In the heart of the bustling banking sector, where every second counts and precision is paramount, a silent revolution is underway. Imagine a digital workforce seamlessly integrated into the intricate machinery of finance, tirelessly performing repetitive tasks with robotic precision. This is the essence of Robotic Process Automation (RPA), a game-changing technology that has set the banking world abuzz with its transformative potential. As financial institutions navigate the ever-evolving landscape of digitization and customer expectations, RPA emerges as a beacon of efficiency, promising to redefine operational paradigms and elevate the banking experience to unprecedented heights.

But what exactly is RPA, and why has it become the cornerstone of innovation in the banking sector? Let's delve into the captivating narrative of RPA's rise and unravel the myriad benefits it bestows upon the financial landscape.

What is RPA?

Robotic Process Automation (RPA), also known as software robotics, utilizes intelligent automation technologies to emulate human tasks, such as data extraction, form filling, and file movement, within digital systems. Through the seamless integration of APIs and user interface interactions, RPA can effectively automate repetitive tasks across different enterprise applications. This rule-based automation liberates human resources from mundane activities, enabling them to prioritize more complex tasks. RPA serves as a transformative force in accelerating digital transformation efforts, fostering efficiency, and generating a higher return on investment for organizations.

What is RPA in Banking?

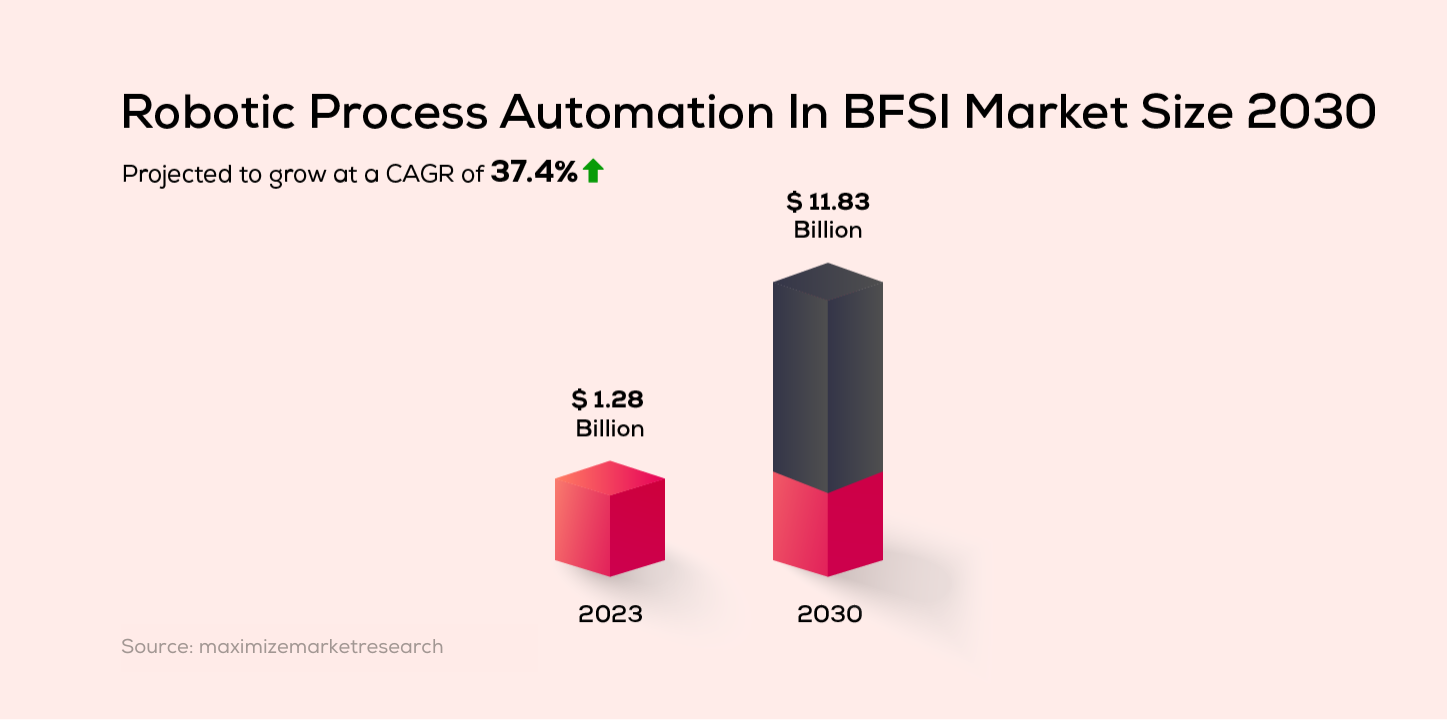

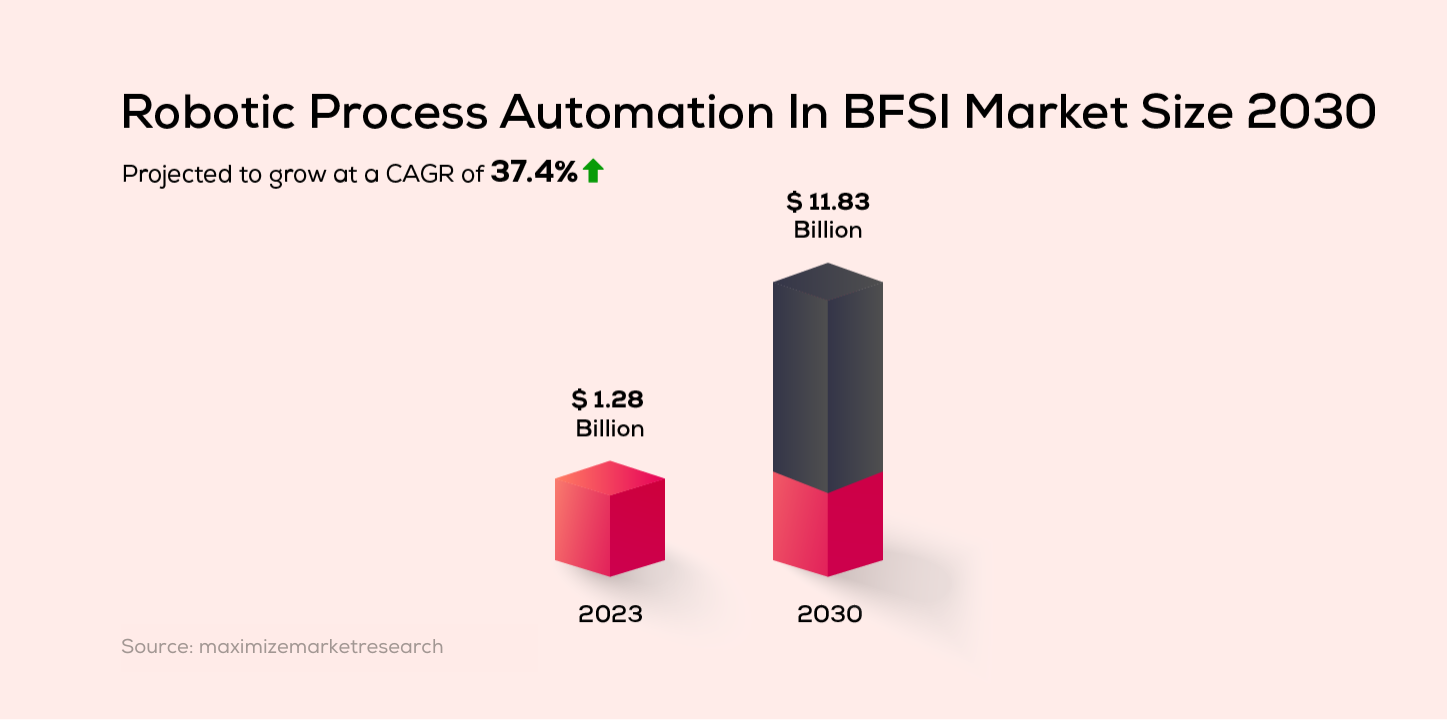

RPA (Robotic Process Automation) in the banking sector offers a transformative solution to automate tedious and time-consuming tasks such as account opening, KYC processes, and customer services. By implementing RPA in banking operations, organizations not only enhance process efficiency but also ensure cost reduction and timely execution. The BFSI industry is expected to witness significant growth in the global robotic process automation market, which is likely to reach $11.83 billion by 2030, expanding at a 37.4% CAGR from 2024 to 2030, according to a report by maximize market research.

Moreover, integrating AI technology with RPA enables automating intricate decision-making processes like fraud detection and anti-money laundering, further enhancing operational integrity. In a sector where manual processing poses risks of errors and vulnerabilities to fraud, the adoption of RPA is pivotal. With RPA, simple validation of customer information across systems can be completed in seconds, significantly reducing processing time and errors. Introducing bots to handle manual processes can slash processing costs by 30% to 70%, freeing up manpower to focus on critical tasks. Embracing RPA in banking not only streamlines operations but also fortifies security measures and optimizes resource allocation for enhanced productivity and competitiveness.

How to Implement RPA in Banking?

To successfully implement RPA in the banking sector, organizations must follow a structured approach. For effective RPA implementation, banking organizations must follow the steps listed below:

- Identifying Manual and Repetitive Tasks for Automation: Examine finance and banking operations to pinpoint tasks conducted manually and repeatedly, such as data entry, account reconciliation, and report generation.

- Setting Clear Objectives: Define precise outcomes aligned with broader strategic objectives, including error reduction, enhanced efficiency, and compliance improvement.

- Selecting the Right RPA Tool: Evaluate a range of RPA tools based on features, scalability, integration capabilities, user-friendliness, and vendor support. Opt for the tool that best aligns with the organization's needs and financial constraints.

- Prioritizing Processes for Automation: Assess each process's suitability for automation, considering stability, rule-based characteristics, transaction volumes, and system compatibility. Prioritize tasks with high volumes, repetitive nature, and minimal exception handling.

- Designing Detailed Workflows: Map out comprehensive process flows using flow diagrams, delineating automation steps such as data extraction and validation.

- Gaining Stakeholder Approvals: Seek approval from relevant stakeholders to ensure compliance with organizational policies and regulations. Address concerns regarding data security, compliance, and operational impact.

- Implementing and Monitoring Performance: Deploy automation scripts in the production environment and closely monitor their performance. Promptly address any issues or exceptions that arise during the process.

- Providing Employee Training: Deliver training to staff involved in automated processes, offering insights into RPA's impact and effective collaboration with software robots.

- Aligning RPA with Organizational Goals: Regularly review and realign RPA initiatives to support broader strategic goals, maximizing its impact on enhancing finance and banking operations.

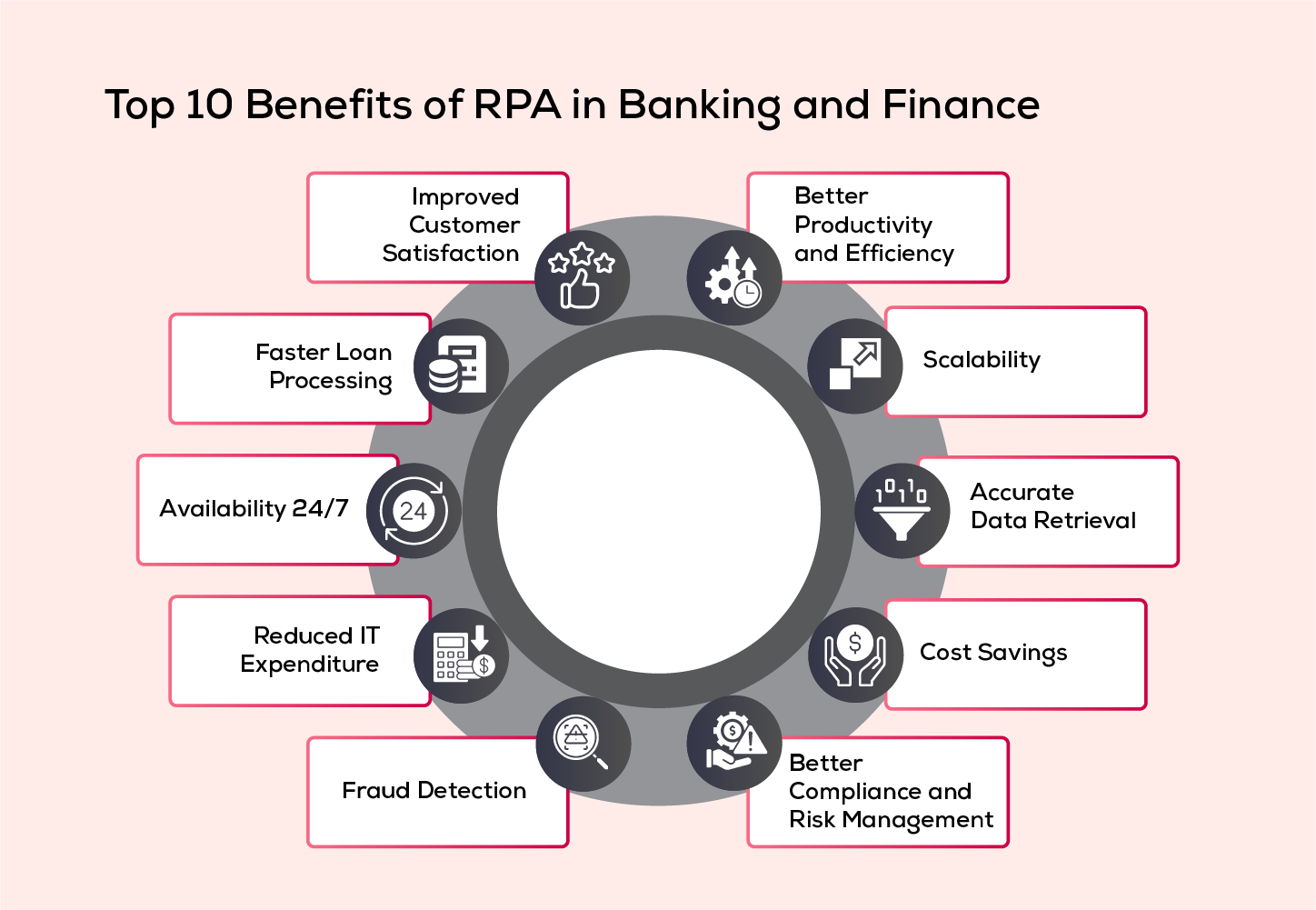

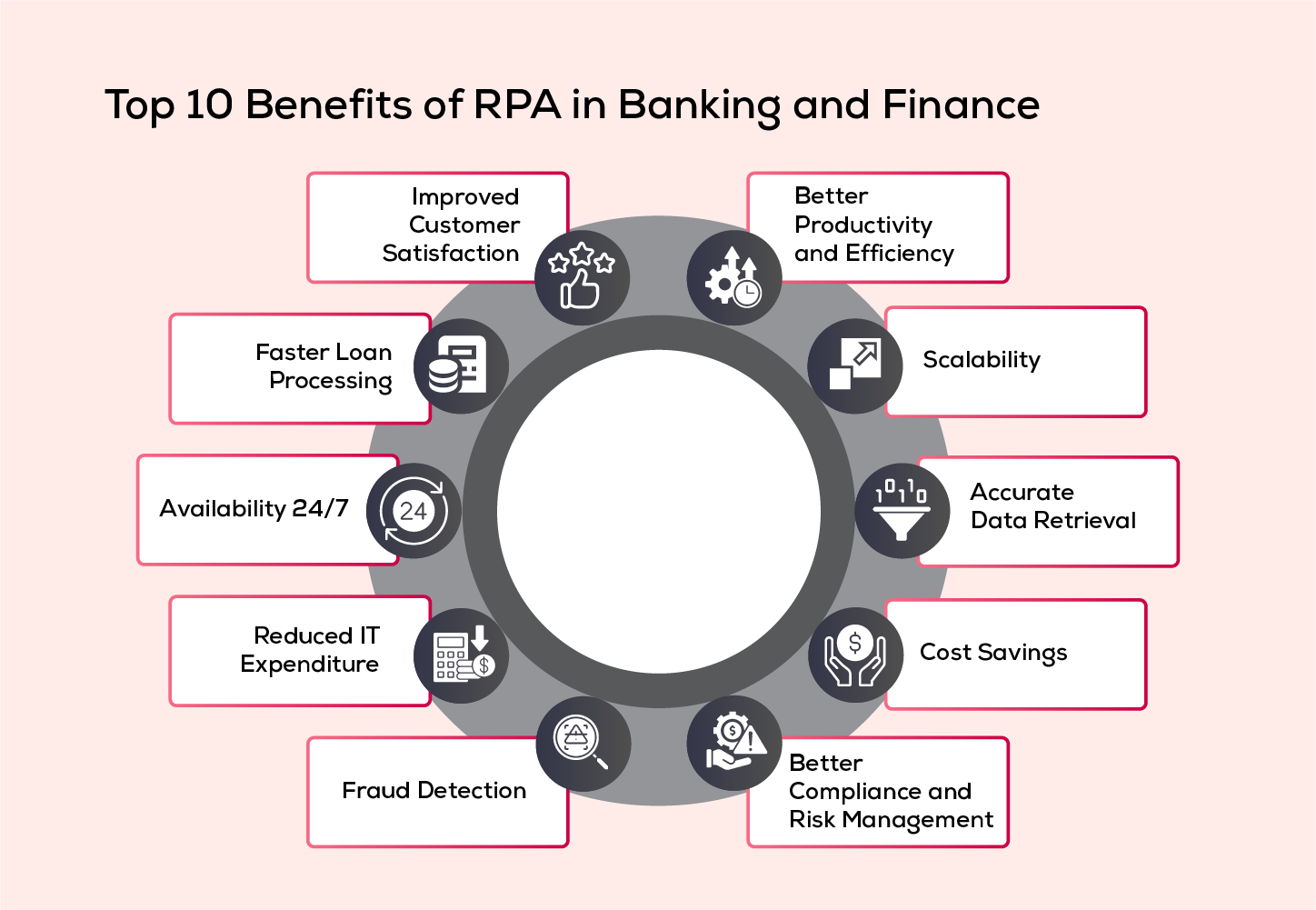

Top 10 Benefits of RPA in Banking and Finance

Let us delve deeper to know what benefits does RPA offer in Banking and Finance.

Better Productivity and Efficiency

RPA systems enhance the efficiency in completing tasks promptly and accurately, as they execute instructions without ambiguity. Unlike manual accounting procedures, robotic processes have no drawbacks. RPA ensures consistent accuracy by eliminating human errors. According to Gartner finance tasks burdened by human mistakes lead to 25,000 hours of avoidable rework each year, costing $878,000.

Scalability

With RPA in banking, scalability is a notable advantage. Robots can swiftly adapt to manage surges in workload during peak business hours, ensuring timely responses to situations. Moreover, implementing RPA empowers banks to prioritize innovative strategies for business growth, liberating employees from repetitive tasks.

Accurate Data Retrieval

RPA is a blend of Artificial Intelligence and Machine Learning. This combo transforms how customer data is managed, making processes more efficient and accurate. RPA swiftly retrieves important data from the vast pool stored, ensuring smooth operations. It also tackles issues like invoice discrepancies by tapping into third-party databases and optimizing Account Receivable and Accounts Payable processes. With Intelligent Automation, these tasks are completed faster than ever, cutting processing times and boosting efficiency in banking operations.

Cost Savings

Streamlining operations and reducing reliance on manual tasks empowers banking and finance institutions to significantly trim costs related to resources, systems, and workforce. Employees are freed from repetitive duties such as data entry and manual process scheduling, leading to increased efficiency. The incorporation of technology into financial systems holds the promise of significant cost savings, driven by improved efficiency, reduced energy usage, and optimized time management.

Better Compliance and Risk Management

Compliance with regulations and standards is a critical aspect for banks and financial institutions globally. Meeting regulatory requirements involves two key objectives: aligning business practices with regulations and maintaining excellent reporting and record-keeping for audits. Fortunately, RPA offers a solution to alleviate compliance and auditing challenges. RPA technology enables the automation of repetitive and manual tasks by deploying software robots, thereby enhancing efficiency and accuracy in meeting regulatory obligations.

Fraud Detection

Fraud detection is paramount in banking operations due to the high volume of transactions. Traditionally, employees handle transaction monitoring in real time to prevent fraudulent activities. However, RPA offers a solution by automating this repetitive process. RPA bots can analyse transactions in real time and generate alerts for any suspicious activities. This enables faster detection of defects and ensures transparency in banking operations.

Reduced IT Expenditure

Lowering IT expenditures is achievable through the adoption of RPA, as it offers cost-effective functionalities. Financial organizations of any size can seamlessly integrate digital systems with minimal functionalities, eliminating the need for skilled IT teams. RPA software is designed to be user-friendly, requiring no specialized coding knowledge for optimal operation. Moreover, since RPA automates tasks, firms can reduce reliance on additional IT experts, further driving down IT expenditures.

Availability 24/7

RPA bots tirelessly operate 24/7, efficiently managing a spectrum of tasks—from checking queries and retrieving information to swiftly routing tickets to the correct banking agents for immediate resolution—all governed by predefined rules.

Faster Loan Processing

RPA can accelerate loan processing tasks. RPA bots efficiently handle these processes, significantly reducing processing time to less than five minutes. This streamlined approach not only ensures swift timelines and increased efficiency for loan processing officers but also offers detailed loan application information for further analysis. What's more, RPA bots can execute tasks on behalf of employees, even in their absence, ensuring continuous workflow and expedited processing.

Improved Customer Satisfaction

By automating tasks such as data extraction and transformation, RPA streamlines the process of gathering and processing large volumes of data. This enables banking organizations to gain comprehensive insights into customer behaviour and preferences more efficiently. With access to consolidated data insights immediately, banks can make data-driven decisions and tailor their products and services to meet the specific needs and preferences of their customers, thus improving customer satisfaction.

Conclusion

RPA is increasingly being embraced by banks and financial institutions, often as opportunistic and point-based solutions, due to their quick and easy implementation compared to large-scale transformations. This trend reflects the recognition of RPA's potential to bring immediate efficiency gains to banking operations. When implemented properly, RPA services can be genuinely transformative for the banking sector. By implementing RPA, banks can streamline operations, reduce errors, and improve turnaround times by automating manual tasks.

As forward-thinking banks seek to stay competitive in an era of rapid technological advancement, integrating RPA with legacy systems becomes essential. RPA serves as a mechanism to bridge the gap between traditional banking tools and newer technologies, making it a crucial asset for banks striving to remain customer-centric, efficient, and competitive in the evolving financial landscape.