relevant details/records are needed at the time of Audit:

- Documents/Records needed for Audit Annexure – GSTAM-I, Annexure – GSTAM-V and Annexure-GSTAM-VI as mentioned in the GST Audit Manual 2019.

- Duplicate of GST registration certificate or application for GST Registration

- Duplicates of Form GSTR-1, GSTR-2A, GSTR-3B and GSTR-9 and GSTR-9C accompanies by the Callahan

- Complete details of the e-way bills for inward and outward supplies

Show Cause Notice(s) issued (if any) and their present status

- Information of the last departmental audit and the time period taken by the Audit (duplicates of reports and other relevant documents(as and when needed)

- Report of Audit conducted by CERA (if any)

Statutory Documents / Records Preserved for a Certain Time Period

(i) Duplicates of Annual Reports (with all schedules and notes to Accounts) , Balance Sheet, Profit & Loss Account Statement, Gross Trial Balance

(ii) Duplicates of Tax Audit Reports (including all annexures) held under Sec 44AB of the Income Tax Act 1961

(iii) Duplicates of Form 3CEB and 3CD Reports under Section 92E of the Income Tax Act 1961

(iv) Cost Audit Report (If any)

(v) Duplicates of 26AS for the period of audit

Documents / Records Preserved by the Company Related to Availment of ITC or Value of Goods and Services Received by you:

(i) List of Input Suppliers with their basic details (if any)

(ii) List of Capital Goods Suppliers with their basic details (if any)

(iii) Input Tax Credit Ledger of ITC availed

(iv) Invoices of Input Tax Credit availed

(v) Contracts, MOUs, Agreements with principals, clients, other group companies or any other person to whom any service is provided / received

(vi) Detailed note of the activities held by you. Note should include the entire aspects of activities such as history of mergers / acquisitions, etc. The note should also contain the activities of the company or groups of companies (if any) in a separate note that are proposed to be verified

(vii) List of the Outlets held by the company (if any). It should also include the details of taxable services / sales rendered by each of such branches

(viii) Copy of TRAN-1 return for verification

(ix) Summary of taxes (Service Tax/Central Excise/GST) paid (Cash & Cenvat / ITC) during the relevant audit period including value of taxable service

(x) List of records as per Annexure B

Assets to be mentioned in the records

I. Records of marketing and outward supplies

1. Purchase orders

2. Price Circulars

3. Delivery Challans

4. Material Transfer Note

5. Sales Book

6. Outward Supply Book

II. Records of stores (as and where applicable)

1. Stores Ledger

2. Goods Receipt Note / Material Receipt Note/Inspection cum Receipt Report (ICRR)

3. Rejected Goods Register

4. Material Return Note

5. Waste Register

6. Job Work / Sub-Contract register

7. Physical Stock Verification Statement

III. Financial Documents

1. Ledgers

2. Debit Note

3. Credit Note

4. Journal Voucher

5. Internal Audit Reports

6. Purchase Book

7. Purchase Return Book

8. Income Tax Audit Report

9. Income Return

10. Fixed Assets Register

11. Monthly Stock Statement to Bank

Other Records

I. Records Related to Marketing and Sales Department

1. Purchase Orders / Agreements / MOUs

2 Stores Ledger

3. Job Work / Sub Contract Register

4. Outward Supply Book

Financial Records

1. Ledgers

2. Debit Note

3. Purchase Book

4. Purchase Return Book

5. Income Tax Audit Report

6. Income Return

7. Credit Note

8. Journal Voucher

9. Internal Audit Reports

Mentioned in the GST Audit Manual 2019 are FAQs on internal control system related to Purchases- inward supplies, outward supplies, Job Work, supply of service, stores, Tax Accounting, invoicing system, accounts and records , making of GST returns place of supply valuation of services & MIS. Moreover, the guidance related to the data related to financial statements including turnover, quantity manufactured and cleared, GST paid through ITC and cash, details of input consumption, waste, Power & Fuel and write off as reflected in financial statements, records preserved by the company under CGST Act, Annual Return, Cost Audit Report, Income Tax Audit Report (Tax Audit Report) , Trial Balance & Balance Sheet and P&L Account ll such details are required by the company.

Filing of Annual Return Form or GSTR 9 along with filing the reconciliation form GSTR 9C. Authenticated by the signature of either a Chartered Accountant or Cost Accountant.

The due date for Annual Return filing (GSTR 9) along with the reconciliation from books of accounts (GSTR 9C) duly authenticated by the Chartered Accountants or Cost Accountants is 31 December 2020.

There is no due date mentioned for re-submitting GSTR 9 and/or GSTR 9C if any of the following error is encountered in the forms:

- Error while summarizing any of the Forms (GSTR-2A, 3B & GSTR 1)

- If table no. 4, 5, 6 and 9 have proper data and rest all the tables have mistakes

- Trans 1/2 credit is reappearing

- If modifications are needed in GSTR 9 and 9C Return

- No effect of tables 10 11 12 13 14 of 17-18 is visible in tables 18-19

- There is no place for 18-19 tables and so there is an urgent need to bring in some absolute changes in the format of the form

- There is no grid where one can deduct ITC of 17-18 that is claimed in 18-19. So there are chances of data getting mismatched with GSTR 3B as it has an entry of both ITC in 17-18 and ITC in 18-19

- Same goes for outward supplies as GSTR 3B might contain details of tax payment in 18-19 that were liable for 17-18

- There is no visibility of table 8 Data of GSTR 2A

- Placement of Trans 1 credit in table 6

- There is no clarity on what information shall be inserted in the tables

The utility for filing GSTR 9 is under process which has led to the challenge for each taxpayer and Chartered Accountant OR Cost Accountant in terms of meeting the deadlines.

Aforesaid are some challenges that might come in way of the taxpayers but these challenges are not that complicated if the taxpayer is ethically making his/her compliance and filing every return with true and accurate information. The write-up was aimed at providing information of amendments or proposed new laws by the tax governance so that one might easily weave through complexities of tax compliance.